Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ive been trying to understand how to start this and need help. my professor does her best but i think i need more help. please

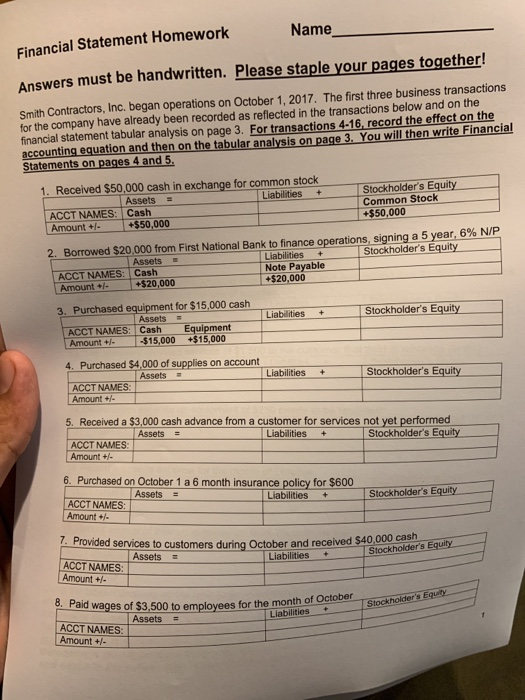

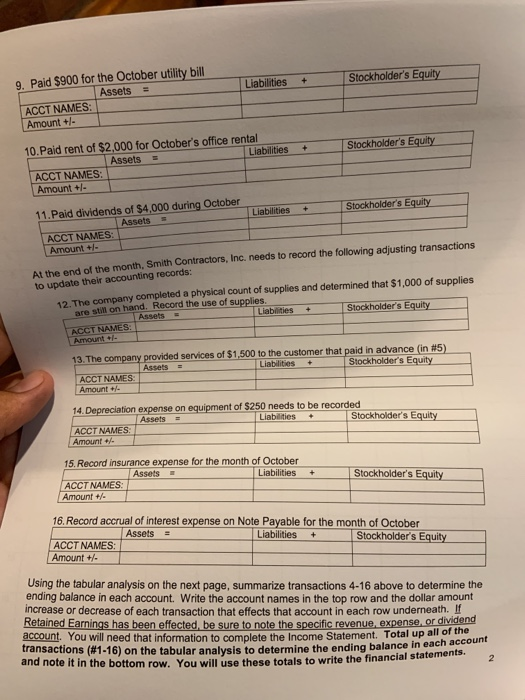

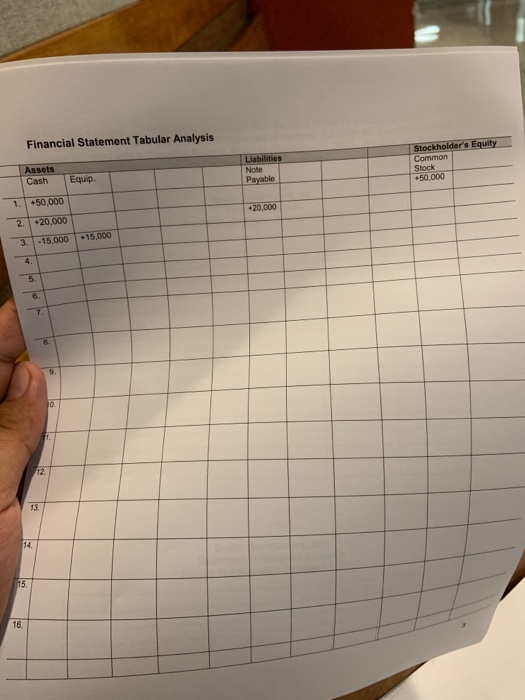

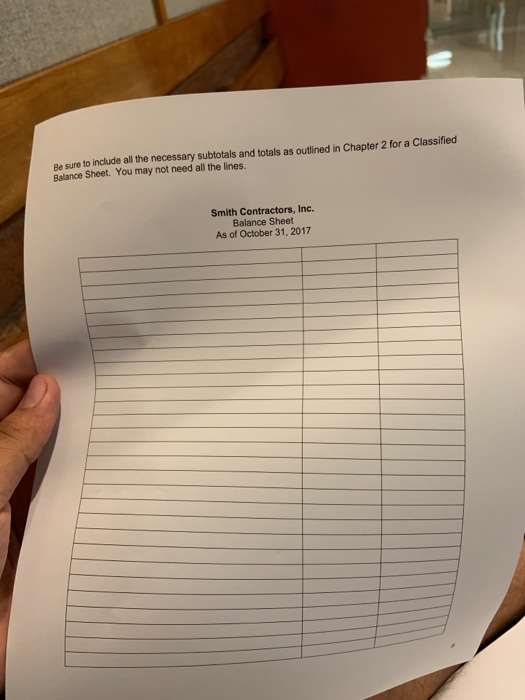

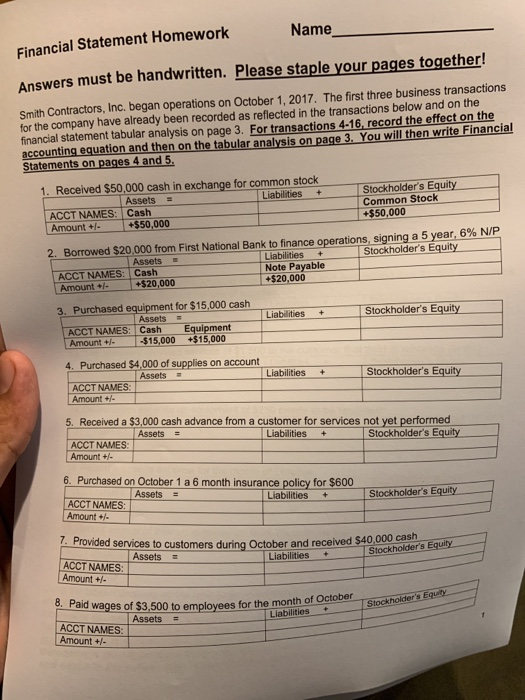

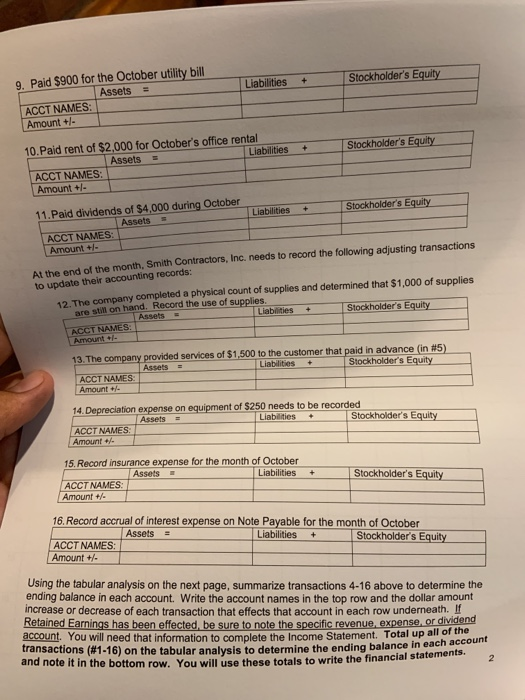

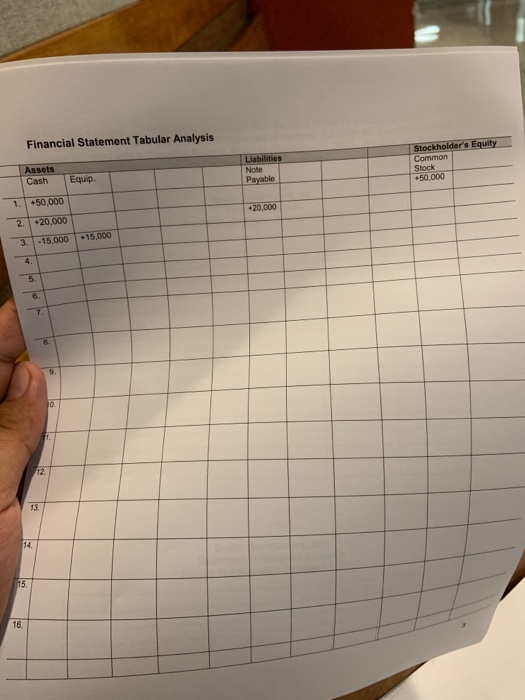

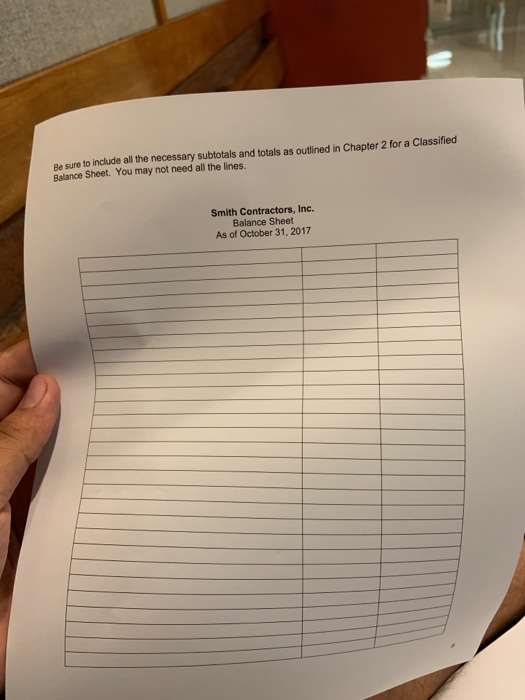

ive been trying to understand how to start this and need help. my professor does her best but i think i need more help. please explain with your answer. Name Financial Statement Homework Answers must be handwritten. Please staple your pages together! Smith Contractors, Inc. began operations on October 1, 2017. The first three business transactions for the company have already been recorded as reflected in the transactions below and on the financial statement tabular analysis on page 3. For transactions 4-16, record the effect on the accounting equation and then on the tabular analysis on page 3. You will then write Financial Statements on pages 4 and 5. 1. Received $50,000 cash in exchange for common stock Assets = Liabilities + ACCT NAMES: Cash Amount + $50,000 Stockholder's Equity Common Stock +$50,000 2. Borrowed $20,000 from First National Bank to finance operations, signing a 5 year, 6% N/P Assets Liabilities + Stockholder's Equity ACCT NAMES: Cash Note Payable Amount+ +$20,000 +$20,000 Liabilities + Stockholder's Equity 3. Purchased equipment for $15,000 cash 1 Assets ACCT NAMES: Cash Equipment Amount + $15,000 +$15,000 Liabilities + Stockholder's Equity 4. Purchased $4,000 of supplies on account Assets = ACCT NAMES: Amount +/- 5. Received a $3,000 cash advance from a customer for services not yet performed Assets = Liabilities + Stockholder's Equity ACCT NAMES Amount +/- 6. Purchased on October 1 a 6 month insurance policy for $600 Assets = Liabilities + ACCT NAMES: Amount +/- Stockholder's Equity Stockholder's Equity Liabilities - 1. Provided services to customers during October and received $40.000 GA Assets = ACCT NAMES: Amount +/- Stockholder's E ad wages of $3.500 to employees for the month of October Liabilities Assets = ACCT NAMES: Amount +/- Liabilities + Stockholder's Equity 9. Paid $900 for the October utility bill Assets = ACCT NAMES: Amount +- 10.Paid rent of $2.000 for October's office rental Assets Liabilities + Stockholder's Equity ACCT NAMES: Amount +- 11.Paid dividends of $4,000 during October Liabilities Assets Stockholder's Equity + ACCT NAMES: Amount +1- At the end of the month, Smith Contractors, Inc. needs to record the following adjusting transactions to update their accounting records: The company completed a physical count of supplies and determined that $1,000 of supplies are still on hand. Record the use of supplies. Assets Liabilities + Stockholder's Equity ACCT NAMES: Amount - 13. The company provided services of $1,500 to the customer that paid in advance (in #5) Assets Liabilities Stockholder's Equity ACCT NAMES: Amount - 14. Depreciation expense on equipment of $250 needs to be recorded Assets = Liabilities + Stockholder's Equity ACCT NAMES: Amount +/- + 15. Record insurance expense for the month of October Assets Liabilities ACCT NAMES: Amount +/- Stockholder's Equity 16. Record accrual of interest expense on Note Payable for the month of October Assets = Liabilities + Stockholder's Equity ACCT NAMES: Amount +/- Using the tabular analysis on the next page, summarize transactions 4-16 above to determine the ending balance in each account. Write the account names in the top row and the dollar amount increase or decrease of each transaction that effects that account in each row underneath. Retained Earnings has been effected be sure to note the specific revenue, expense, or dividend account. You will need that information to complete the Income Statement. Total up all of the transactions (#1-16) on the tabular analysis to determine the ending balance in eac and note it in the bottom row. You will use these totals to write the financial state Be sure to include all the necessary subtotals and totals as outlined in Chapter 2 for a Classified Balance Sheet. You may not need all the lines. Smith Contractors, Inc. Balance Sheet As of October 31, 2017

ive been trying to understand how to start this and need help. my professor does her best but i think i need more help. please explain with your answer. Name Financial Statement Homework Answers must be handwritten. Please staple your pages together! Smith Contractors, Inc. began operations on October 1, 2017. The first three business transactions for the company have already been recorded as reflected in the transactions below and on the financial statement tabular analysis on page 3. For transactions 4-16, record the effect on the accounting equation and then on the tabular analysis on page 3. You will then write Financial Statements on pages 4 and 5. 1. Received $50,000 cash in exchange for common stock Assets = Liabilities + ACCT NAMES: Cash Amount + $50,000 Stockholder's Equity Common Stock +$50,000 2. Borrowed $20,000 from First National Bank to finance operations, signing a 5 year, 6% N/P Assets Liabilities + Stockholder's Equity ACCT NAMES: Cash Note Payable Amount+ +$20,000 +$20,000 Liabilities + Stockholder's Equity 3. Purchased equipment for $15,000 cash 1 Assets ACCT NAMES: Cash Equipment Amount + $15,000 +$15,000 Liabilities + Stockholder's Equity 4. Purchased $4,000 of supplies on account Assets = ACCT NAMES: Amount +/- 5. Received a $3,000 cash advance from a customer for services not yet performed Assets = Liabilities + Stockholder's Equity ACCT NAMES Amount +/- 6. Purchased on October 1 a 6 month insurance policy for $600 Assets = Liabilities + ACCT NAMES: Amount +/- Stockholder's Equity Stockholder's Equity Liabilities - 1. Provided services to customers during October and received $40.000 GA Assets = ACCT NAMES: Amount +/- Stockholder's E ad wages of $3.500 to employees for the month of October Liabilities Assets = ACCT NAMES: Amount +/- Liabilities + Stockholder's Equity 9. Paid $900 for the October utility bill Assets = ACCT NAMES: Amount +- 10.Paid rent of $2.000 for October's office rental Assets Liabilities + Stockholder's Equity ACCT NAMES: Amount +- 11.Paid dividends of $4,000 during October Liabilities Assets Stockholder's Equity + ACCT NAMES: Amount +1- At the end of the month, Smith Contractors, Inc. needs to record the following adjusting transactions to update their accounting records: The company completed a physical count of supplies and determined that $1,000 of supplies are still on hand. Record the use of supplies. Assets Liabilities + Stockholder's Equity ACCT NAMES: Amount - 13. The company provided services of $1,500 to the customer that paid in advance (in #5) Assets Liabilities Stockholder's Equity ACCT NAMES: Amount - 14. Depreciation expense on equipment of $250 needs to be recorded Assets = Liabilities + Stockholder's Equity ACCT NAMES: Amount +/- + 15. Record insurance expense for the month of October Assets Liabilities ACCT NAMES: Amount +/- Stockholder's Equity 16. Record accrual of interest expense on Note Payable for the month of October Assets = Liabilities + Stockholder's Equity ACCT NAMES: Amount +/- Using the tabular analysis on the next page, summarize transactions 4-16 above to determine the ending balance in each account. Write the account names in the top row and the dollar amount increase or decrease of each transaction that effects that account in each row underneath. Retained Earnings has been effected be sure to note the specific revenue, expense, or dividend account. You will need that information to complete the Income Statement. Total up all of the transactions (#1-16) on the tabular analysis to determine the ending balance in eac and note it in the bottom row. You will use these totals to write the financial state Be sure to include all the necessary subtotals and totals as outlined in Chapter 2 for a Classified Balance Sheet. You may not need all the lines. Smith Contractors, Inc. Balance Sheet As of October 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started