It's your first day as an analyst and you have been asked to prepare a valuation for an energy drink company that is set

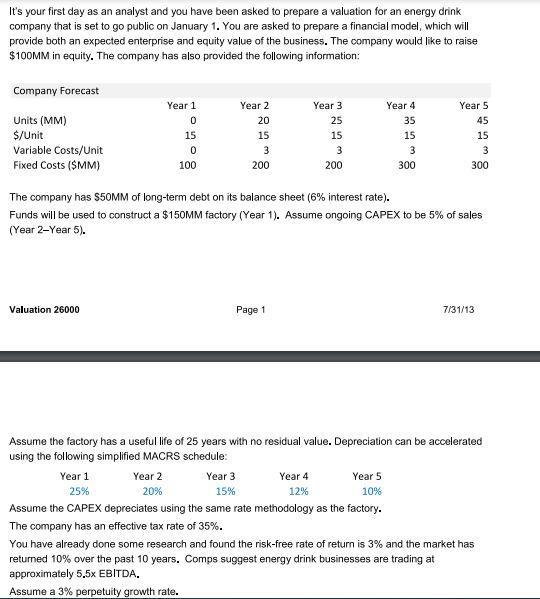

It's your first day as an analyst and you have been asked to prepare a valuation for an energy drink company that is set to go public on January 1. You are asked to prepare a financial model, which will provide both an expected enterprise and equity value of the business. The company would like to raise $100MM in equity. The company has also provided the following information: Company Forecast Units (MM) $/Unit Variable Costs/Unit Fixed Costs ($MM) Valuation 26000 Year 1 0 15 0 100 Year 1 25% Year 2 20% Year 2 20 15 3 200 Year 3 15% The company has $50MM of long-term debt on its balance sheet (6% interest rate). Funds will be used to construct a $150MM factory (Year 1). Assume ongoing CAPEX to be 5% of sales (Year 2-Year 5). Page 1 Year 3 25 15 3 200 Year 4 12% Assume the factory has a useful life of 25 years with no residual value. Depreciation can be accelerated using the following simplified MACRS schedule: Year 4 Year 5 10% 35 15 3 300 Assume the CAPEX depreciates using the same rate methodology as the factory. The company has an effective tax rate of 35%. Year 5 45 15 3 300 7/31/13 You have already done some research and found the risk-free rate of return is 3% and the market has returned 10% over the past 10 years. Comps suggest energy drink businesses are trading at approximately 5,5x EBITDA, Assume a 3% perpetuity growth rate.

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started