it's urgent, solve in minutes. I will gave you thumbs up

it's urgent, solve in minutes. I will gave you thumbs up

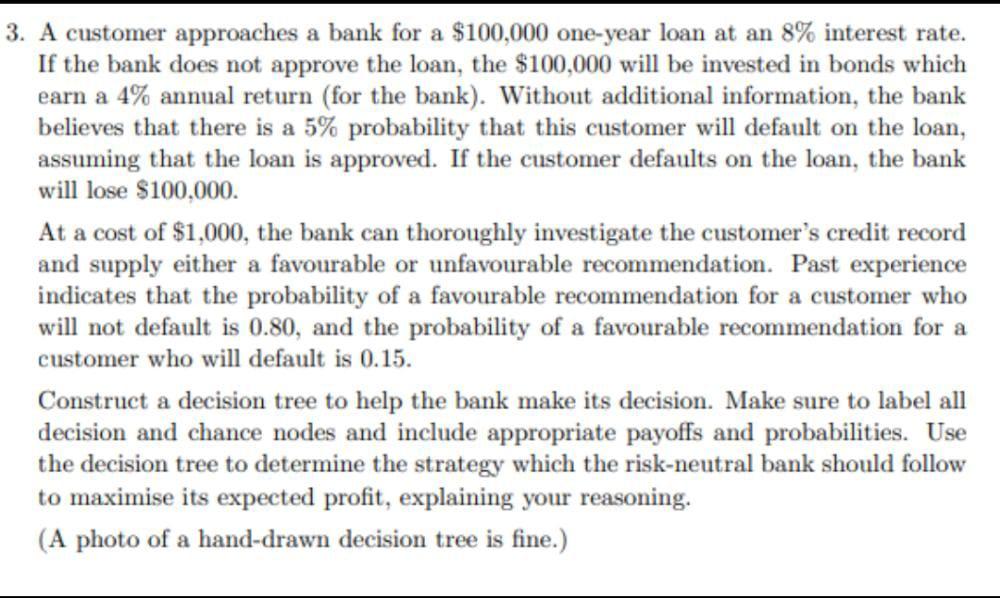

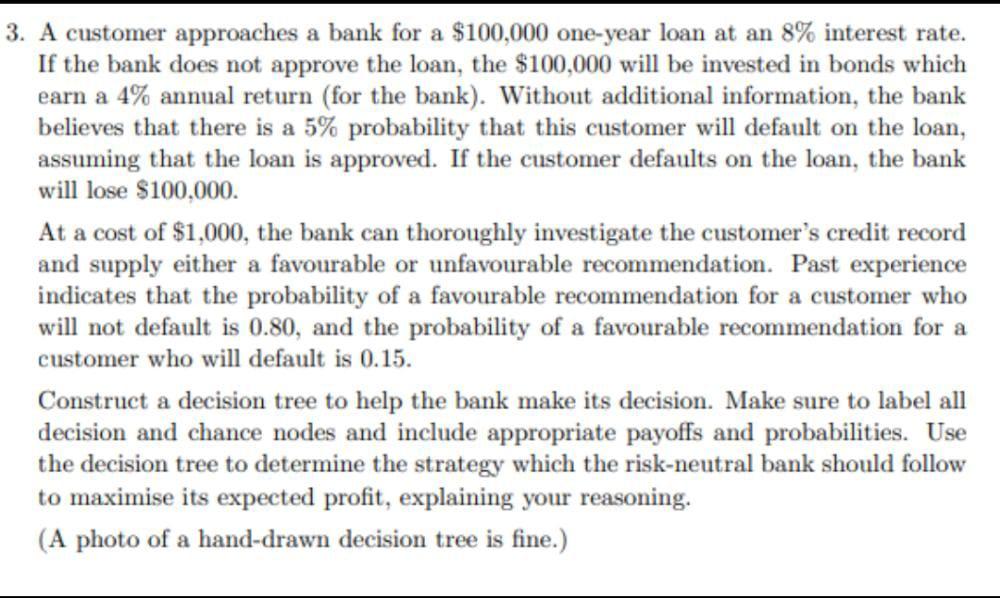

3. A customer approaches a bank for a $100,000 one-year loan at an 8% interest rate. If the bank does not approve the loan, the $100,000 will be invested in bonds which earn a 4% annual return (for the bank). Without additional information, the bank believes that there is a 5% probability that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the bank will lose $100,000. At a cost of $1,000, the bank can thoroughly investigate the customer's credit record and supply either a favourable or unfavourable recommendation. Past experience indicates that the probability of a favourable recommendation for a customer who will not default is 0.80, and the probability of a favourable recommendation for a customer who will default is 0.15. Construct a decision tree to help the bank make its decision. Make sure to label all decision and chance nodes and include appropriate payoffs and probabilities. Use the decision tree to determine the strategy which the risk-neutral bank should follow to maximise its expected profit, explaining your reasoning. (A photo of a hand-drawn decision tree is fine.) 3. A customer approaches a bank for a $100,000 one-year loan at an 8% interest rate. If the bank does not approve the loan, the $100,000 will be invested in bonds which earn a 4% annual return (for the bank). Without additional information, the bank believes that there is a 5% probability that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the bank will lose $100,000. At a cost of $1,000, the bank can thoroughly investigate the customer's credit record and supply either a favourable or unfavourable recommendation. Past experience indicates that the probability of a favourable recommendation for a customer who will not default is 0.80, and the probability of a favourable recommendation for a customer who will default is 0.15. Construct a decision tree to help the bank make its decision. Make sure to label all decision and chance nodes and include appropriate payoffs and probabilities. Use the decision tree to determine the strategy which the risk-neutral bank should follow to maximise its expected profit, explaining your reasoning. (A photo of a hand-drawn decision tree is fine.)

it's urgent, solve in minutes. I will gave you thumbs up

it's urgent, solve in minutes. I will gave you thumbs up