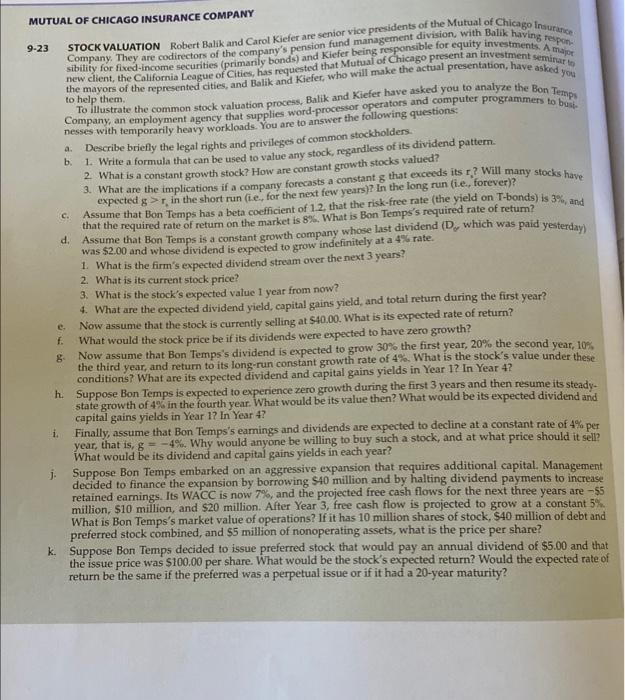

IUTUAL OF CHICAGO INSURANCE COMPANY -23 STOCK VALUATION Robert Balik and Carol Kiefer are senior vice presidents of the Mutual of Chicago insuranee Company. They are codirectors of the company's pension fund management division, with Balik having respon- being responsible for equity investments, A mhajor sibility for fixed-income securities (primarily bonds) and Kicfer being responsible for equity investments. A that Mual of Chica post an invest new client, the California League of Cities, has requested that shotual make the actual presentation, have asked you To illustrate the common stock valuation process, Balik and Kiefer have asked you to analy computer programmers to busk. to help them. Company, an employment agency that supplies word-processor operators and comp: nesses with temporarily heavy workloads. You are to answet the following que a. Describe briefly the legal rights and privileges of common stockholders. 2. What is a constant growth stock? How are constant growth stocks valued? 3. What are the implications if a company forecasts a constant g that exceeds its r ? Will many stocks have 3. What are the implications if a company forecasts a constant g that exceeds its ri. Will merter expected g>r, in the short run (i.e, for the next few years)? in the long run (i.e, forever)? c. Assume that Bon Temps has a beta coefficient of 12 , that the risk-free rate (the yield on T-bonds) is 3%, and Assume that bon Temps has a beta coemricient of 12 , that the risk-free rate of return on the market is 8%. What is Bon Temps's required rate of retum? d. Assume that Bon Temps is a constant growth company whose last dividend ( D which was paid yesterday) Assume that Bon Temps is a constant growth company whoce last dividend whose dividend is expected to grow indefinitely at a 4% rate. 1. What is the firm's expected dividend stream over the next 3 years? 2. What is its current stock price? 3. What is the stock's expected value 1 year from now? 4. What are the expected dividend yield, capital gains yield, and total return during the first year? e. Now assume that the stock is currently selling at $40.00. What is its expected rate of return? f. What would the stock price be if its dividends were expected to have zero growth? g. Now assume that Bon Temps's dividend is expected to grow 30% the first year, 20% the second year, 10% the third year, and return to its long-run constant growth rate of 4%. What is the stock's value under these conditions? What are its expected dividend and capital gains yields in Year 1? In Year 4? h. Suppose Bon Temps is expected to experience zero growth during the first 3 years and then resume its steadystate growth of 4% in the fourth year. What would be its value then? What would be its expected dividend and capital gains yields in Year 1? in Year 4 ? i. Finally, assume that Bon Temps's eamings and dividends are expected to decline at a constant rate of 4% per year, that is, g=4%. Why would anyone be willing to buy such a stock, and at what price should it sell? What would be its dividend and capital gains yields in each year? j. Suppose Bon Temps embarked on an aggressive expansion that requires additional capital. Management decided to finance the expansion by borrowing $40 million and by halting dividend payments to increase retained earnings. Its WACC is now 7\%, and the projected free cash flows for the next three years are - $5 million, $10 million, and $20 million. After Year 3 , free cash flow is projected to grow at a constant 5% What is Bon Temps's market value of operations? If it has 10 million shares of stock, $40 million of debt and preferred stock combined, and 55 million of nonoperating assets, what is the price per share? k. Suppose Bon Temps decided to issue preferred stock that would pay an annual dividend of $5.00 and that the issue price was $100.00 per share. What would be the stock's expected return? Would the expected rate of return be the same if the preferred was a perpetual issue or if it had a 20 -year maturity? e. Now assume that the stock is currently selling at $40.00. What is its expected rate of return? f. What would the stock price be if its dividends were expected to have zero growth