Answered step by step

Verified Expert Solution

Question

1 Approved Answer

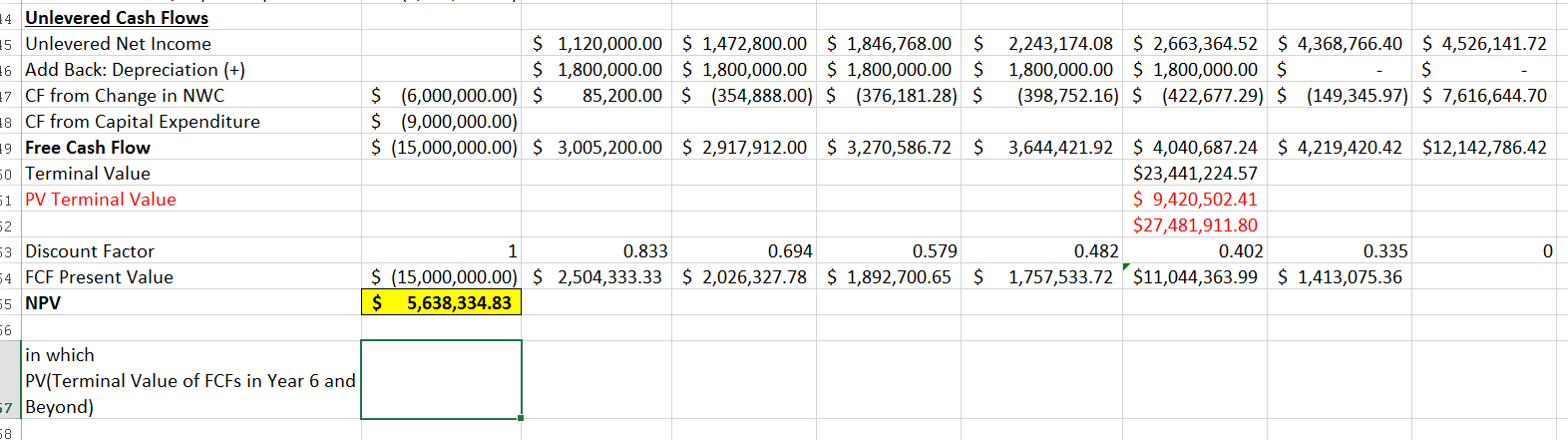

I've done the leg work for NPV, but I'm not sure what the last box is asking. I'm almost positive I've done it right, but

I've done the leg work for NPV, but I'm not sure what the last box is asking. I'm almost positive I've done it right, but I calculated NPV the first time and got 4,225, 259.... maybe that's what the last box is asking, I'm confuzzled? The highlighted one. Any Ideas?

$ 1,120,000.00 $ 1,472,800.00 $ 1,846,768.00 $ $ 1,800,000.00 $ 1,800,000.00 $ 1,800,000.00 $ $ (6,000,000.00 $ 85,200.00 $ (354,888.00) $ (376,181.28) $ $ (9,000,000.00) $ (15,000,000.00) $ 3,005,200.00 $ 2,917,912.00 $ 3,270,586.72 $ 2,243,174.08 $ 2,663,364.52 $ 4,368,766.40 $ 4,526,141.72 1,800,000.00 $ 1,800,000.00 $ $ (398,752.16) $ (422,677.29) $ (149,345.97) $ 7,616,644.70 4 Unlevered Cash Flows 15 Unlevered Net Income 16 Add Back: Depreciation (+) 7 CF from Change in NWC 18 CF from Capital Expenditure 19 Free Cash Flow 50 Terminal Value 51 PV Terminal Value 52 53 Discount Factor 54 FCF Present Value 55 NPV 3,644,421.92 $ 4,040,687.24 $ 4,219,420.42 $12,142,786.42 $23,441,224.57 $ 9,420,502.41 $27,481,911.80 0.482 0.402 0.335 1,757,533.72 $11,044,363.99 $ 1,413,075.36 0 1 0.833 0.694 0.579 $ (15,000,000.00 $ 2,504,333.33 $ 2,026,327.78 $ 1,892,700.65 $ $ 5,638,334.83 56 in which PV(Terminal Value of FCFs in Year 6 and 7 Beyond)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started