Answered step by step

Verified Expert Solution

Question

1 Approved Answer

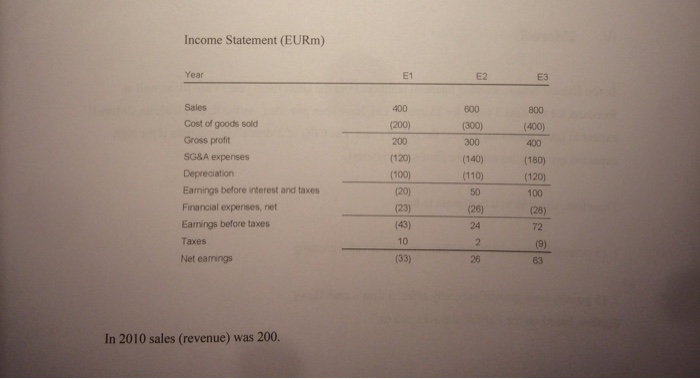

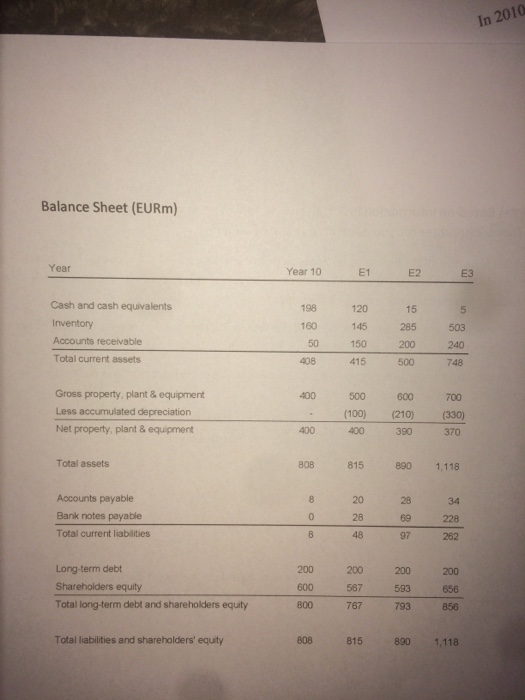

IV. 2More4U In the Exhibit below, selected financial numbers from the latest fiscal year (Year 10) as well as forecasts for the next 3 years

IV. 2More4U

In the Exhibit below, selected financial numbers from the latest fiscal year (Year 10) as well as forecasts for the next 3 years for 2More4U Ltd. have been provided. As the figures indicate, 2More4U expect to grow substantially over the next 3 years. The CEO of 2More4U is uncertain if the high expected growth rates are in the firms best interest.

Therefore, she asks you to explain to her:

1.Under which conditions growth is value creating

2. How growth generally affect a firms cash flows Further, based on the Exhibit she asks you to:

3. (5 points) Calculate 2More4U growth rate in sales for E1E3

4. (5 points) Prepare a cash flow statement for E1E3. Your cash flow statement should be divided into:

Cash flows from operations

Cash flows from investing

Cash flows from financing

(try to provide in one table, where the first column lists all the items, while column 2 3 and 4 show the number for each of the year, respectively.)

And to explain:

5. Whether cash flow from operations or operating earnings are better at explaining the performance (i.e. the value creation) of 2More4U in the Exhibit?

6. Why earnings are positive, while cash flows from operations are negative (in the forecast period)?

In answering the questions, please make sure to state any assumptions that you make (if you are making any).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started