Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its three parts. please explain with formulas if possible 4. Prepare any journal entries that the company should make as a result of the bank

its three parts. please explain with formulas if possible

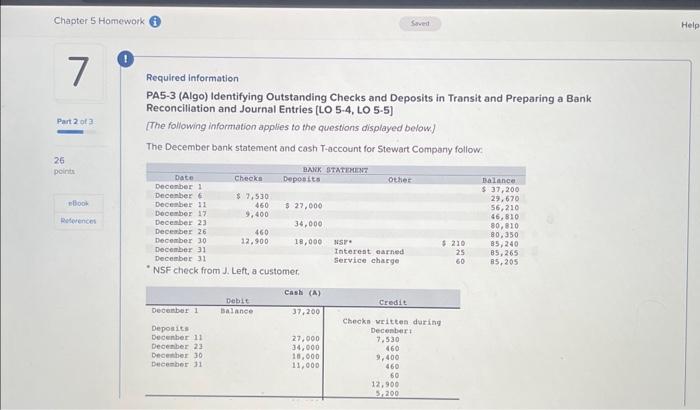

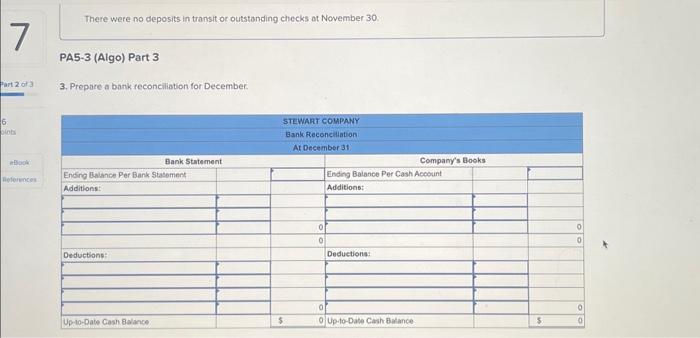

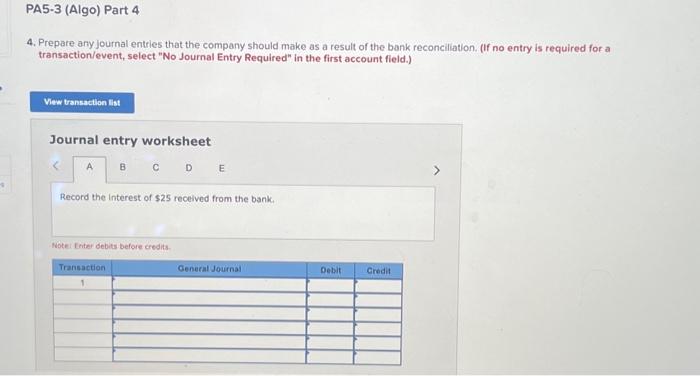

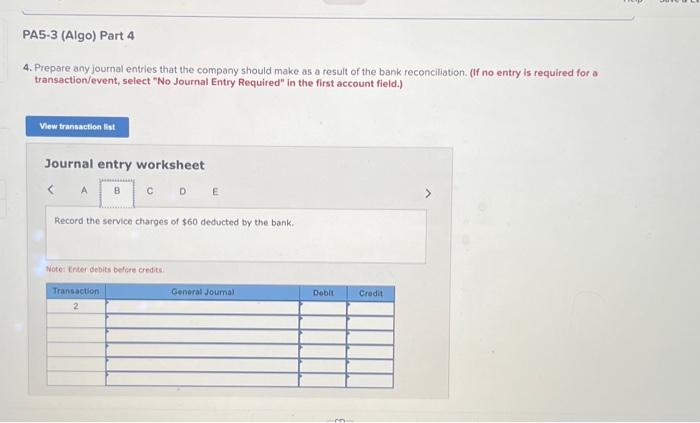

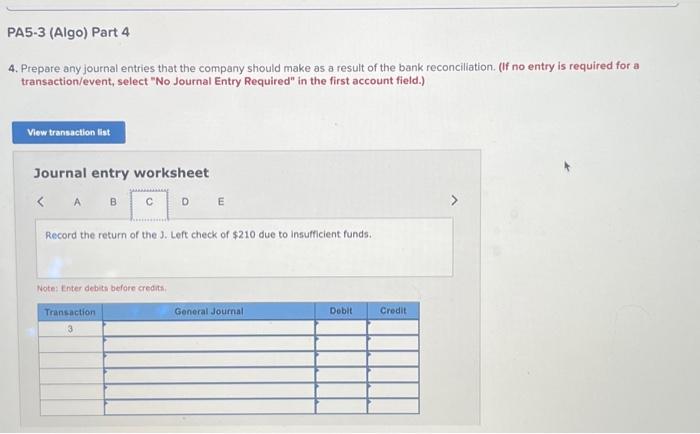

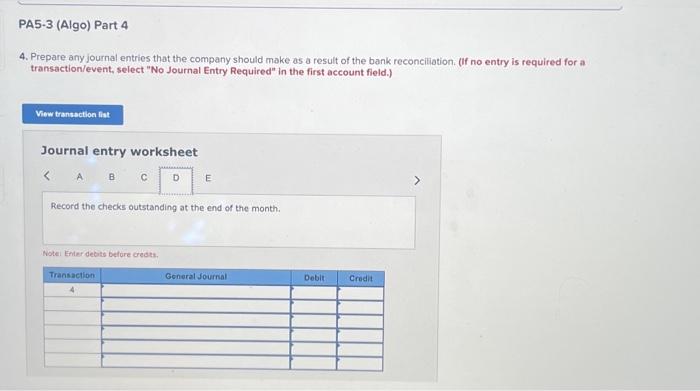

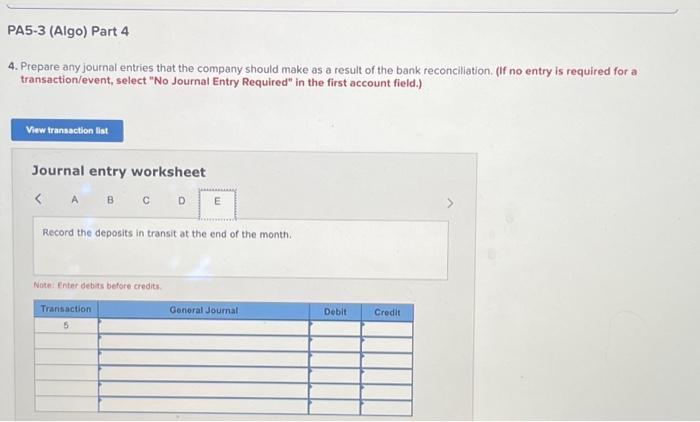

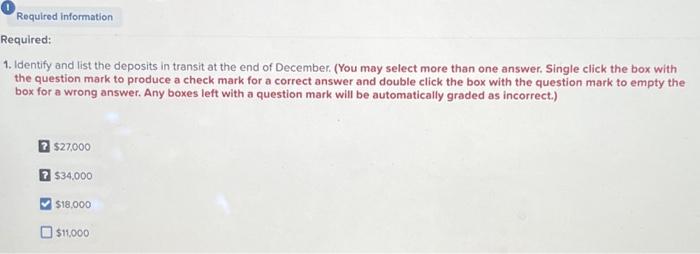

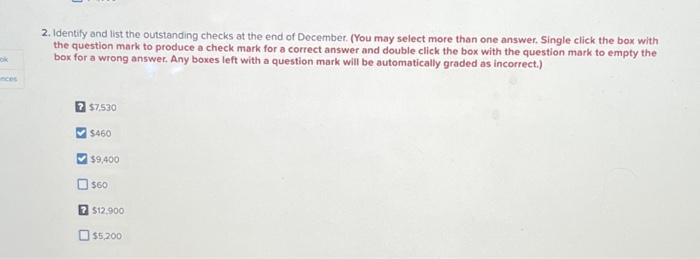

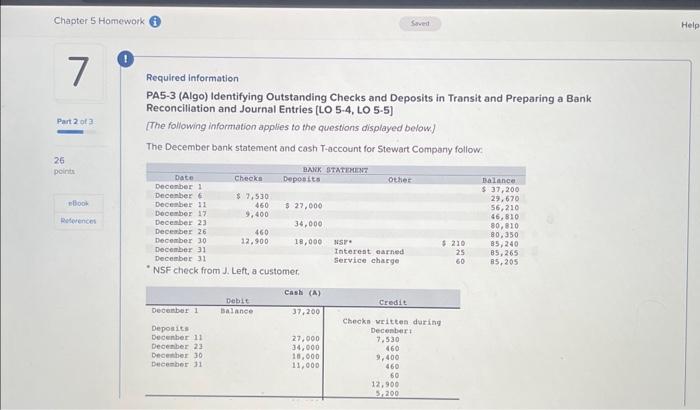

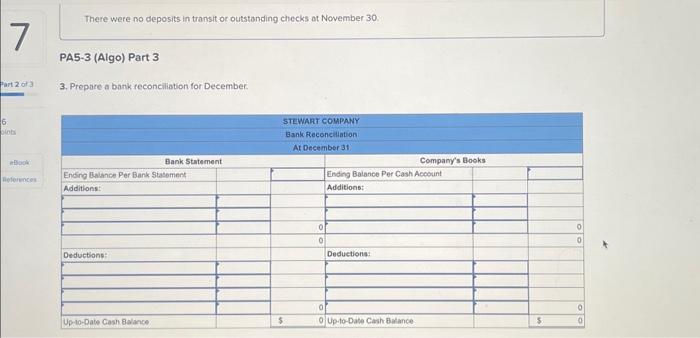

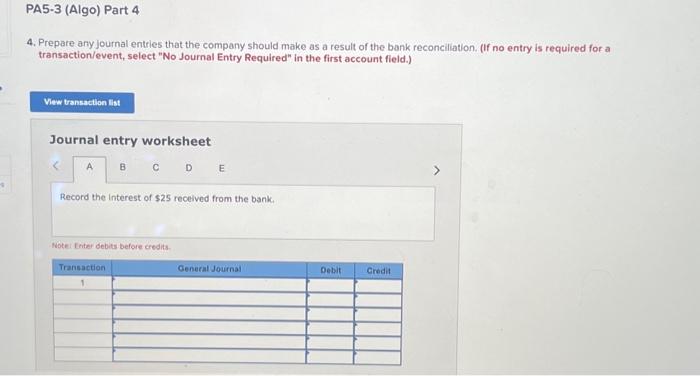

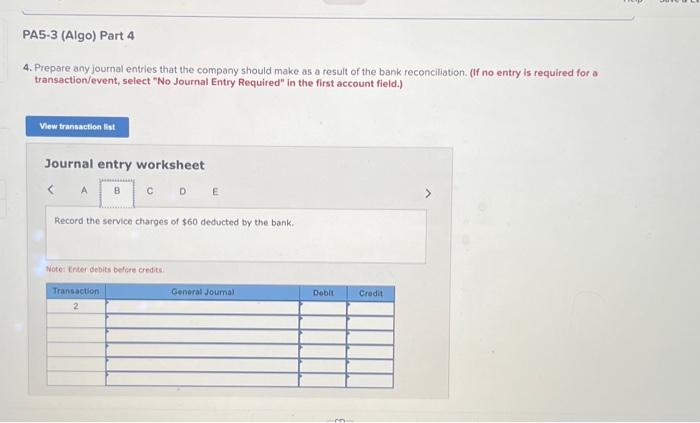

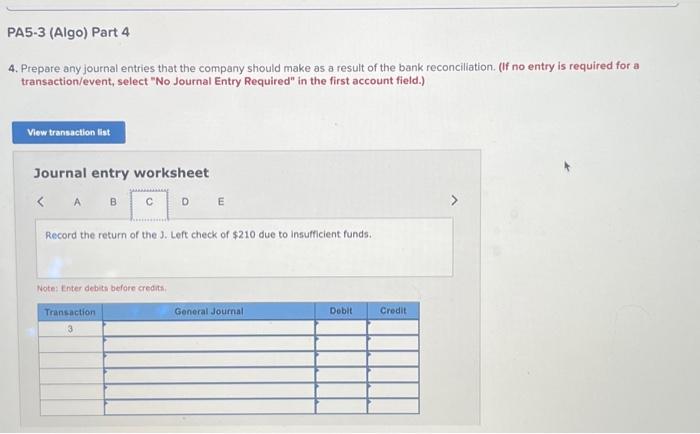

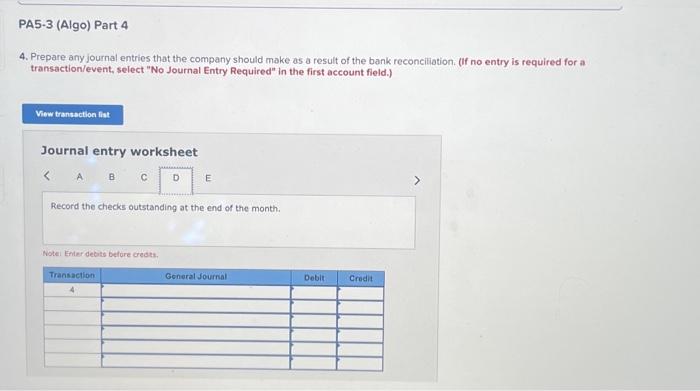

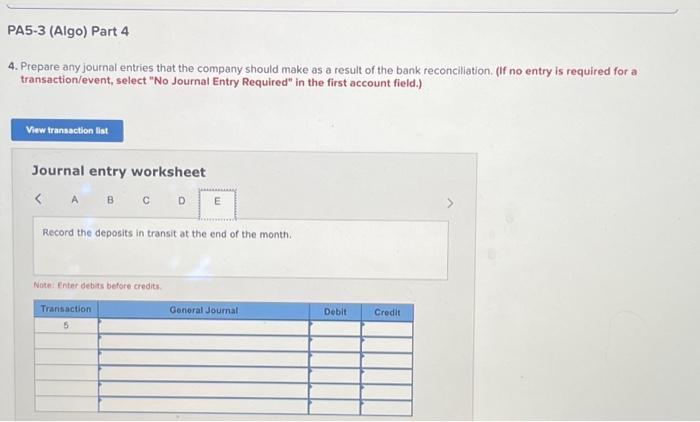

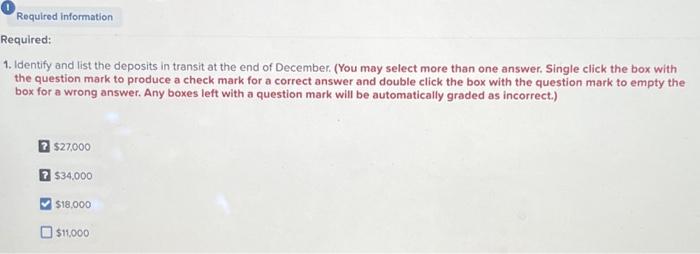

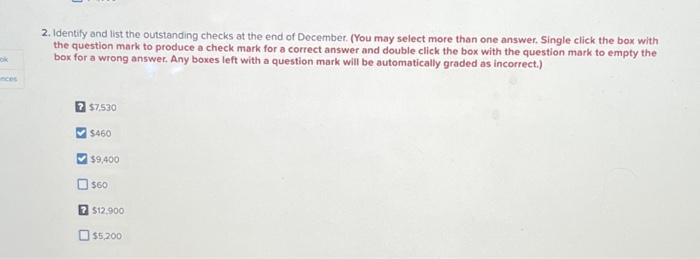

4. Prepare any journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the service charges of $60 deducted by the bank. Notes Enter debits before credies. 2. Identify and list the outstanding checks at the end of Docember. (You may select more than one answer, Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) 57.530 $460 $9,400 $60 $12.900 $5,200 1. Identify and list the deposits in transit at the end of December. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) $27,000 $34.000 $18,000 $11,000 4. Prepare any journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet B C D E Record the interest of $25 recelved from the bank. Note Enter debits before credits. 7. Prepare any journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the return of the J. Left check of $210 due to insufficient funds. Note: Enter debits before credits. 4. Prepare any journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet A B E Record the checks outstanding at the end of the month. Note: Enler debits before creats. Prepare any journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the deposits in transit at the end of the month. Noten Enter debits before credits. There were no deposits in transit or outstanding checks at November 30 . PA5-3 (Algo) Part 3 3. Prepare a bank reconciliation for December. Required information PA5-3 (Algo) Identifying Outstanding Checks and Deposits in Transit and Preparing a Bank Reconciliation and Journal Entries [LO 5-4, LO 5-5] [The following information applies to the questions displayed below] The December bank statement and cash T-account for Stewart Company follow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started