Answered step by step

Verified Expert Solution

Question

1 Approved Answer

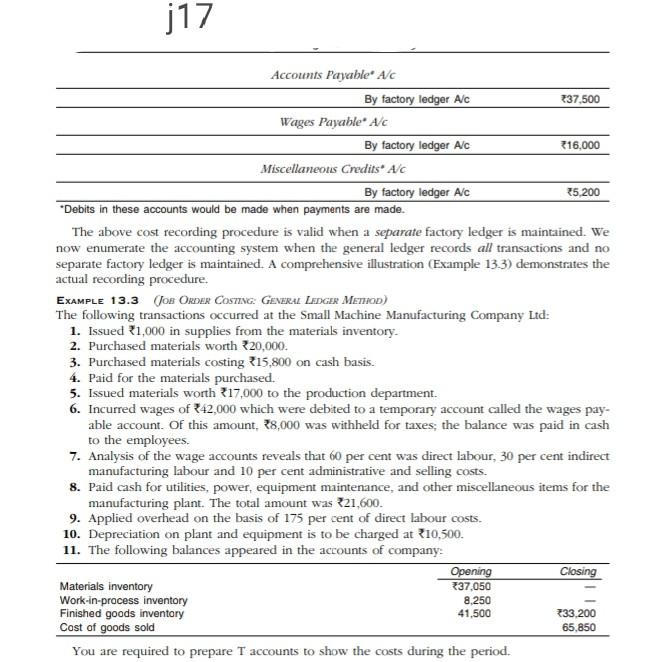

j17 Accounts Payable A/C By factory ledger Alc 37,500 Wages Payable AC By factory ledger Alc 216,000 Miscellaneous Credits A/C By factory ledger Alc *5,200

j17 Accounts Payable A/C By factory ledger Alc 37,500 Wages Payable AC By factory ledger Alc 216,000 Miscellaneous Credits A/C By factory ledger Alc *5,200 *Debits in these accounts would be made when payments are made. The above cost recording procedure is valid when a separate factory ledger is maintained. We now enumerate the accounting system when the general ledger records all transactions and no separate factory ledger is maintained. A comprehensive illustration (Example 13.3) demonstrates the actual recording procedure. EXAMPLE 13.3 (fos ORDER COSTING: GENERAL LEDGER METHOD) The following transactions occurred at the Small Machine Manufacturing Company Ltd: 1. Issued 31,000 in supplies from the materials inventory. 2. Purchased materials worth 20,000. 3. Purchased materials costing 15,800 on cash basis. 4. Paid for the materials purchased. 5. Issued materials worth 17,000 to the production department. 6. Incurred wages of 242,000 which were debited to a temporary account called the wages pay- able account. Of this amount, 18,000 was withheld for taxes: the balance was paid in cash to the employees. 7. Analysis of the wage accounts reveals that 60 per cent was direct labour, 30 per cent indirect manufacturing labour and 10 per cent administrative and selling costs. 8. Paid cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant. The total amount was 21,600. 9. Applied overhead on the basis of 175 per cent of direct labour costs. 10. Depreciation on plant and equipment is to be charged at 10,500. 11. The following balances appeared in the accounts of company: Opening Closing Materials inventory *37,050 Work-in-process inventory 8,250 Finished goods inventory 33,200 Cost of goods sold You are required to prepare T accounts to show the costs during the period. 41,500 65,850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started