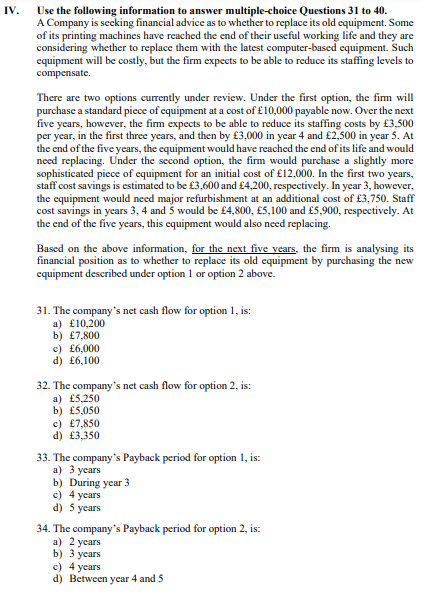

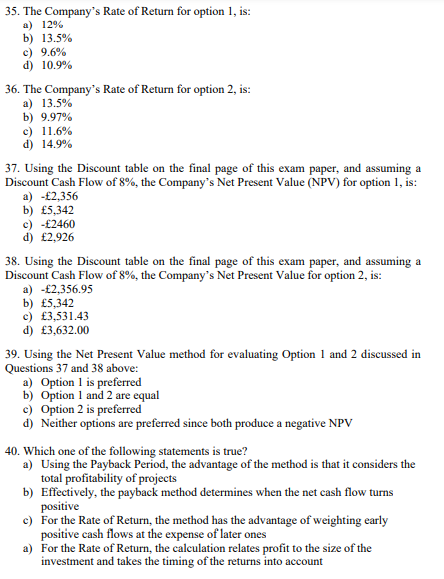

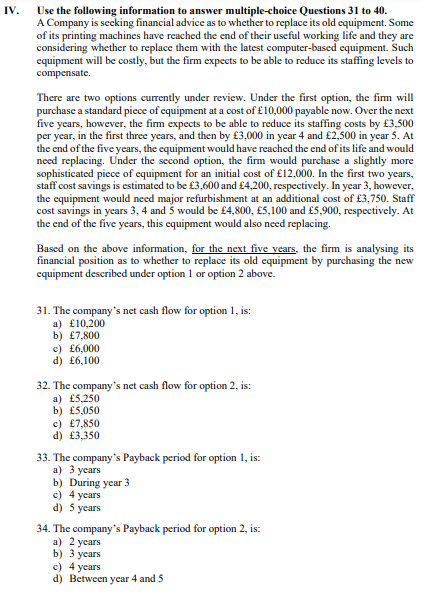

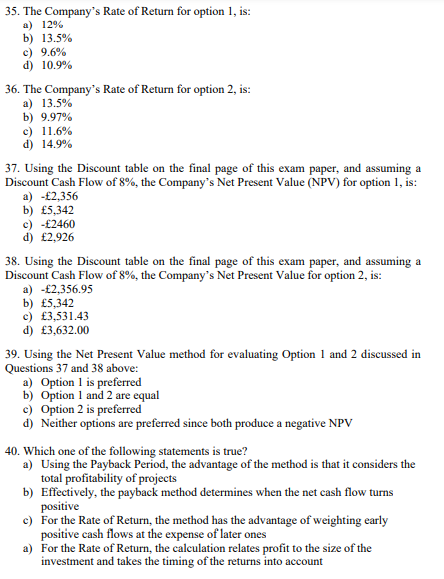

IV. Use the following information to answer multiple-choice Questions 31 to 40. A Company is seeking financial advice as to whether to replace its old equipment. Some of its printing machines have reached the end of their useful working life and they are considering whether to replace them with the latest computer-based equipment. Such equipment will be costly, but the firm expects to be able to reduce its staffing levels to compensate. There are two options currently under review. Under the first option, the fim will purchase a standard piece of equipment at a cost of 10,000 payable now. Over the next five years, however, the fim expects to be able to reduce its staffing costs by 3,500 per year, in the first three years, and then by 3,000 in year 4 and 2,500 in year 5. At the end of the five years, the equipment would have reached the end of its life and would need replacing. Under the second option, the firm would purchase a slightly more sophisticated piece of equipment for an initial cost of 12,000. In the first two years, staff cost savings is estimated to be 3,600 and 4,200, respectively. In year 3, however, the equipment would need major refurbishment at an additional cost of 3,750. Staff cost savings in years 3, 4 and 5 would be 4,800, 5,100 and 5,900, respectively. At the end of the five years, this equipment would also need replacing. Based on the above information, for the next five years, the firm is analysing its financial position as to whether to replace its old equipment by purchasing the new equipment described under option 1 or option 2 above. 31. The company's net cash flow for option 1, is: a) 10,200 b) 7,800 c) 6,000 d) 6,100 32. The company's net cash flow for option 2, is: a) 5,250 b) 5,050 c) 7,850 d) 3,350 33. The company's Payback period for option 1, is: a) 3 years b) During year 3 c) 4 years d) 5 years 34. The company's Payback period for option 2, is: a) 2 years b) 3 years c) 4 years d) Between year 4 and 5 35. The Company's Rate of Return for option 1, is: a) 1296 b) 13.5% c) 9.6% d) 10.9% 36. The Company's Rate of Return for option 2, is: a) 13.5% b) 9.97% c) 11.6% d) 14.9% 37. Using the Discount table on the final page of this exam paper, and assuming a Discount Cash Flow of 8%, the Company's Net Present Value (NPV) for option 1, is: a) -2,356 b) 5,342 c) -2460 d) 2,926 38. Using the Discount table on the final page of this exam paper, and assuming a Discount Cash Flow of 8%, the Company's Net Present Value for option 2, is: a) -2,356.95 b) 5,342 c) 3,531.43 d) 3,632.00 39. Using the Net Present Value method for evaluating Option 1 and 2 discussed in Questions 37 and 38 above: a) Option 1 is preferred b) Option 1 and 2 are equal c) Option 2 is preferred d) Neither options are preferred since both produce a negative NPV 40. Which one of the following statements is true? a) Using the Payback Period, the advantage of the method is that it considers the total profitability of projects b) Effectively, the payback method determines when the net cash flow turns positive c) For the Rate of Return, the method has the advantage of weighting early positive cash flows at the expense of later ones a) For the Rate of Return, the calculation relates profit to the size of the investment and takes the timing of the returns into account