Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ive been struggling with this for a couple weeks now. I was told not to use the excel formulas that are built in. I have

Ive been struggling with this for a couple weeks now. I was told not to use the excel formulas that are built in. I have to make my own. It can be done in excel or R. Please help me figure this out.

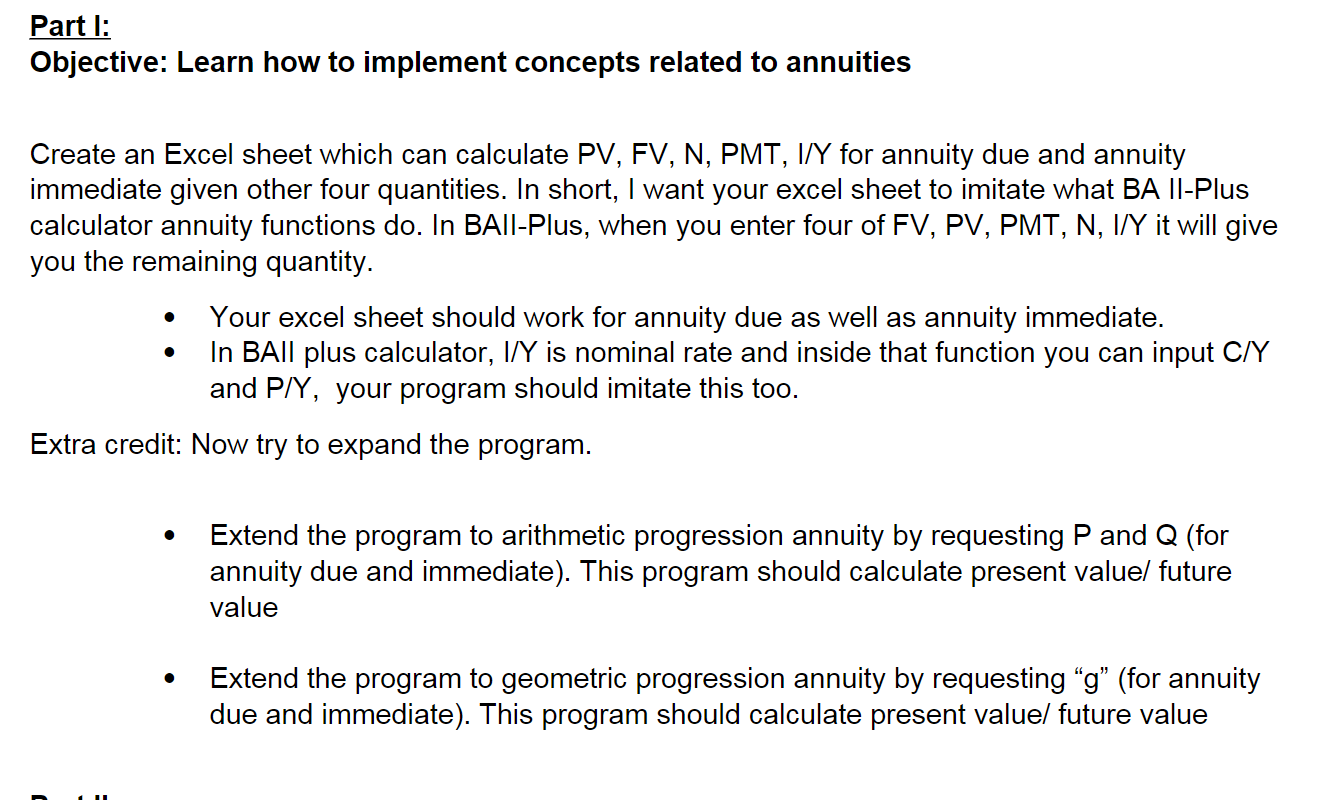

Part I: Objective: Learn how to implement concepts related to annuities Create an Excel sheet which can calculate PV, FV, N, PMT, I/Y for annuity due and annuity immediate given other four quantities. In short, I want your excel sheet to imitate what BA II-Plus calculator annuity functions do. In BAll-Plus, when you enter four of FV, PV, PMT, N, I/Y it will give you the remaining quantity. - Your excel sheet should work for annuity due as well as annuity immediate. - In BAll plus calculator, I/Y is nominal rate and inside that function you can input C/Y and P/Y, your program should imitate this too. Extra credit: Now try to expand the program. - Extend the program to arithmetic progression annuity by requesting P and Q (for annuity due and immediate). This program should calculate present value/ future value - Extend the program to geometric progression annuity by requesting "g" (for annuity due and immediate). This program should calculate present value/ future value Part I: Objective: Learn how to implement concepts related to annuities Create an Excel sheet which can calculate PV, FV, N, PMT, I/Y for annuity due and annuity immediate given other four quantities. In short, I want your excel sheet to imitate what BA II-Plus calculator annuity functions do. In BAll-Plus, when you enter four of FV, PV, PMT, N, I/Y it will give you the remaining quantity. - Your excel sheet should work for annuity due as well as annuity immediate. - In BAll plus calculator, I/Y is nominal rate and inside that function you can input C/Y and P/Y, your program should imitate this too. Extra credit: Now try to expand the program. - Extend the program to arithmetic progression annuity by requesting P and Q (for annuity due and immediate). This program should calculate present value/ future value - Extend the program to geometric progression annuity by requesting "g" (for annuity due and immediate). This program should calculate present value/ future valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started