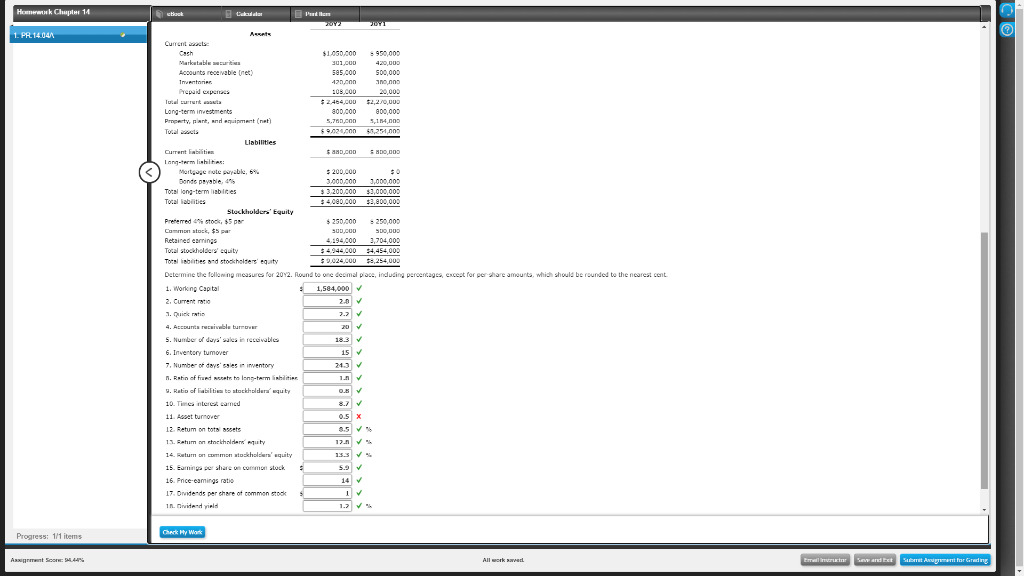

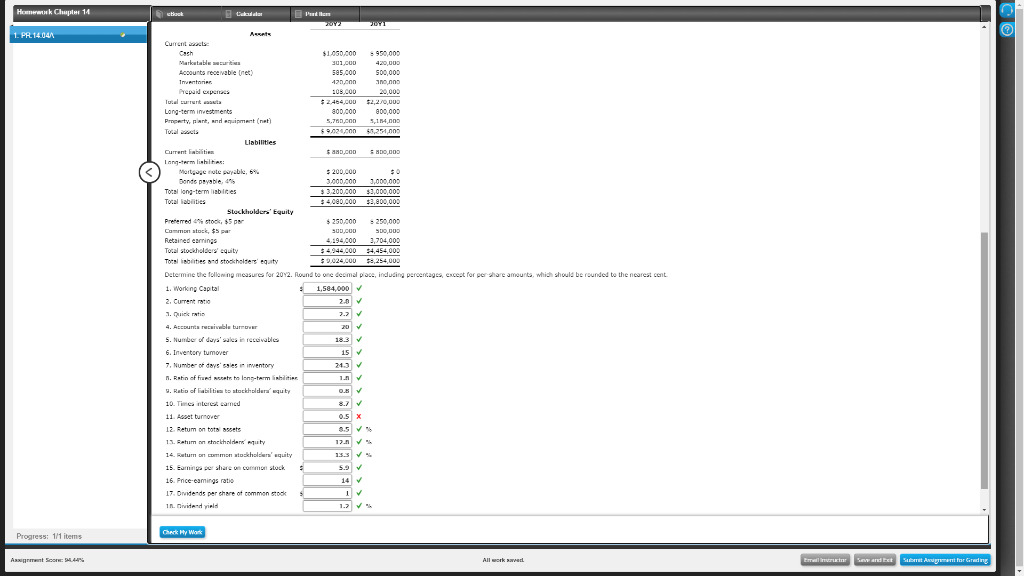

I've already figured out most of them except for #11, I tried searching for the answer but even though a lot of people have given different answers they're all still marked as wrong. I've found answers ranging from .47 to 2.05

I've already figured out most of them except for #11, I tried searching for the answer but even though a lot of people have given different answers they're all still marked as wrong. I've found answers ranging from .47 to 2.05

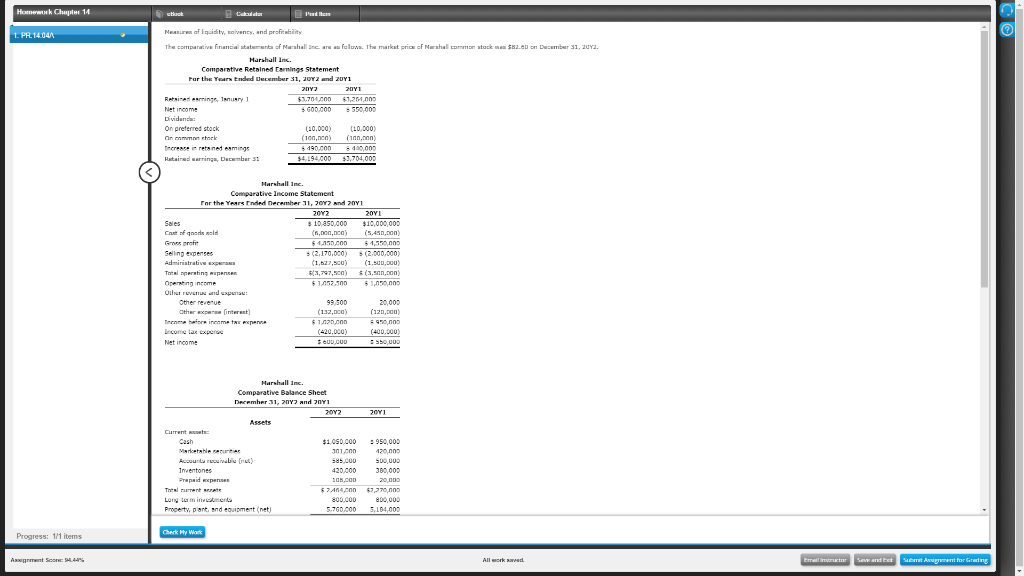

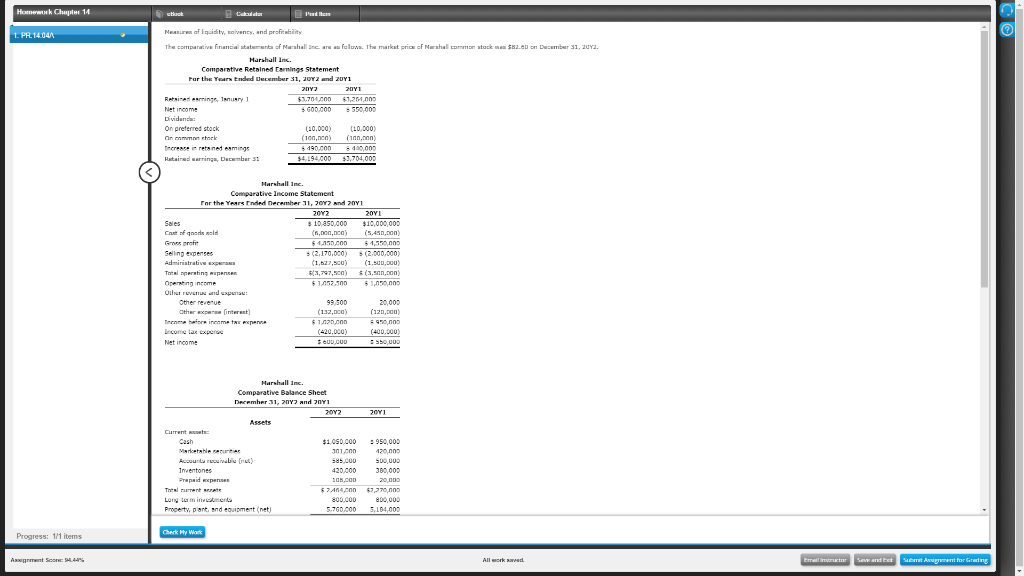

Homework Chapter 14 stock 1. PR. 14.041 Mees of liquidity, walenty, and profitability The comparative financial statement of Marshall Incar as follows the market price of Marshall common stock was $2.0 on December 31, 2012. Marshallins Comparative Retained Carving statement For the Year Ended December 31, 2012 and 20Y1 2012 2011 Retained in TURY $1.700.000 67,261,000 Net income $ 600.000 - 550.000 Dividence On preferred stock (10,000) (10.000) On Apl (100,000) (non, non Increase in retained esmings $490.000 6400,000 Hatain warning, December $4,194.000 $3,704,000 Marshall Inc. Comparative Income Statement For the Year Ended December 11, 2012 and 2011 2012 2011 Sales 3 10 850.000 $10,000,000 Cost of good old (1,000,000) (5.450,000) Grafi $24.950.000 545 Selling expenses - (2,170,000) 5 (2.000.000) Administrativ XpS (1,627,500) (1.100.000 Total penting penen (3,797,500) (3.500,000) Operating income $1.052.00 51,050,000 OTW and Other revenue 99,500 20.000 Other expe(interest (132,00) (120,000) Terme bare income tax expense $1,220.000 950,000 Encome tax cap (420,000 (400,000) Net income SOUD DUD 550,000 Marshall Inc. Comparative Balance Sheet December 31, 2012 and 2041 2012 2011 Current Marketable BUPA Aucun rival Inventones Prepaid expenses The current Long terminements Property, plant, and equipment (net) $100.000 301.000 385.000 420.000 105.000 $ 2.Ancon $7464,00 800.000 5.760.000 950 000 120,000 SDO,000 300,003 20,000 $7,770,000 800,000 SIDO 5,164,000 Progress: 1/1 items Axigent Score: 4.44% All worker Elmar Save and it Sudet Argent forming Homework Chapter 14 1. PR. 14.041 lichting stock Could dem 2012 UYU Assets Current Cach $1.050.000 - 950,000 Marketable with 301 CU 420,003 Accounts receivable (net) 585.000 500,000 tner. 42.con Prepaid experts 103.000 20,000 lucru $2.464.000 $2,2/0,000 Long-term investments 80D.COD 800,000 Property, plant, and animant (net) 5.700.000 5,114.000 Tocal la $9.92.000 59,251,000 Llabilities Current liabilities $2.000 5800,000 Intermishilar: Mortgage note payable, 69 $ 200.000 Bonde payable, 3.000.000 3,000,000 Total long-term inbikes $ 3,200.000 $3,000,000 Tocal abilities $ 4.000.000 $3,800,000 Stockholders' Equity Preferred to $ 250.000 - 250,000 Common stock, $ SUB,Cuu SUODU Retained earrings 4194.000 3.704,000 Tocal stockholborg quity $ 4.944,000 $4,454,000 Torslisbiter ad stockholdes equity $9.024.000 $5,254,000 Determine the following measures for 20Y2. Round to one decimal place, inducing percentages, except for per share amounts, which should be rounded to the nearest cent. 1. Working Capital 1,584,000 2. Current ratio 2.1 3. Dratis 4. Antarile turnover 20 5. Number of duya'walesin receivables 6. Inventory tumover 15 7, Number of de inventory 243 n. Rain of freed Ins-tarmsbilities 1. 9. Ratio of liabilities to stockholders' wuty ON 10. Time interes canned 8.7 11. szetturnover 0.5 X 12. Retum on to assets 15. Batum en holder ty 12.0 14. Ruum montokholders' equity 13.3 15. Earning per share on common stock 5 5.9 16. Price-eamings ratio 14 17. Dividends per chare of common stock I 1. Dividend yield 1.2 Progress: 11 items Check My Work Axigent Score: 4.44% All worker Error Sew and Est Serment for Grading

I've already figured out most of them except for #11, I tried searching for the answer but even though a lot of people have given different answers they're all still marked as wrong. I've found answers ranging from .47 to 2.05

I've already figured out most of them except for #11, I tried searching for the answer but even though a lot of people have given different answers they're all still marked as wrong. I've found answers ranging from .47 to 2.05