Question

I've been working on below for hours..I'm quite sure I have the main components correct but I'm conflicted with NPV/IRR answers. Problem 3 ABC Inc.

I've been working on below for hours..I'm quite sure I have the main components correct but I'm conflicted with NPV/IRR answers.

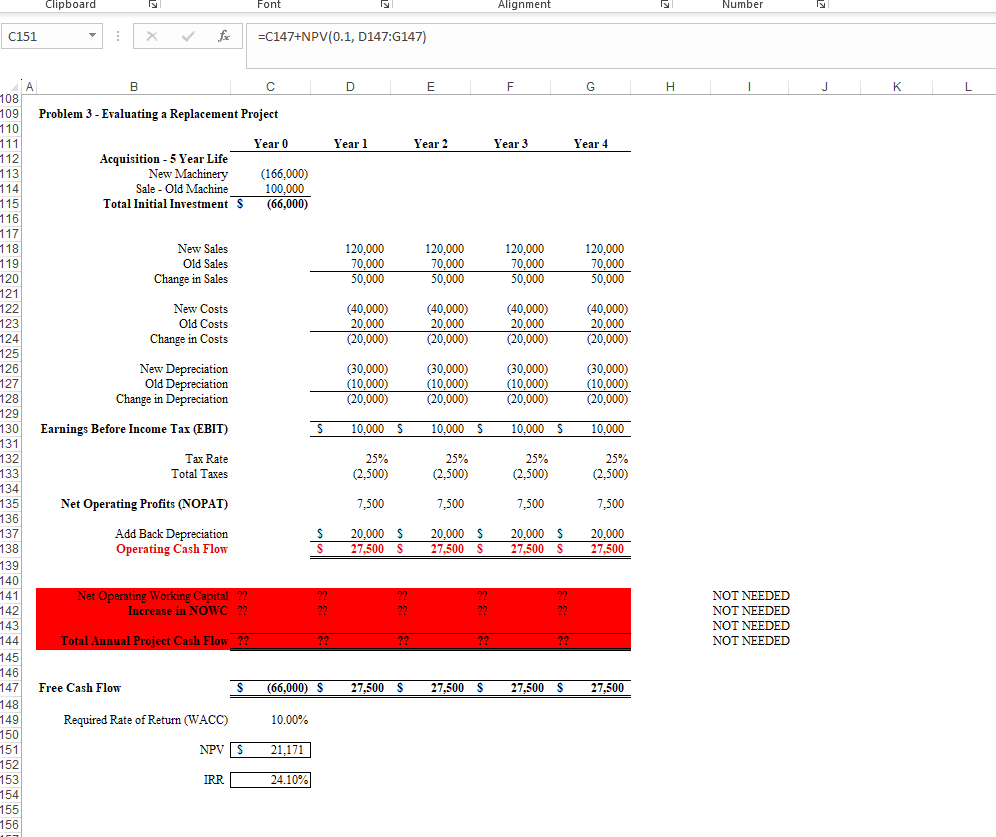

Problem 3 ABC Inc. wishes to buy new machinery that would cost $166,000, but it would lead to increased output, higher sales, and higher costs. Moreover, the firm would receive $100,000 after taxes for the old machine. The new machine would result in sales of $120,000 per year versus old sales of $70,000, and the new costs would be $40,000 versus old costs of $20,000. Finally, the old machine was being depreciated at the rate of $10,000 per year, but the new machine would have $30,000 of annual depreciation. The marginal tax rate is 25 percent and WACC is 10 percent. Based on these figures, and assuming the new and old machines both have a life of four years, find the incremental cash flows.

\begin{tabular}{rrrrrrr} Net Operating Working Capital & ?? & ?? & ?? & ?? & ?? & NOT NEEDED \\ Increase in NOWC & ?? & ?? & ?? & ?? & ?? \\ & & ?? & ?? & ?? & ?? \\ \hline \end{tabular} Free Cash Flow \begin{tabular}{llllllllll} \hline$ & (66,000) & $ & 27,500 & $ & 27,500 & $ & 27,500 & $ & 27,500 \\ \hline \hline \end{tabular} Required Rate of Return (WACC) 10.00% NPV $21,171 IRR 24.10%

\begin{tabular}{rrrrrrr} Net Operating Working Capital & ?? & ?? & ?? & ?? & ?? & NOT NEEDED \\ Increase in NOWC & ?? & ?? & ?? & ?? & ?? \\ & & ?? & ?? & ?? & ?? \\ \hline \end{tabular} Free Cash Flow \begin{tabular}{llllllllll} \hline$ & (66,000) & $ & 27,500 & $ & 27,500 & $ & 27,500 & $ & 27,500 \\ \hline \hline \end{tabular} Required Rate of Return (WACC) 10.00% NPV $21,171 IRR 24.10% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started