Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I've answered part A. I need help in answering B. Dec 27. LO.2,9 Consider each of the following independent situations, and answer the following questions.

I've answered part A. I need help in answering B.

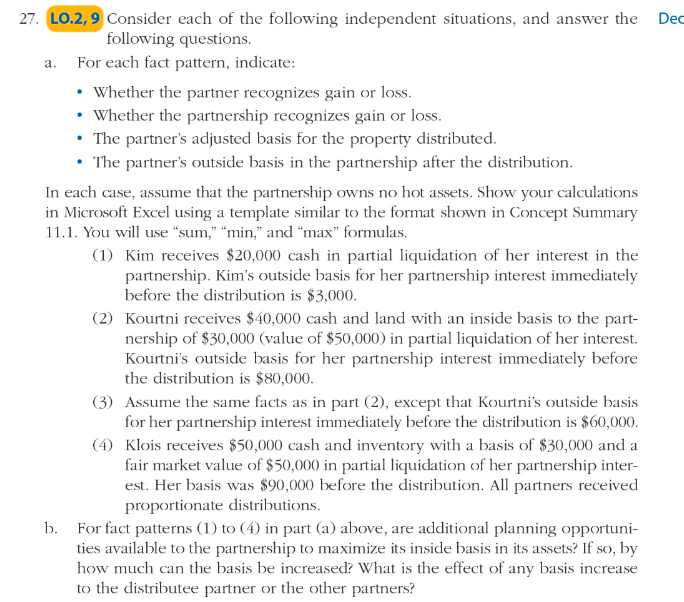

Dec 27. LO.2,9 Consider each of the following independent situations, and answer the following questions. a. For each fact pattern, indicate: Whether the partner recognizes gain or loss. Whether the partnership recognizes gain or loss. The partner's adjusted basis for the property distributed The partner's outside basis in the partnership after the distribution. In each case, assume that the partnership owns no hot assets. Show your calculations in Microsoft Excel using a template similar to the format shown in Concept Summary 11.1. You will use "sum," "min," and "max" formulas. (1) Kim receives $20,000 cash in partial liquidation of her interest in the partnership. Kim's outside basis for her partnership interest immediately before the distribution is $3,000. (2) Kourtni receives $40,000 cash and land with an inside basis to the part- nership of $30,000 (value of $50,000) in partial liquidation of her interest. Kourtni's outside basis for her partnership interest immediately before the distribution is $80,000. (3) Assume the same facts as in part (2), except that Kourtni's outside basis for her partnership interest immediately before the distribution is $60,000. (4) Klois receives $50,000 cash and inventory with a basis of $30,000 and a fair market value of $50,000 in partial liquidation of her partnership inter- est. Her basis was $90,000 before the distribution. All partners received proportionate distributions. b. For fact patterns (1) to (4) in part (a) above, are additional planning opportuni- ties available to the partnership to maximize its inside basis in its assets? If so, by how much can the basis be increased? What is the effect of any basis increase to the distributee partner or the other partnersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started