Answered step by step

Verified Expert Solution

Question

1 Approved Answer

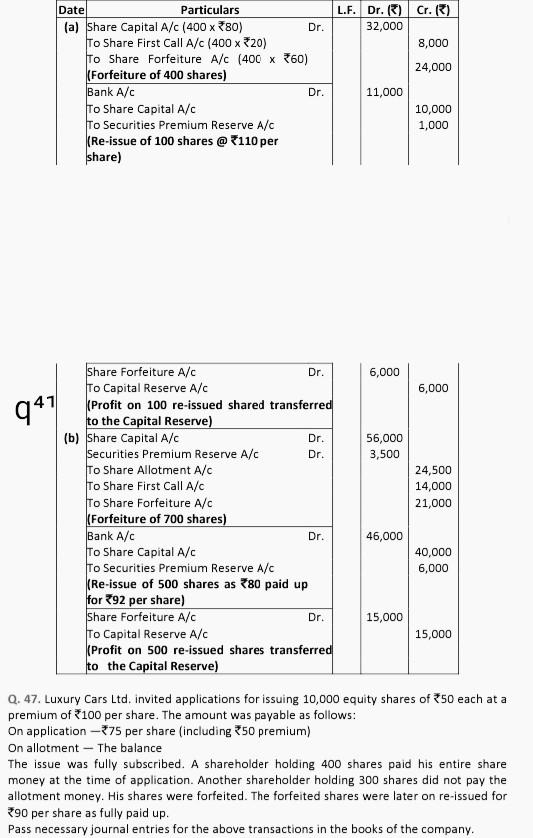

j Date Particulars (a) Share Capital A/c (400 x 80) Dr. To Share First Call A/c (400x320) To Share Forfeiture A/c (400 x 360) (Forfeiture

j

Date Particulars (a) Share Capital A/c (400 x 80) Dr. To Share First Call A/c (400x320) To Share Forfeiture A/c (400 x 360) (Forfeiture of 400 shares) Bank A/c Dr. To Share Capital A/C To Securities Premium Reserve A/c (Re-issue of 100 shares @ 7110 per share) L.F. Dr. () Cr.) 32,000 8,000 24,000 11,000 10,000 1,000 Dr. 6,000 6,000 941 56,000 3,500 24,500 14,000 21,000 Share Forfeiture A/C To Capital Reserve A/C (Profit on 100 re-issued shared transferred to the Capital Reserve) (b) Share Capital A/C Dr. Securities Premium Reserve A/C Dr. To Share Allotment A/c To Share First Call A/C To Share Forfeiture A/C (Forfeiture of 700 shares) Bank A/C To Share Capital A/C To Securities Premium Reserve A/c (Re-issue of 500 shares as 80 paid up for 92 per share) Share Forfeiture A/C Dr. To Capital Reserve A/C (Profit on 500 re-issued shares transferred to the Capital Reserve) Dr. 46,000 40,000 6,000 15,000 15,000 Q. 47. Luxury Cars Ltd. invited applications for issuing 10,000 equity shares of 50 each at a premium of 100 per share. The amount was payable as follows: On application - 375 per share (including 50 premium) On allotment - The balance The issue was fully subscribed. A shareholder holding 400 shares paid his entire share money at the time of application. Another shareholder holding 300 shares did not pay the allotment money. His shares were forfeited. The forfeited shares were later on re-issued for 390 per share as fully paid up. Pass necessary journal entries for the above transactions in the books of the companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started