Question: I've been told that 2016 NOA = $26,472 and 2016 NOPAT = $10,575, but I'm not sure if that is correct. Forecasting with the Parsimonious

I've been told that 2016 NOA = $26,472 and 2016 NOPAT = $10,575, but I'm not sure if that is correct.

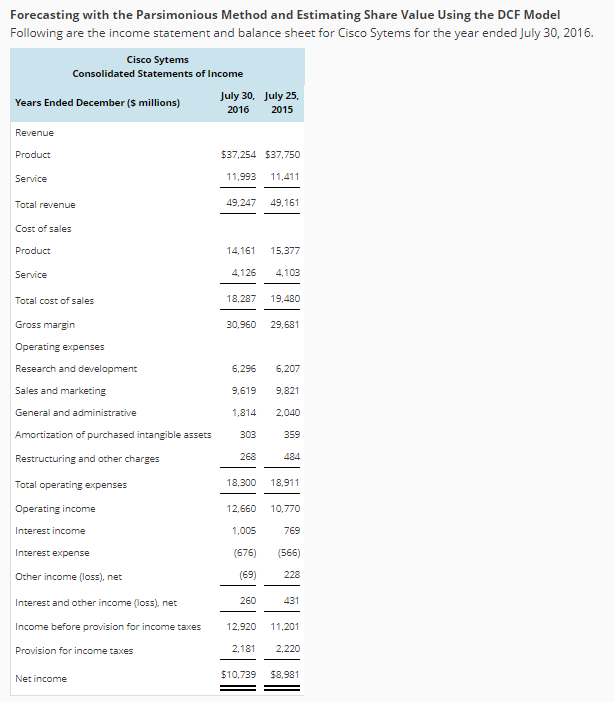

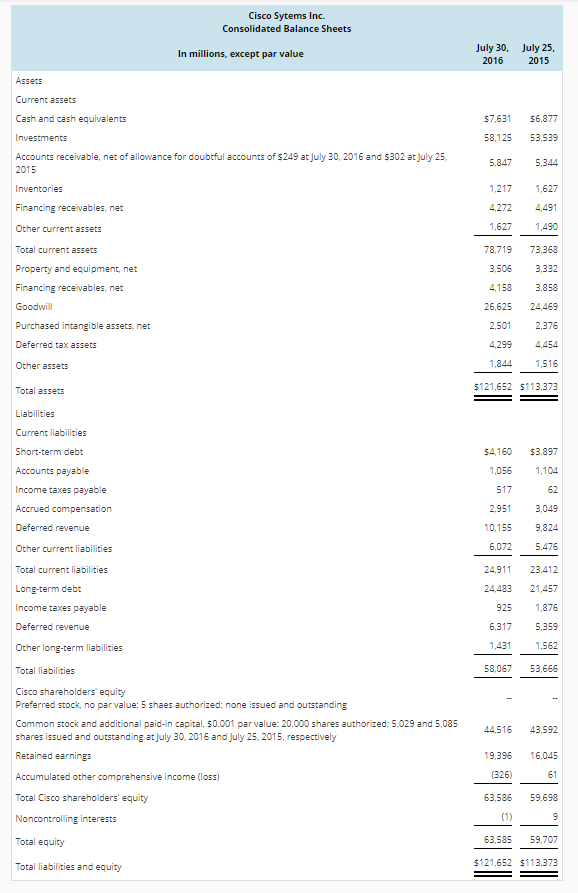

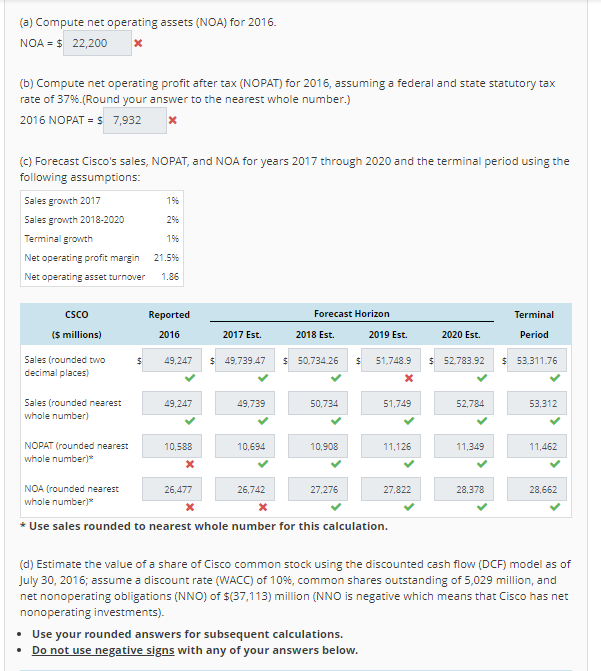

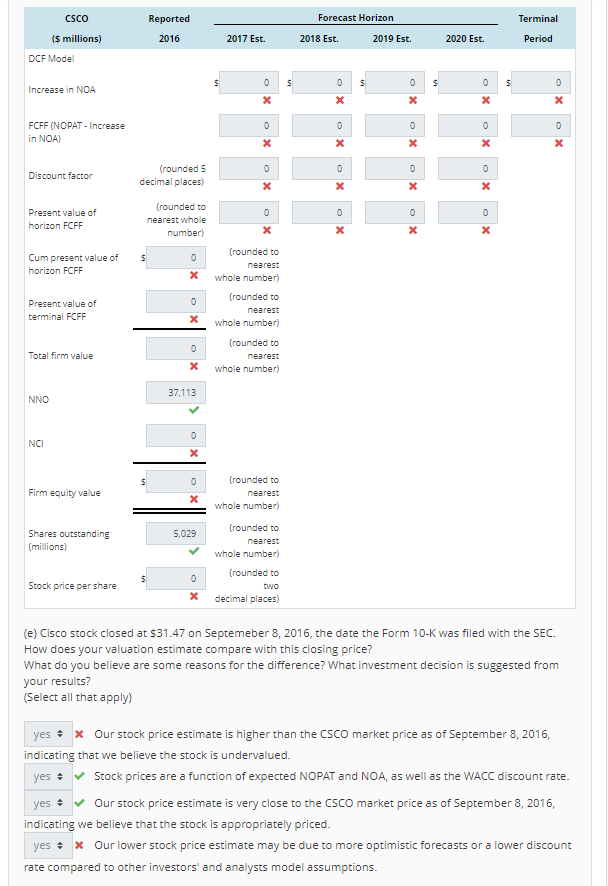

Forecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model Following are the income statement and balance sheet for Cisco Sytems for the year ended July 30, 2016. Cisco Sytems Consolidated Statements of Income July 30, July 25, 2016 2015 Years Ended December (S millions) Revenue Product Service $37,254 $37,750 11,993 11,411 49,247 49,161 Total revenue Cost of sales Product Service Total cost of sales Gross margin Operating expenses Research and development Sales and marketing General and administrative Amortization of purchased intangible assets Restructuring and other charges Total operating expenses Operating income Interest income 14,161 15,377 4,126 4,103 18,287 19,480 30,960 29,681 6,296 6,207 9,619 9,821 1,814 2,040 359 268 484 18,300 18,911 12,660 10,770 769 (676) (566) (69) 228 260 431 Income before provision for income taxes 12,920 11,201 2.181 2.220 510,739 $8,981 303 1,005 Interest expense Other income (loss), net Interest and other income (loss). net Provision for income taxes Net income Cisco Sytems Inc. Consolidated Balance Sheets July 30, 2016 July 25, 2015 In millions, except par value Assets Current assets Cash and cash equivalents 57,631 $6,877 58.125 53.539 Accounts receivable, net of allowance for doubtful accounts of $249 at July 30, 2016 and s302 atJuly 25 2015 Financing receivables, net Other current assets Total current assets Property and equipment, net Financing receivables, net Goodwill Purchased intangible assets, net Deferred tax assets Other assets .847 5.344 1,2171,627 4,272 4491 1.627 1,490 78,719 73,368 3506 3.332 4,158 3.858 26.625 24469 2.501 2.376 4,299 4454 1844 1516 121,652 $113.373 Total assets Liabilities Current liabilities Short-term debt Accounts payable Income taxes payable Accrued compensation Deferred revenue Other current liabilities Total current liabilities Long-term debt Income taxes payable Deferred revenue Other long-term liabilities Total liabilities Cisco shareholders equity Preferred stock, no par value: 5 shaes authorized; none issued and outstanding Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; 5,029 and 5,085 shares issued and outstanding at July 30, 2016 and July 25, 2015, respectively Retained earnings Accumulated other comprehensive income (loss) Total Cisco shareholders' equity Noncontrolling interests Total equity $4,160 $3.897 1,056 1104 62 2.951 3.049 10.155 9.824 6,072 5,476 24,911 23,412 24,483 21,457 925 1,876 6.317 5.359 1,431 1562 58,067 53.666 517 44516 43.592 19,396 16,045 61 63,586 59,698 (326) 63.535 59.707 121,652 $113.373 Total liabilities and equity (a) Compute net operating assets (NOA) for 2016. NOA= $ 22,200 (b) Compute net operating profit after tax (NOPAT) for 2016, assuming a federal and state statutory tax rate of 37%.(Round your answer to the nearest whole number.) 2016 NOPAT S 7,932 X (C) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period using the following assumptions: Sales growth 2017 Sales growth 2018-2020 Terminal growth Net operating profit margin Net operating asset turnover 196 296 15% 21.5% 1.86 CSCO Reported Forecast Horizon Terminal S millions) 2016 2017 Est. 2018 Est. 2019 Est. 2020 Est. Period Sales (rounded two decimal places) 49,247 49,739.47 50,734 26 51.748.9 52.783.92 53.311.76 53,312 Sales (rounded nearest whole number) 49,247 49,739 50,734 51,749 52,784 NOPAT (rounded nearest whole number 10,588 10,694 10,908 11,126 11,349 11,462 NOA (rounded nearest whole number * Use sales rounded to nearest whole number for this calculation 26,477 26,742 27,276 27,822 28,378 28,662 (d) Estimate the value of a share of Cisco common stock using the discounted cash flow (DCF) model as of July 30, 2016, assume a discount rate (WACC) of 10%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million (NNO is negative which means that Cisco has net nonoperating investments). Use your rounded answers for subsequent calculations. Do not use negative signs with any of your answers below CSCO Reported Forecast Horizon Terminal S millions) 2016 2017 Est. 2018 Est. 2019 Est. 2020 Est. Period DCF Model Increase in NOA FCFF (NOPAT Increase in NOA) (rounded5 decimal places) Discount factor Present value of horizon FCFF (rounded to nearest whole number) (rounded to xwhole number) (rounded to whole number) (rounded to xwhole number) Cum present value of horizon FCFF Present value of terminal FCFF neareS Total firm value 37,113 NNO NCI (rounded to whole number) (rounded to whole numberl Firm equity value Shares outstanding (millions) 5,029 (rounded to two decimal places) Stock price per share X (e) Cisco stock closed at $31.47 on Septemeber 8, 2016, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference? What investment decision is suggested from your results? (Select all that apply) yes # indicating that we believe the stock is undervalued. Our stock price estimate is higher than the CSCO market price as of September 8, 2016, yes Stock prices are a function of expected NOPAT and NOA, as well as the WACC discount rate yes # Our stock price estimate is very close to the CSCO market price as of September 8, 2016 indicating we believe that the stock is appropriately priced yesx Our lower stock price estimate may be due to more optimistic forecasts or a lower dicount rate compared to other investors' and analysts model assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts