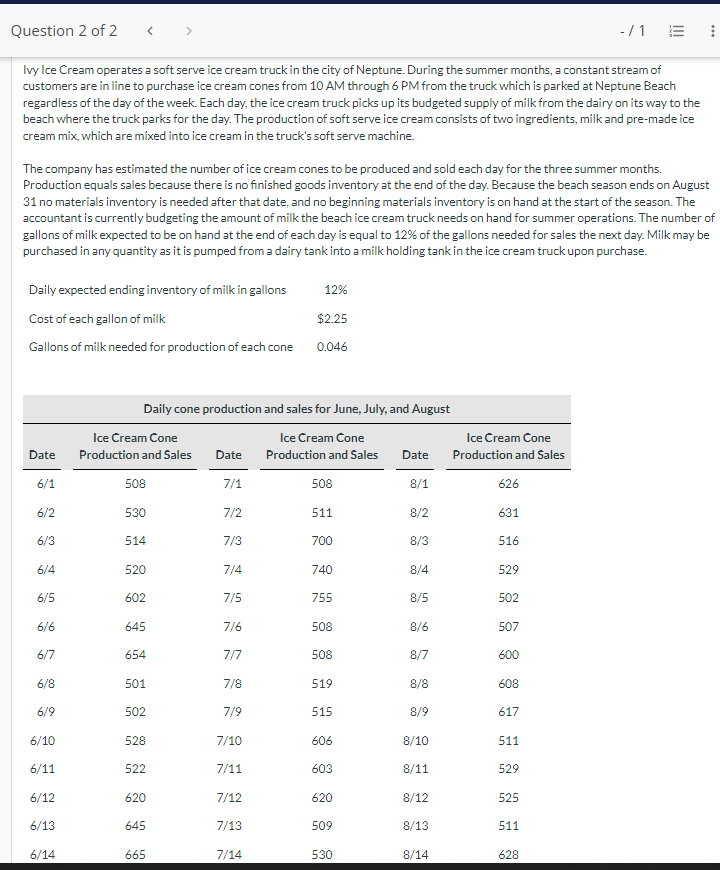

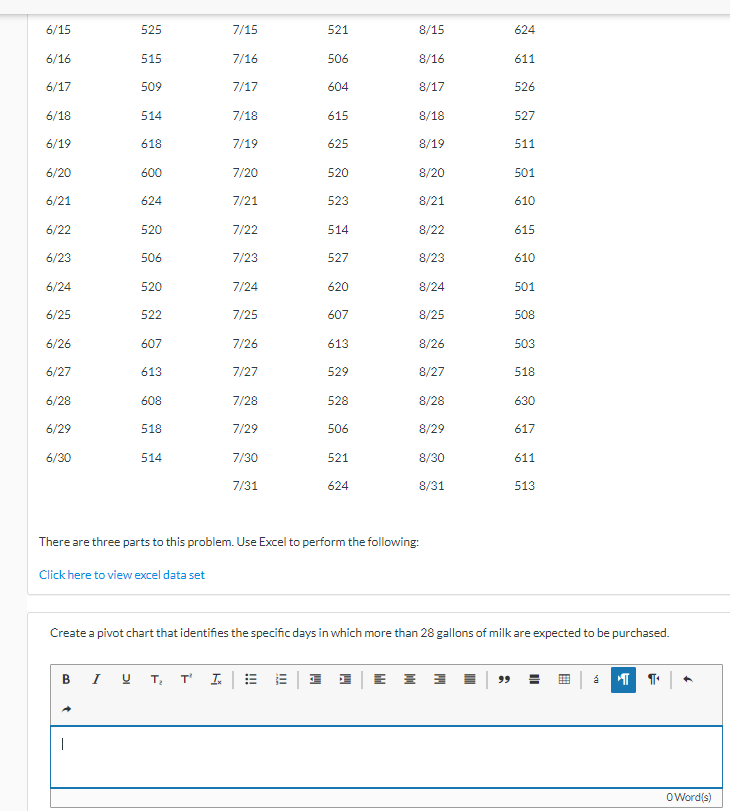

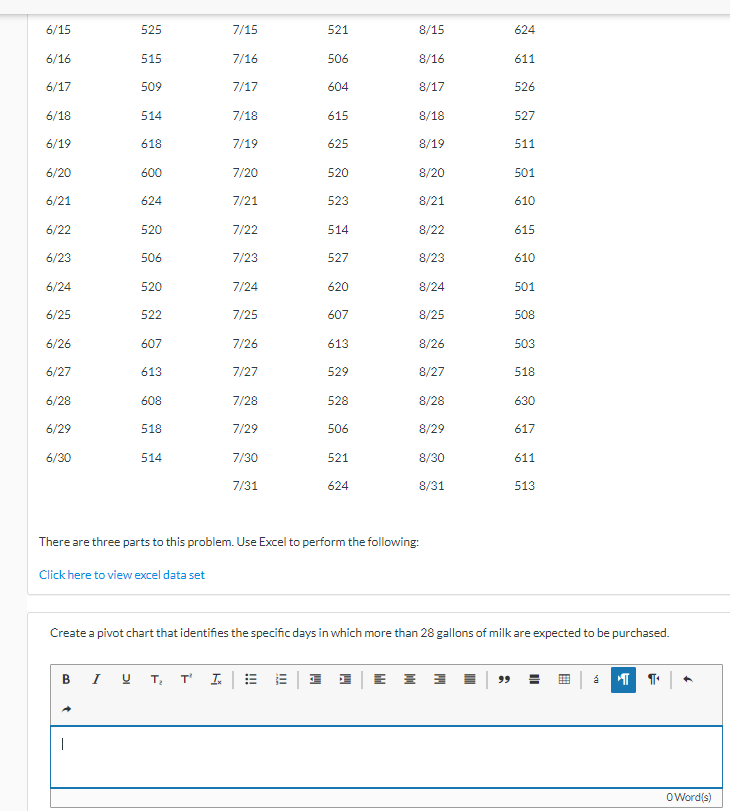

Ivy Ice Cream operates a soft serve ice cream truck in the city of Neptune. During the summer months, a constant stream of customers are in line to purchase ice cream cones from 10AM through 6PM from the truck which is parked at Neptune Beach regardless of the day of the week. Each day, the ice cream truck picks up its budgeted supply of milk from the dairy on its way to the beach where the truck parks for the day. The production of soft serve ice cream consists of two ingredients, milk and pre-made ice cream mix, which are mixed into ice cream in the truck's soft serve machine. The company has estimated the number of ice cream cones to be produced and sold each day for the three summer months. Production equals sales because there is no finished goods inventory at the end of the day. Because the beach season ends on August 31 no materials inventory is needed after that date, and no beginning materials inventory is on hand at the start of the season. The accountant is currently budgeting the amount of milk the beach ice cream truck needs on hand for summer operations. The number of gallons of milk expected to be on hand at the end of each day is equal to 12% of the gallons needed for sales the next day. Milk may be purchased in any quantity as it is pumped from a dairy tank into a milk holding tank in the ice cream truck upon purchase. There are three parts to this problem. Use Excel to perform the following: Create a pivot chart that identifies the specific days in which more than 28 gallons of milk are expected to be purchased. Without providing further calculations, indicate what may occur to the budgeted cost of milk purchases if any milk left over at the end of each day is disposed of, so that the milk tank can be sanitized daily. Is this option preferable to the current practice? Provide justification for your response. Ivy Ice Cream operates a soft serve ice cream truck in the city of Neptune. During the summer months, a constant stream of customers are in line to purchase ice cream cones from 10AM through 6PM from the truck which is parked at Neptune Beach regardless of the day of the week. Each day, the ice cream truck picks up its budgeted supply of milk from the dairy on its way to the beach where the truck parks for the day. The production of soft serve ice cream consists of two ingredients, milk and pre-made ice cream mix, which are mixed into ice cream in the truck's soft serve machine. The company has estimated the number of ice cream cones to be produced and sold each day for the three summer months. Production equals sales because there is no finished goods inventory at the end of the day. Because the beach season ends on August 31 no materials inventory is needed after that date, and no beginning materials inventory is on hand at the start of the season. The accountant is currently budgeting the amount of milk the beach ice cream truck needs on hand for summer operations. The number of gallons of milk expected to be on hand at the end of each day is equal to 12% of the gallons needed for sales the next day. Milk may be purchased in any quantity as it is pumped from a dairy tank into a milk holding tank in the ice cream truck upon purchase. There are three parts to this problem. Use Excel to perform the following: Create a pivot chart that identifies the specific days in which more than 28 gallons of milk are expected to be purchased. Without providing further calculations, indicate what may occur to the budgeted cost of milk purchases if any milk left over at the end of each day is disposed of, so that the milk tank can be sanitized daily. Is this option preferable to the current practice? Provide justification for your response