Question

J had the following transactions: 6/1/20 Sold ABC stock for $2,700 with a $200 sales expense. The stock was purchased 2/1/20 for $3,000. 6/1/20

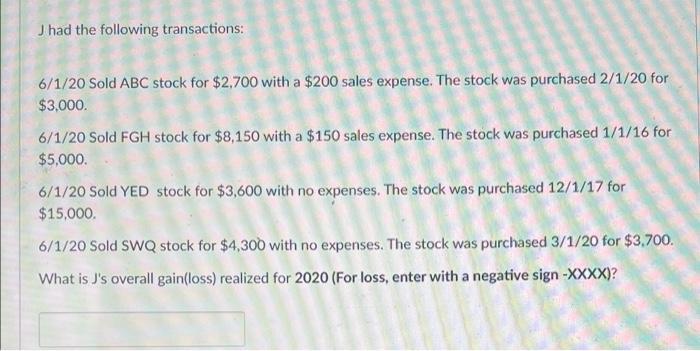

J had the following transactions: 6/1/20 Sold ABC stock for $2,700 with a $200 sales expense. The stock was purchased 2/1/20 for $3,000. 6/1/20 Sold FGH stock for $8,150 with a $150 sales expense. The stock was purchased 1/1/16 for $5,000. 6/1/20 Sold YED stock for $3,600 with no expenses. The stock was purchased 12/1/17 for $15,000. 6/1/20 Sold SWQ stock for $4,300 with no expenses. The stock was purchased 3/1/20 for $3,700. What is J's overall gain(loss) realized for 2020 (For loss, enter with a negative sign-XXXX)?

Step by Step Solution

3.22 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Answer step by step solution While valuing the inventories from sales value sellin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting A User Perspective

Authors: Robert E Hoskin, Maureen R Fizzell, Donald C Cherry

6th Canadian Edition

470676604, 978-0470676608

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App