Answered step by step

Verified Expert Solution

Question

1 Approved Answer

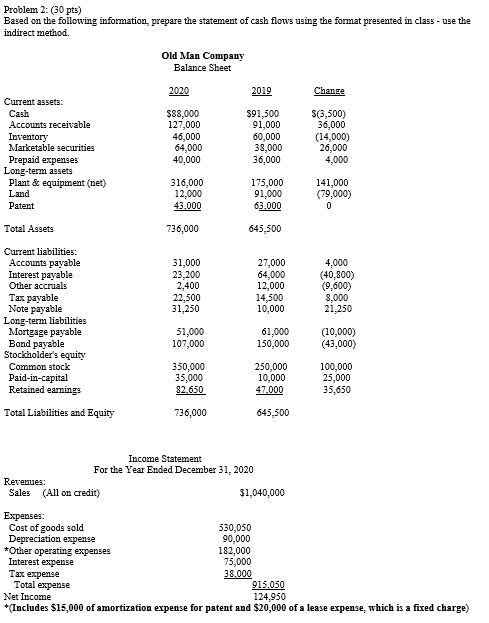

I've tried this twice now and always end up with $120,500 instead of $124,950. Some help would be greatly appreciated Problem 2: (30 pts) Based

I've tried this twice now and always end up with $120,500 instead of $124,950. Some help would be greatly appreciated

Problem 2: (30 pts) Based on the following information, prepare the statement of cash flows using the format presented in class - use the indirect method. Old Man Company Balance Sheet 2020 2019 Change Current assets: Cash $88,000 $91,500 S(3,500) Accounts receivable 127,000 91,000 36,000 Inventory 46,000 60,000 (14,000) Marketable securities 64,000 38,000 26,000 Prepaid expenses 40,000 36,000 4,000 Long-term assets Plant & equipment (net) 316,000 175,000 141,000 Land 12,000 91,000 (79,000) Patent 43.000 63,000 0 Total Assets 736.000 645,500 31,000 23,200 2,400 22,500 31,250 27,000 64,000 12,000 14,500 10,000 4,000 (40,800) (9.600) 8,000 21,250 Current liabilities: Accounts payable Interest payable Other accruals Tax payable Note payable Long-term liabilities Mortgage payable Bond payable Stockholder's equity Common stock Paid-in-capital Retained earnings 61,000 150,000 (10,000) (43,000) 51,000 107,000 350,000 35,000 82,650 250,000 10,000 47.000 100,000 25,000 35,650 Total Liabilities and Equity 736.000 645,500 Income Statement For the Year Ended December 31, 2020 Revenues: Sales (All on credit) $1,040,000 Expenses: Cost of goods sold 530,050 Depreciation expense 90,000 *Other operating expenses 182,000 Interest expense 75,000 Tax expense 38.000 Total expense 915.050 Net Income 124,950 *Includes $15,000 of amortization expense for patent and $20,000 of a lease expense, which is a fixed charge) Problem 2: (30 pts) Based on the following information, prepare the statement of cash flows using the format presented in class - use the indirect method. Old Man Company Balance Sheet 2020 2019 Change Current assets: Cash $88,000 $91,500 S(3,500) Accounts receivable 127,000 91,000 36,000 Inventory 46,000 60,000 (14,000) Marketable securities 64,000 38,000 26,000 Prepaid expenses 40,000 36,000 4,000 Long-term assets Plant & equipment (net) 316,000 175,000 141,000 Land 12,000 91,000 (79,000) Patent 43.000 63,000 0 Total Assets 736.000 645,500 31,000 23,200 2,400 22,500 31,250 27,000 64,000 12,000 14,500 10,000 4,000 (40,800) (9.600) 8,000 21,250 Current liabilities: Accounts payable Interest payable Other accruals Tax payable Note payable Long-term liabilities Mortgage payable Bond payable Stockholder's equity Common stock Paid-in-capital Retained earnings 61,000 150,000 (10,000) (43,000) 51,000 107,000 350,000 35,000 82,650 250,000 10,000 47.000 100,000 25,000 35,650 Total Liabilities and Equity 736.000 645,500 Income Statement For the Year Ended December 31, 2020 Revenues: Sales (All on credit) $1,040,000 Expenses: Cost of goods sold 530,050 Depreciation expense 90,000 *Other operating expenses 182,000 Interest expense 75,000 Tax expense 38.000 Total expense 915.050 Net Income 124,950 *Includes $15,000 of amortization expense for patent and $20,000 of a lease expense, which is a fixed charge)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started