Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ive done the formulation to these problems i just dont seem to get the correct answer. Other bookmark Example 2-17 Nancy Seigle earns a monthly

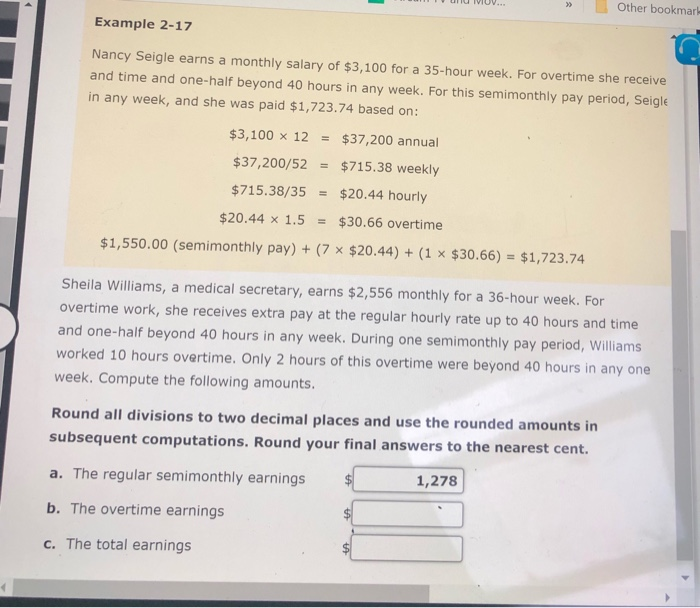

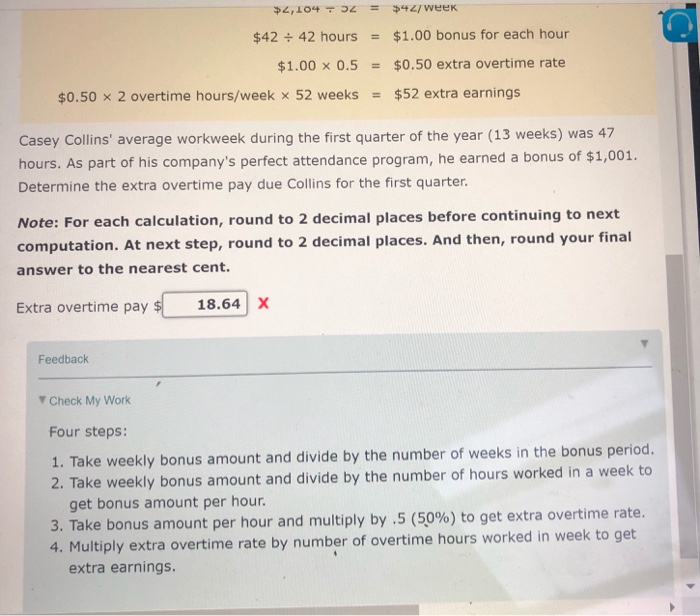

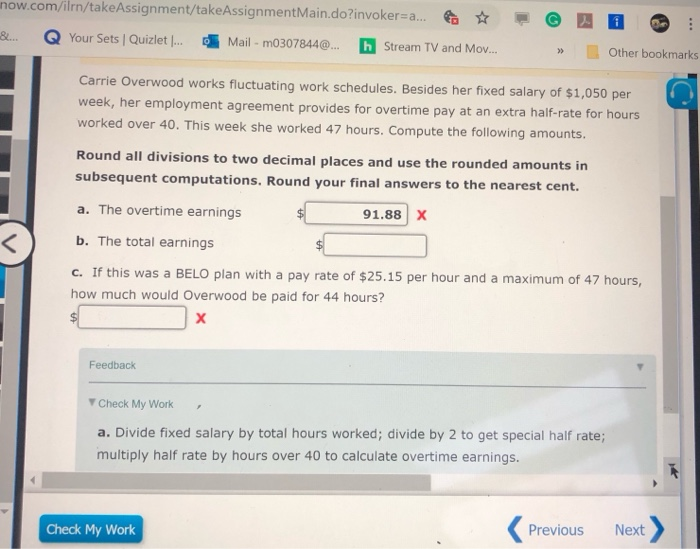

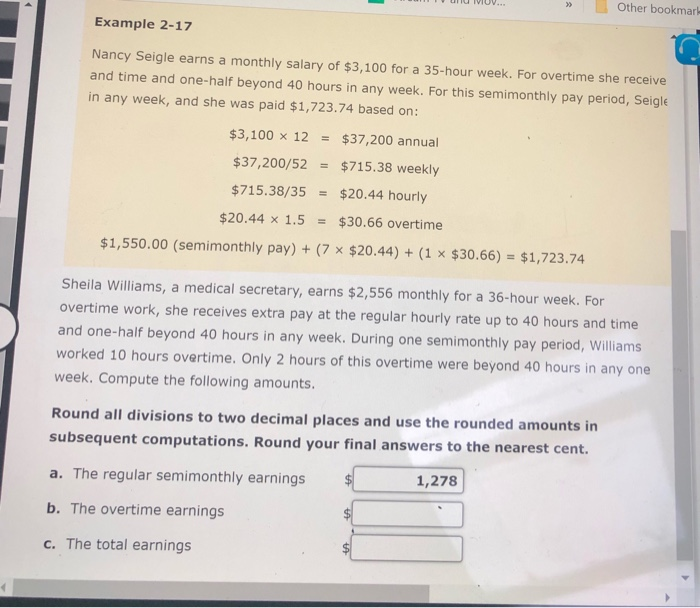

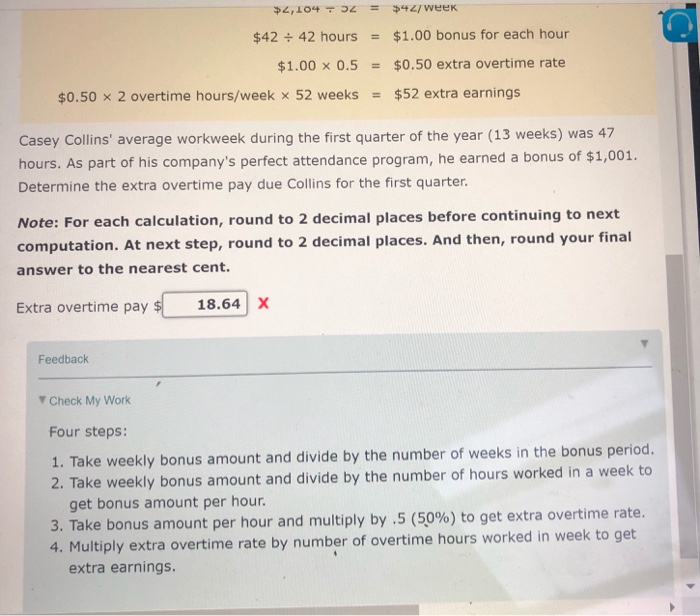

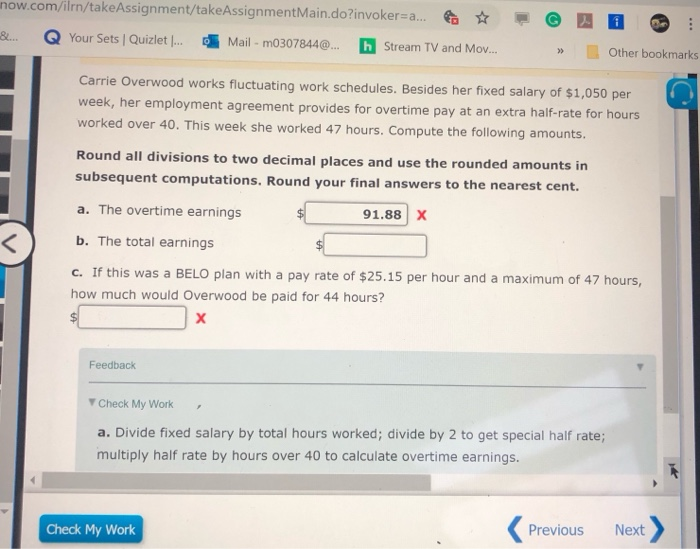

ive done the formulation to these problems i just dont seem to get the correct answer. Other bookmark Example 2-17 Nancy Seigle earns a monthly salary of $3,100 for a 35-hour week. For overtime she receive and time and one-half beyond 40 hours in any week. For this semimonthly pay period, Seigle in any week, and she was paid $1,723.74 based on : $3,100 x 12 $37,200 annual $715.38 weekly $37,200/52 $715.38/35 $20.44 hourly $20.44 x 1.5 $30.66 overtime $1,550.00 (semimonthly pay) + (7 x $20.44) + (1 x $30.66) = $1,723.74 Sheila Williams, a medical secretary, earns $2,556 monthly for a 36-hour week. For overtime work, she receives extra pay at the regular hourly rate up to 40 hours and time and one-half beyond 40 hours in any week. During one semimonthly pay period, Williams worked 10 hours overtime. Only 2 hours of this overtime were beyond 40 hours in any one week.Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. 1,278 a. The regular semimonthly earnings b. The overtime earnings c. The total earnings $42/weeK 2,104-0 $4242 hours $1.00 bonus for each hour = $0.50 extra overtime rate $1.00 x 0.5 $52 extra earnings 2 overtime hours/week x 52 weeks $0.50 X was 47 Casey Collins' average workweek during the first quarter of the year (13 weeks) hours. As part of his company's perfect attendance program, he earned a bonus of $1,00 1 Determine the extra overtime pay due Collins for the first quarter. Note: For each calculation, round to 2 decimal places before continuing to next computation. At next step, round to 2 decimal places. And then, round your final answer to the nearest cent. 18.64 X Extra overtime pay $ Feedback Y Check My Work Four steps: 1. Take weekly bonus amount and divide by the number of weeks in the bonus period. 2. Take weekly bonus amount and divide by the number of hours worked in a week to get bonus amount per hour. 3. Take bonus amount per hour and multiply by .5 (50%) to get extra overtime rate. 4. Multiply extra overtime rate by number of overtime hours worked in week to get extra earnings. now.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker= a... Your Sets Quizlet .. Mail m0307844@... h Stream TV and Mov.... Other bookmarks Carrie Overwood works fluctuating work schedules. Besides her fixed salary of $1,050 per week, her employment agreement provides for overtime pay at an extra half-rate for hours worked over 40. This week she worked 47 hours. Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. a. The overtime earnings 91.88 X b. The total earnings c. If this was a BELO plan with a pay rate of $25.15 per hour and a maximum of 47 hours, how much would Overwood be paid for 44 hours? X Feedback Check My Work a. Divide fixed salary by total hours worked; divide by 2 to get special half rate; multiply half rate by hours over 40 to calculate overtime earnings. Check My Work Previous Next Other bookmark Example 2-17 Nancy Seigle earns a monthly salary of $3,100 for a 35-hour week. For overtime she receive and time and one-half beyond 40 hours in any week. For this semimonthly pay period, Seigle in any week, and she was paid $1,723.74 based on : $3,100 x 12 $37,200 annual $715.38 weekly $37,200/52 $715.38/35 $20.44 hourly $20.44 x 1.5 $30.66 overtime $1,550.00 (semimonthly pay) + (7 x $20.44) + (1 x $30.66) = $1,723.74 Sheila Williams, a medical secretary, earns $2,556 monthly for a 36-hour week. For overtime work, she receives extra pay at the regular hourly rate up to 40 hours and time and one-half beyond 40 hours in any week. During one semimonthly pay period, Williams worked 10 hours overtime. Only 2 hours of this overtime were beyond 40 hours in any one week.Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. 1,278 a. The regular semimonthly earnings b. The overtime earnings c. The total earnings $42/weeK 2,104-0 $4242 hours $1.00 bonus for each hour = $0.50 extra overtime rate $1.00 x 0.5 $52 extra earnings 2 overtime hours/week x 52 weeks $0.50 X was 47 Casey Collins' average workweek during the first quarter of the year (13 weeks) hours. As part of his company's perfect attendance program, he earned a bonus of $1,00 1 Determine the extra overtime pay due Collins for the first quarter. Note: For each calculation, round to 2 decimal places before continuing to next computation. At next step, round to 2 decimal places. And then, round your final answer to the nearest cent. 18.64 X Extra overtime pay $ Feedback Y Check My Work Four steps: 1. Take weekly bonus amount and divide by the number of weeks in the bonus period. 2. Take weekly bonus amount and divide by the number of hours worked in a week to get bonus amount per hour. 3. Take bonus amount per hour and multiply by .5 (50%) to get extra overtime rate. 4. Multiply extra overtime rate by number of overtime hours worked in week to get extra earnings. now.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker= a... Your Sets Quizlet .. Mail m0307844@... h Stream TV and Mov.... Other bookmarks Carrie Overwood works fluctuating work schedules. Besides her fixed salary of $1,050 per week, her employment agreement provides for overtime pay at an extra half-rate for hours worked over 40. This week she worked 47 hours. Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. a. The overtime earnings 91.88 X b. The total earnings c. If this was a BELO plan with a pay rate of $25.15 per hour and a maximum of 47 hours, how much would Overwood be paid for 44 hours? X Feedback Check My Work a. Divide fixed salary by total hours worked; divide by 2 to get special half rate; multiply half rate by hours over 40 to calculate overtime earnings. Check My Work Previous Next

ive done the formulation to these problems i just dont seem to get the correct answer. Other bookmark Example 2-17 Nancy Seigle earns a monthly salary of $3,100 for a 35-hour week. For overtime she receive and time and one-half beyond 40 hours in any week. For this semimonthly pay period, Seigle in any week, and she was paid $1,723.74 based on : $3,100 x 12 $37,200 annual $715.38 weekly $37,200/52 $715.38/35 $20.44 hourly $20.44 x 1.5 $30.66 overtime $1,550.00 (semimonthly pay) + (7 x $20.44) + (1 x $30.66) = $1,723.74 Sheila Williams, a medical secretary, earns $2,556 monthly for a 36-hour week. For overtime work, she receives extra pay at the regular hourly rate up to 40 hours and time and one-half beyond 40 hours in any week. During one semimonthly pay period, Williams worked 10 hours overtime. Only 2 hours of this overtime were beyond 40 hours in any one week.Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. 1,278 a. The regular semimonthly earnings b. The overtime earnings c. The total earnings $42/weeK 2,104-0 $4242 hours $1.00 bonus for each hour = $0.50 extra overtime rate $1.00 x 0.5 $52 extra earnings 2 overtime hours/week x 52 weeks $0.50 X was 47 Casey Collins' average workweek during the first quarter of the year (13 weeks) hours. As part of his company's perfect attendance program, he earned a bonus of $1,00 1 Determine the extra overtime pay due Collins for the first quarter. Note: For each calculation, round to 2 decimal places before continuing to next computation. At next step, round to 2 decimal places. And then, round your final answer to the nearest cent. 18.64 X Extra overtime pay $ Feedback Y Check My Work Four steps: 1. Take weekly bonus amount and divide by the number of weeks in the bonus period. 2. Take weekly bonus amount and divide by the number of hours worked in a week to get bonus amount per hour. 3. Take bonus amount per hour and multiply by .5 (50%) to get extra overtime rate. 4. Multiply extra overtime rate by number of overtime hours worked in week to get extra earnings. now.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker= a... Your Sets Quizlet .. Mail m0307844@... h Stream TV and Mov.... Other bookmarks Carrie Overwood works fluctuating work schedules. Besides her fixed salary of $1,050 per week, her employment agreement provides for overtime pay at an extra half-rate for hours worked over 40. This week she worked 47 hours. Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. a. The overtime earnings 91.88 X b. The total earnings c. If this was a BELO plan with a pay rate of $25.15 per hour and a maximum of 47 hours, how much would Overwood be paid for 44 hours? X Feedback Check My Work a. Divide fixed salary by total hours worked; divide by 2 to get special half rate; multiply half rate by hours over 40 to calculate overtime earnings. Check My Work Previous Next Other bookmark Example 2-17 Nancy Seigle earns a monthly salary of $3,100 for a 35-hour week. For overtime she receive and time and one-half beyond 40 hours in any week. For this semimonthly pay period, Seigle in any week, and she was paid $1,723.74 based on : $3,100 x 12 $37,200 annual $715.38 weekly $37,200/52 $715.38/35 $20.44 hourly $20.44 x 1.5 $30.66 overtime $1,550.00 (semimonthly pay) + (7 x $20.44) + (1 x $30.66) = $1,723.74 Sheila Williams, a medical secretary, earns $2,556 monthly for a 36-hour week. For overtime work, she receives extra pay at the regular hourly rate up to 40 hours and time and one-half beyond 40 hours in any week. During one semimonthly pay period, Williams worked 10 hours overtime. Only 2 hours of this overtime were beyond 40 hours in any one week.Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. 1,278 a. The regular semimonthly earnings b. The overtime earnings c. The total earnings $42/weeK 2,104-0 $4242 hours $1.00 bonus for each hour = $0.50 extra overtime rate $1.00 x 0.5 $52 extra earnings 2 overtime hours/week x 52 weeks $0.50 X was 47 Casey Collins' average workweek during the first quarter of the year (13 weeks) hours. As part of his company's perfect attendance program, he earned a bonus of $1,00 1 Determine the extra overtime pay due Collins for the first quarter. Note: For each calculation, round to 2 decimal places before continuing to next computation. At next step, round to 2 decimal places. And then, round your final answer to the nearest cent. 18.64 X Extra overtime pay $ Feedback Y Check My Work Four steps: 1. Take weekly bonus amount and divide by the number of weeks in the bonus period. 2. Take weekly bonus amount and divide by the number of hours worked in a week to get bonus amount per hour. 3. Take bonus amount per hour and multiply by .5 (50%) to get extra overtime rate. 4. Multiply extra overtime rate by number of overtime hours worked in week to get extra earnings. now.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker= a... Your Sets Quizlet .. Mail m0307844@... h Stream TV and Mov.... Other bookmarks Carrie Overwood works fluctuating work schedules. Besides her fixed salary of $1,050 per week, her employment agreement provides for overtime pay at an extra half-rate for hours worked over 40. This week she worked 47 hours. Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. a. The overtime earnings 91.88 X b. The total earnings c. If this was a BELO plan with a pay rate of $25.15 per hour and a maximum of 47 hours, how much would Overwood be paid for 44 hours? X Feedback Check My Work a. Divide fixed salary by total hours worked; divide by 2 to get special half rate; multiply half rate by hours over 40 to calculate overtime earnings. Check My Work Previous Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started