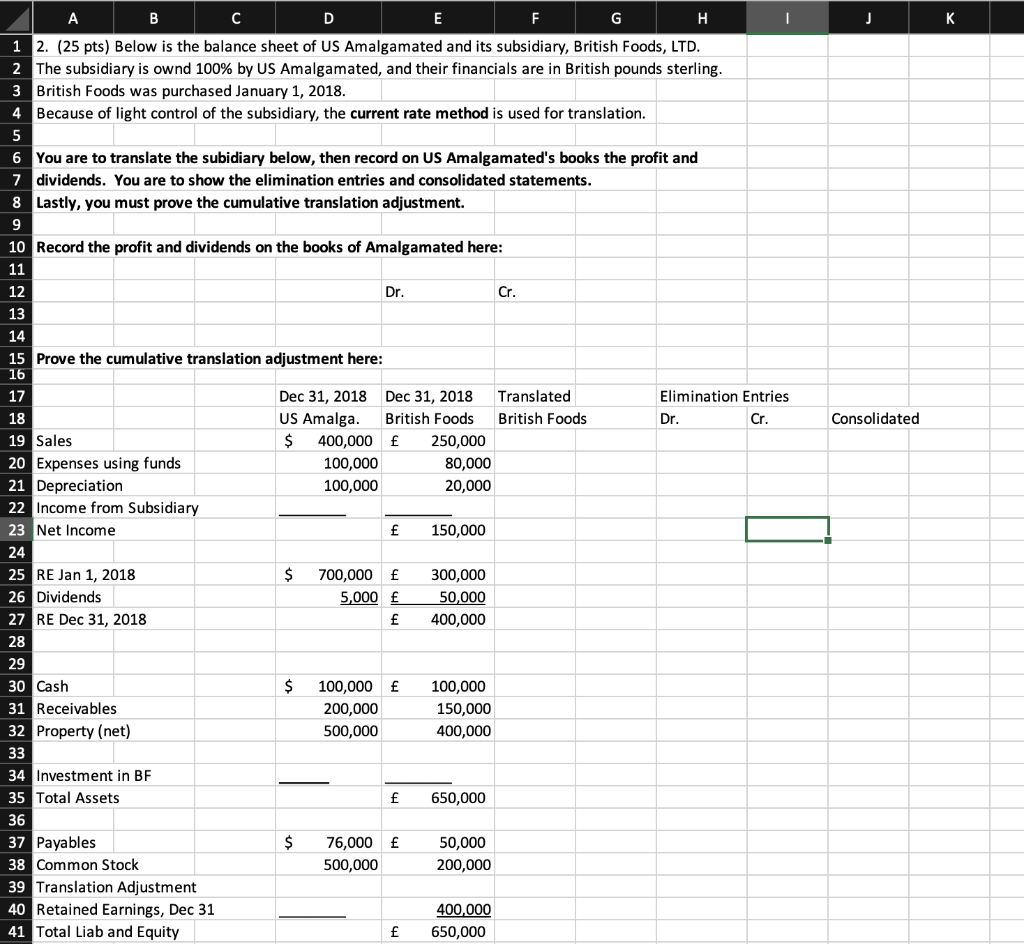

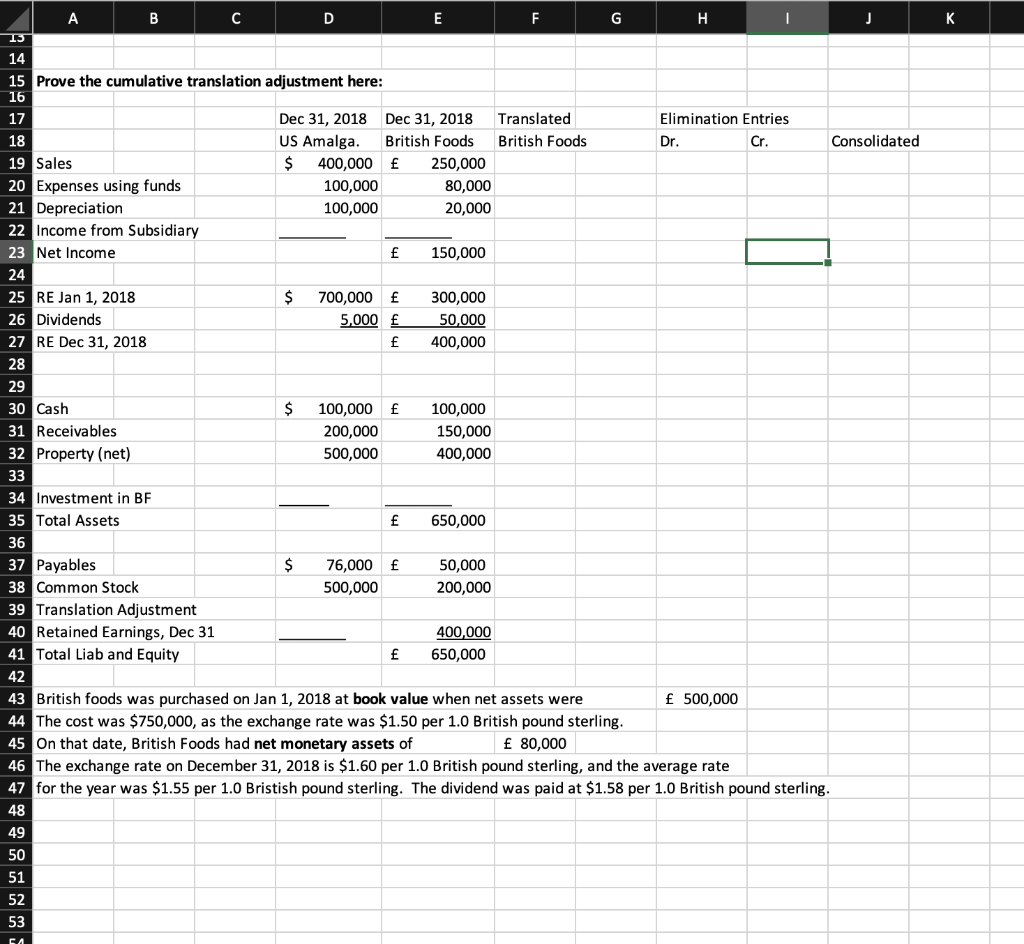

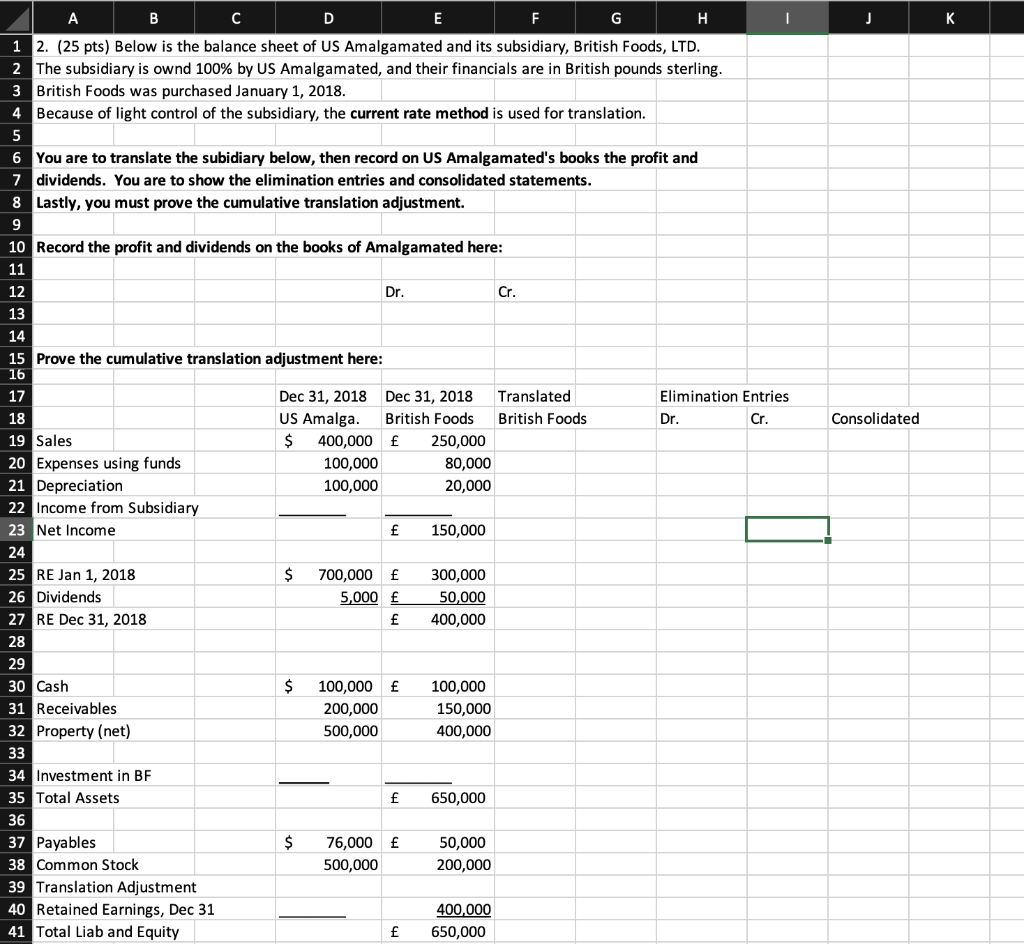

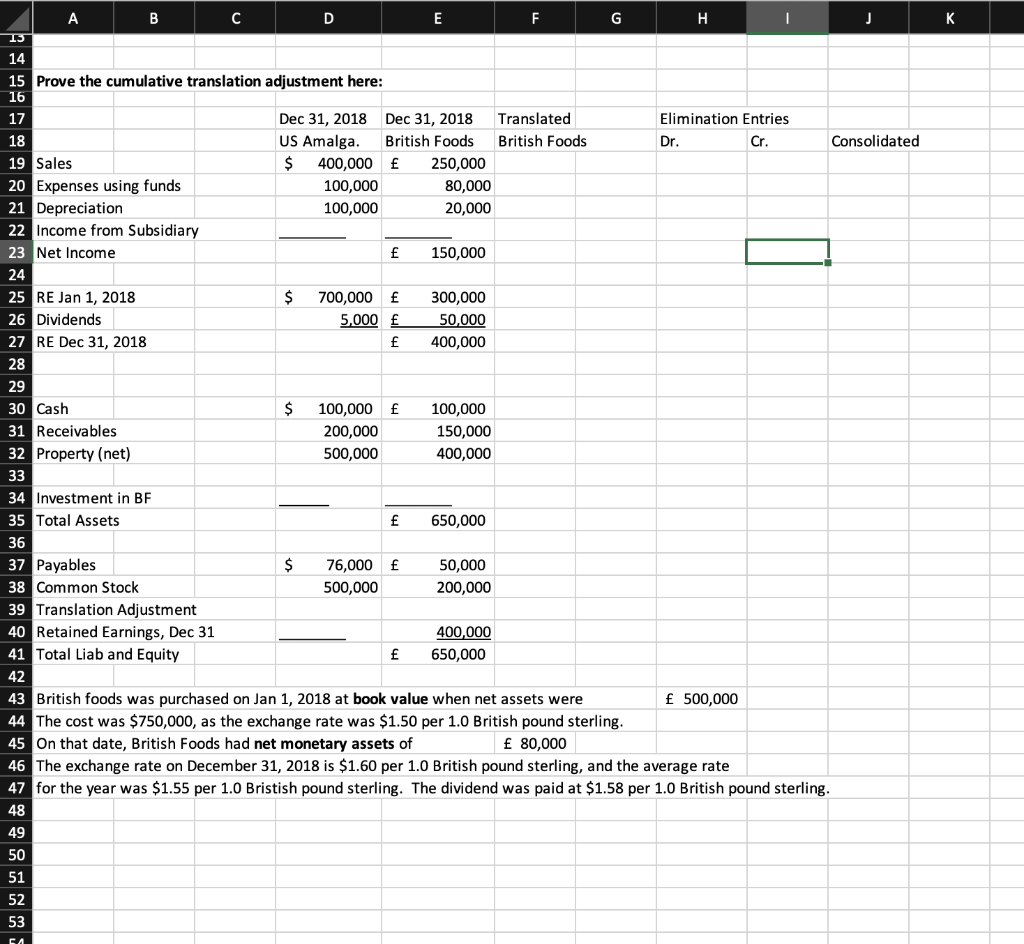

J Consolidated B C F G H . 1 2. (25 pts) Below is the balance sheet of US Amalgamated and its subsidiary, British Foods, LTD. 2 The subsidiary is ownd 100% by US Amalgamated, and their financials are in British pounds sterling. 3 British Foods was purchased January 1, 2018. 4 Because of light control of the subsidiary, the current rate method is used for translation. 5 6 You are to translate the subidiary below, then record on US Amalgamated's books the profit and 7 dividends. You are to show the elimination entries and consolidated statements. 8 Lastly, you must prove the cumulative translation adjustment. 9 10 Record the profit and dividends on the books of Amalgamated here: 11 12 Dr. Cr. 13 14 15 Prove the cumulative translation adjustment here: 16 17 Dec 31, 2018 Dec 31, 2018 Translated Elimination Entries 18 US Amalga. British Foods British Foods Dr. Cr. 19 Sales $ 400,000 250,000 20 Expenses using funds 100,000 80,000 21 Depreciation 100,000 20,000 22 Income from Subsidiary 23 Net Income 150,000 24 25 RE Jan 1, 2018 $ 700,000 300,000 26 Dividends 5,000 50,000 27 RE Dec 31, 2018 f 400,000 28 29 30 Cash $ 100,000 100,000 31 Receivables 200,000 150,000 32 Property (net) 500,000 400,000 33 34 Investment in BF 35 Total Assets f 650,000 36 37 Payables $ 76,000 50,000 38 Common Stock 500,000 200,000 39 Translation Adjustment 40 Retained Earnings, Dec 31 400,000 41 Total Liab and Equity 650,000 B D E F . 15 14 15 Prove the cumulative translation adjustment here: 16 17 Dec 31, 2018 Dec 31, 2018 Translated Elimination Entries 18 US Amalga. British Foods British Foods Dr. Cr. Consolidated 19 Sales $ 400,000 250,000 20 Expenses using funds 100,000 80,000 21 Depreciation 100,000 20,000 22 Income from Subsidiary 23 Net Income 150,000 24 25 RE Jan 1, 2018 $ 700,000 300,000 26 Dividends 5,000 50,000 27 RE Dec 31, 2018 400,000 28 29 30 Cash $ 100,000 f 100,000 31 Receivables 200,000 150,000 32 Property (net) 500,000 400,000 33 34 Investment in BF 35 Total Assets 650,000 36 37 Payables $ 76,000 50,000 38 Common Stock 500,000 200,000 39 Translation Adjustment 40 Retained Earnings, Dec 31 400,000 41 Total Liab and Equity 650,000 42 43 British foods was purchased on Jan 1, 2018 at book value when net assets were 500,000 44 The cost was $750,000, as the exchange rate was $1.50 per 1.0 British pound sterling. 45 On that date, British Foods had net monetary assets of 80,000 46 The exchange rate on December 31, 2018 is $1.60 per 1.0 British pound sterling, and the average rate 47 for the year was $1.55 per 1.0 Bristish pound sterling. The dividend was paid at $1.58 per 1.0 British pound sterling. 48 49 50 51 52 53 J Consolidated B C F G H . 1 2. (25 pts) Below is the balance sheet of US Amalgamated and its subsidiary, British Foods, LTD. 2 The subsidiary is ownd 100% by US Amalgamated, and their financials are in British pounds sterling. 3 British Foods was purchased January 1, 2018. 4 Because of light control of the subsidiary, the current rate method is used for translation. 5 6 You are to translate the subidiary below, then record on US Amalgamated's books the profit and 7 dividends. You are to show the elimination entries and consolidated statements. 8 Lastly, you must prove the cumulative translation adjustment. 9 10 Record the profit and dividends on the books of Amalgamated here: 11 12 Dr. Cr. 13 14 15 Prove the cumulative translation adjustment here: 16 17 Dec 31, 2018 Dec 31, 2018 Translated Elimination Entries 18 US Amalga. British Foods British Foods Dr. Cr. 19 Sales $ 400,000 250,000 20 Expenses using funds 100,000 80,000 21 Depreciation 100,000 20,000 22 Income from Subsidiary 23 Net Income 150,000 24 25 RE Jan 1, 2018 $ 700,000 300,000 26 Dividends 5,000 50,000 27 RE Dec 31, 2018 f 400,000 28 29 30 Cash $ 100,000 100,000 31 Receivables 200,000 150,000 32 Property (net) 500,000 400,000 33 34 Investment in BF 35 Total Assets f 650,000 36 37 Payables $ 76,000 50,000 38 Common Stock 500,000 200,000 39 Translation Adjustment 40 Retained Earnings, Dec 31 400,000 41 Total Liab and Equity 650,000 B D E F . 15 14 15 Prove the cumulative translation adjustment here: 16 17 Dec 31, 2018 Dec 31, 2018 Translated Elimination Entries 18 US Amalga. British Foods British Foods Dr. Cr. Consolidated 19 Sales $ 400,000 250,000 20 Expenses using funds 100,000 80,000 21 Depreciation 100,000 20,000 22 Income from Subsidiary 23 Net Income 150,000 24 25 RE Jan 1, 2018 $ 700,000 300,000 26 Dividends 5,000 50,000 27 RE Dec 31, 2018 400,000 28 29 30 Cash $ 100,000 f 100,000 31 Receivables 200,000 150,000 32 Property (net) 500,000 400,000 33 34 Investment in BF 35 Total Assets 650,000 36 37 Payables $ 76,000 50,000 38 Common Stock 500,000 200,000 39 Translation Adjustment 40 Retained Earnings, Dec 31 400,000 41 Total Liab and Equity 650,000 42 43 British foods was purchased on Jan 1, 2018 at book value when net assets were 500,000 44 The cost was $750,000, as the exchange rate was $1.50 per 1.0 British pound sterling. 45 On that date, British Foods had net monetary assets of 80,000 46 The exchange rate on December 31, 2018 is $1.60 per 1.0 British pound sterling, and the average rate 47 for the year was $1.55 per 1.0 Bristish pound sterling. The dividend was paid at $1.58 per 1.0 British pound sterling. 48 49 50 51 52 53