Answered step by step

Verified Expert Solution

Question

1 Approved Answer

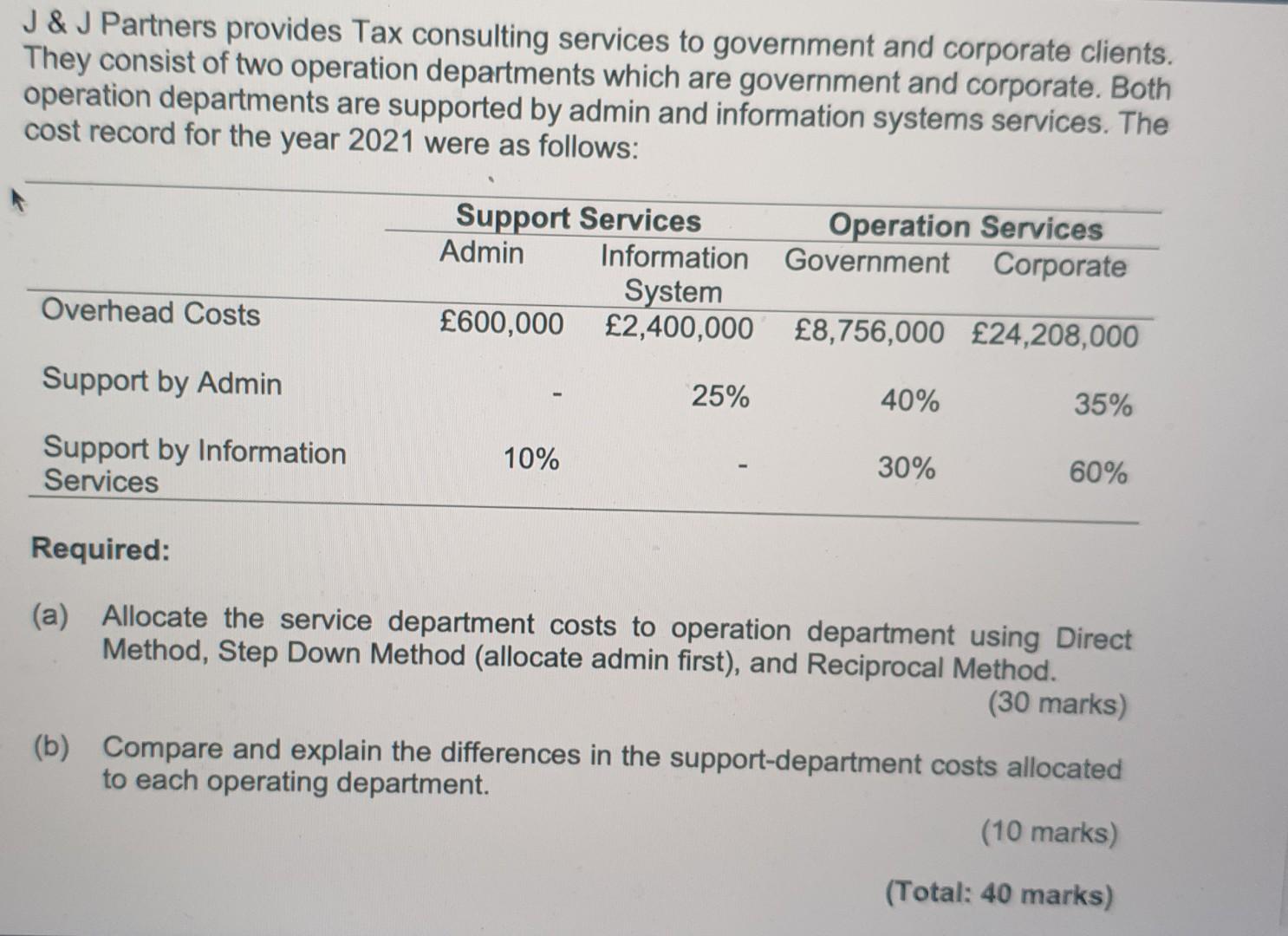

J & J Partners provides Tax consulting services to government and corporate clients. They consist of two operation departments which are government and corporate. Both

J & J Partners provides Tax consulting services to government and corporate clients. They consist of two operation departments which are government and corporate. Both operation departments are supported by admin and information systems services. The cost record for the year 2021 were as follows: Support Services Operation Services Admin Information Government Corporate System 600,000 2,400,000 8,756,000 24,208,000 Overhead Costs Support by Admin 25% 40% 35% Support by Information Services 10% 30% 60% Required: (a) Allocate the service department costs to operation department using Direct Method, Step Down Method (allocate admin first), and Reciprocal Method. (30 marks) (b) Compare and explain the differences in the support-department costs allocated to each operating department. (10 marks) (Total: 40 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started