Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I've ran out of check my marks and am now out of ideas. m. Based on the following data, would Beth and Roger Simmons receive

I've ran out of check my marks and am now out of ideas.

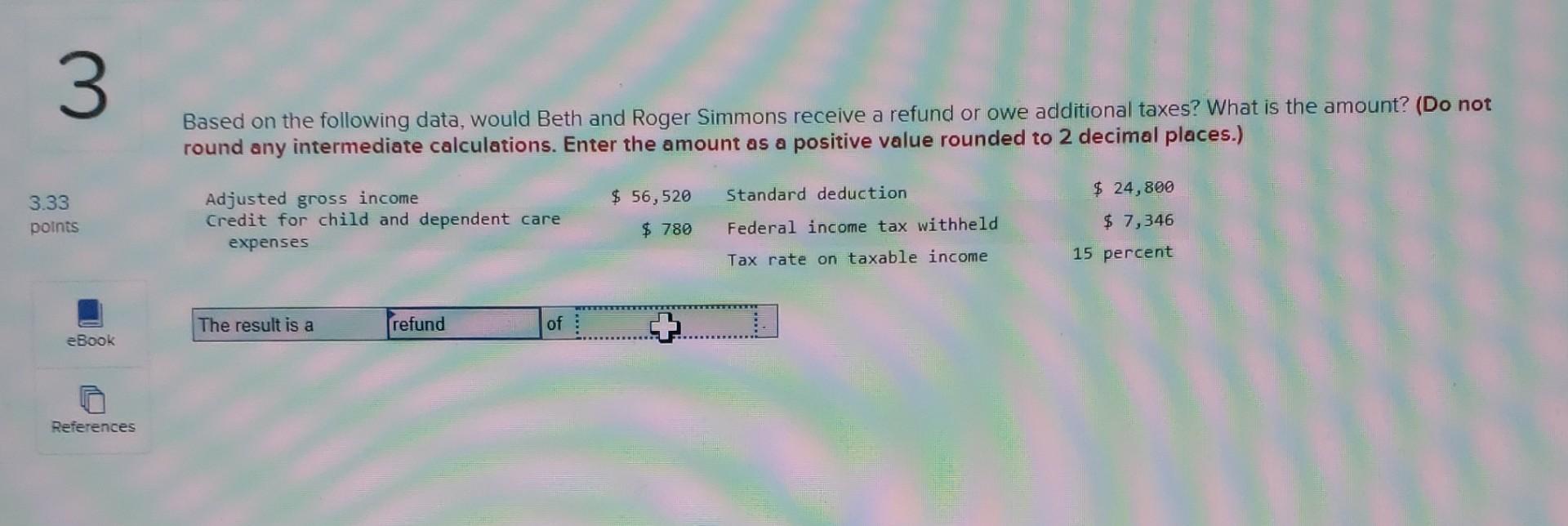

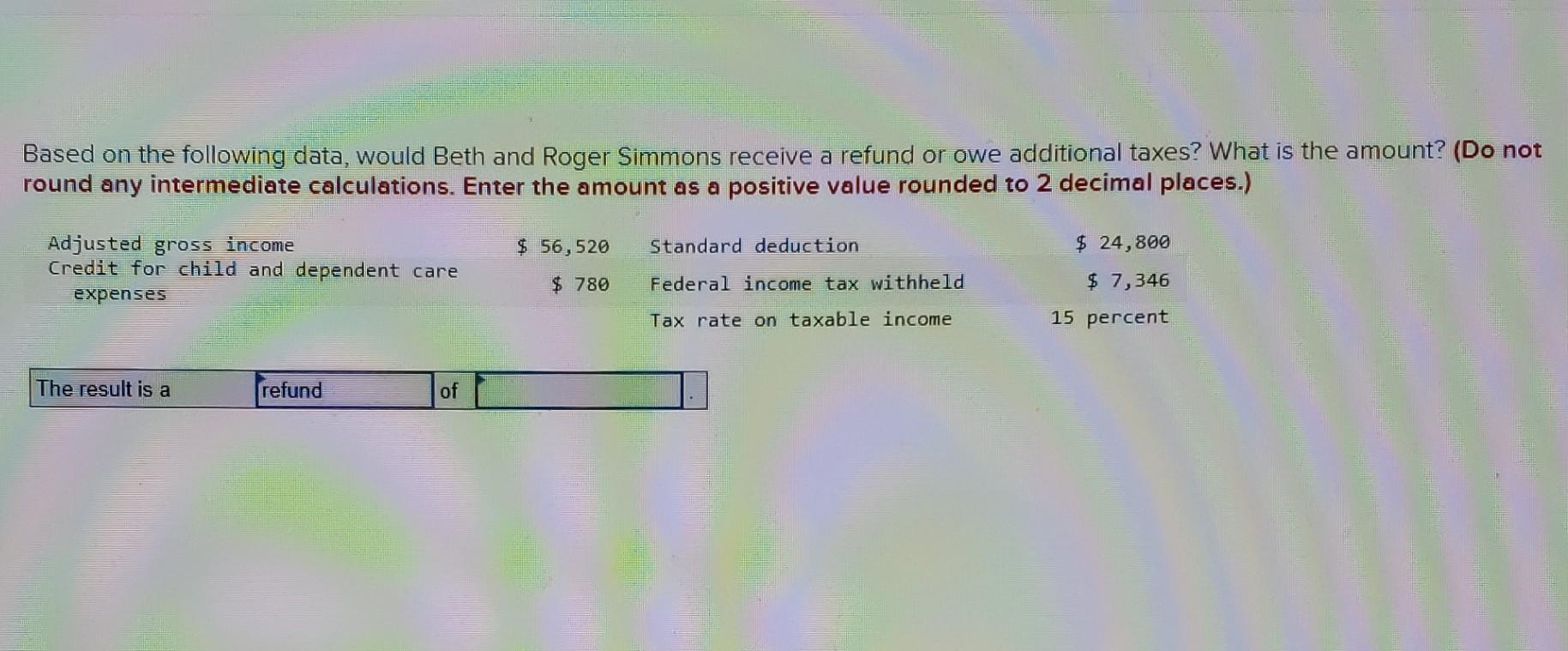

m. Based on the following data, would Beth and Roger Simmons receive a refund or owe additional taxes? What is the amount? (Do not round any intermediate calculations. Enter the amount as a positive value rounded to 2 decimal places.) $ 56,520 Standard deduction $ 24,800 3.33 points Adjusted gross income Credit for child and dependent care expenses $ 7,346 $ 780 Federal income tax withheld Tax rate on taxable income 15 percent The result is a refund of eBook References Based on the following data, would Beth and Roger Simmons receive a refund or owe additional taxes? What is the amount? (Do not round any intermediate calculations. Enter the amount as a positive value rounded to 2 decimal places.) $ 56,520 Standard deduction $ 24,800 Adjusted gross income Credit for child and dependent care expenses $ 780 Federal income tax withheld $ 7,346 Tax rate on taxable income 15 percent The result is a refund of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started