Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I've tried several times to solve them, with different numbers, yet I still can't seem to understand what I am doing wrong. 3 year(s) ago,

I've tried several times to solve them, with different numbers, yet I still can't seem to understand what I am doing wrong.

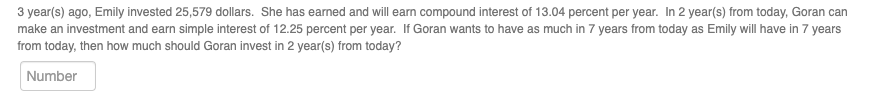

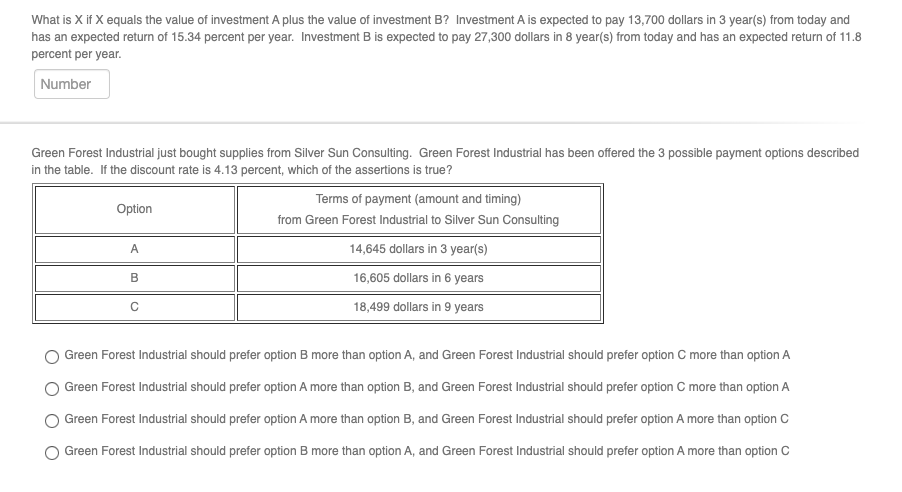

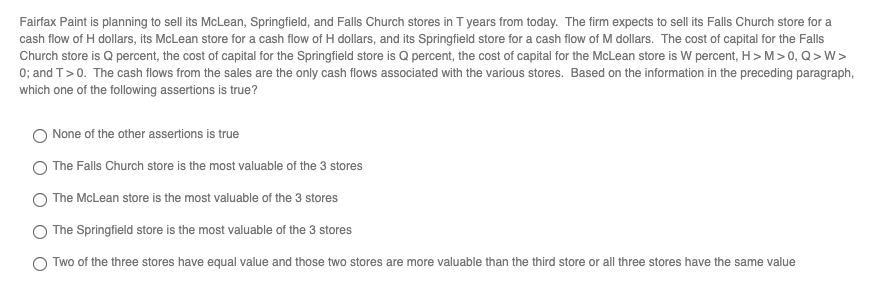

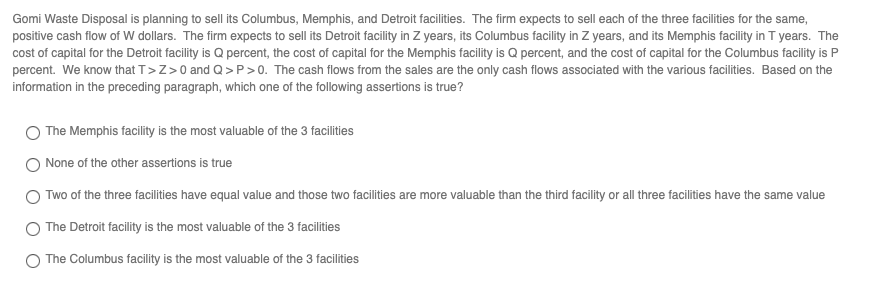

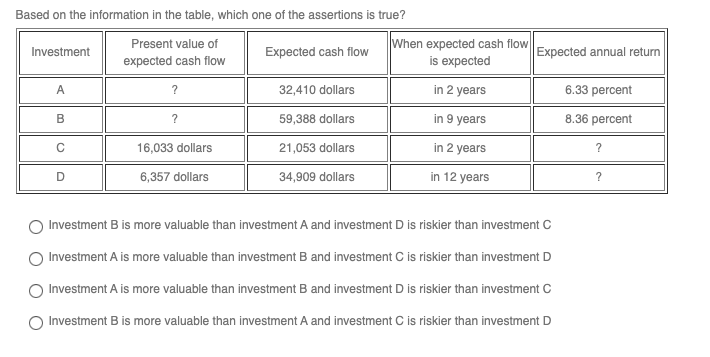

3 year(s) ago, Emily invested 25,579 dollars. She has earned and will earn compound interest of 13.04 percent per year. In 2 year(s) from today, Goran can make an investment and earn simple interest of 12.25 percent per year. If Goran wants to have as much in 7 years from today as Emily will have in 7 years from today, then how much should Goran invest in 2 year(s) from today? Number What is X if X equals the value of investment A plus the value of investment B? Investment A is expected to pay 13,700 dollars in 3 year(s) from today and has an expected return of 15.34 percent per year. Investment B is expected to pay 27,300 dollars in 8 year(s) from today and has an expected return of 11.8 percent per year. Number Green Forest Industrial just bought supplies from Silver Sun Consulting. Green Forest Industrial has been offered the 3 possible payment options described in the table. If the discount rate is 4.13 percent, which of the assertions is true? Terms of payment (amount and timing) Option from Green Forest Industrial to Silver Sun Consulting 14,645 dollars in 3 year(s) 16,605 dollars in 6 years 18,499 dollars in 9 years A B Green Forest Industrial should prefer option B more than option A, and Green Forest Industrial should prefer option C more than option A Green Forest Industrial should prefer option A more than option B, and Green Forest Industrial should prefer option C more than option A Green Forest Industrial should prefer option A more than option B, and Green Forest Industrial should prefer option A more than option Green Forest Industrial should prefer option B more than option A, and Green Forest Industrial should prefer option A more than option C Fairfax Paint is planning to sell its McLean, Springfield, and Falls Church stores in Tyears from today. The firm expects to sell its Falls Church store for a cash flow of H dollars, its McLean store for a cash flow of H dollars, and its Springfield store for a cash flow of M dollars. The cost of capital for the Falls Church store is a percent, the cost of capital for the Springfield store is Q percent, the cost of capital for the McLean store is W percent, H>M>0,Q>W> 0; and T>0. The cash flows from the sales are the only cash flows associated with the various stores. Based on the information in the preceding paragraph, which one of the following assertions is true? None of the other assertions is true The Falls Church store is the most valuable of the 3 stores The McLean store is the most valuable of the 3 stores The Springfield store is the most valuable of the 3 stores Two of the three stores have equal value and those two stores are more valuable than the third store or all three stores have the same value Gomi Waste Disposal is planning to sell its Columbus, Memphis, and Detroit facilities. The firm expects to sell each of the three facilities for the same, positive cash flow of W dollars. The firm expects to sell its Detroit facility in Z years, its Columbus facility in Z years, and its Memphis facility in T years. The cost of capital for the Detroit facility is Q percent, the cost of capital for the Memphis facility is Q percent, and the cost of capital for the Columbus facility is P percent. We know that T>Z>0 and Q>P>0. The cash flows from the sales are the only cash flows associated with the various facilities. Based on the information in the preceding paragraph, which one of the following assertions is true? The Memphis facility is the most valuable of the 3 facilities None of the other assertions is true Two of the three facilities have equal value and those two facilities are more valuable than the third facility or all three facilities have the same value The Detroit facility is the most valuable of the 3 facilities The Columbus facility is the most valuable of the 3 facilities Expected annual return Based on the information in the table, which one of the assertions is true? Present value of When expected cash flow Investment Expected cash flow expected cash flow is expected A 32,410 dollars in 2 years 59,388 dollars in 9 years 16,033 dollars 21,053 dollars in 2 years D 6,357 dollars 34,909 dollars in 12 years 6.33 percent B ? 8.36 percent C ? ? Investment B is more valuable than investment A and investment D is riskier than investment C Investment A is more valuable than investment B and investment C is riskier than investment D Investment A is more valuable than investment B and investment D is riskier than investment C Investment B is more valuable than investment A and investment C is riskier than investment DStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started