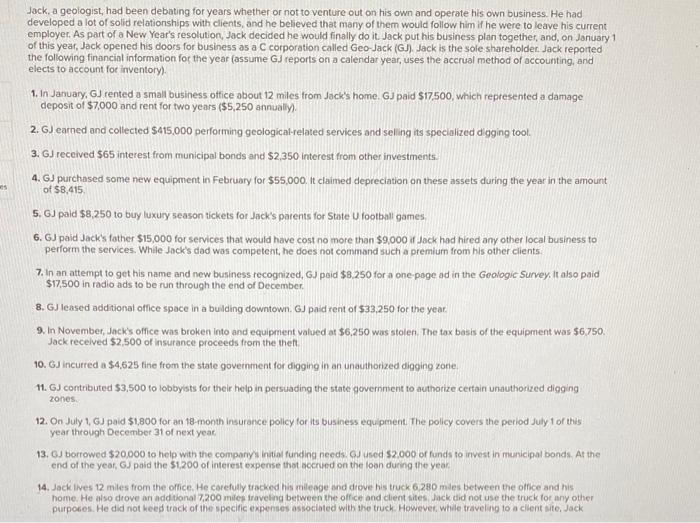

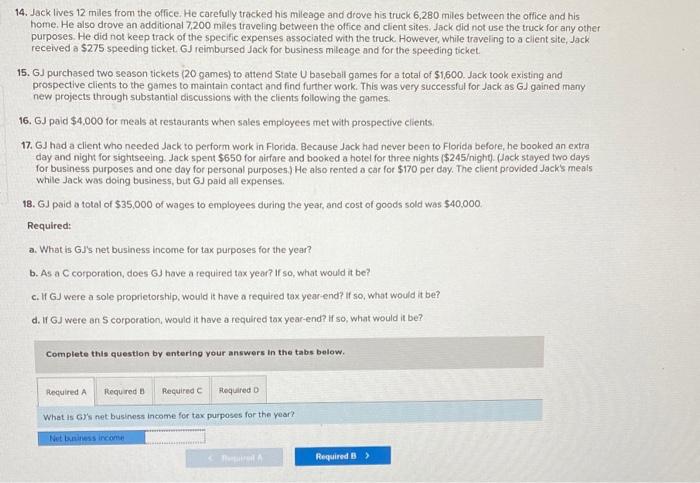

Jack, a geologist, had been debating for years whether or not to venture out on his own and operate his own business. He had developed a lot of solid relationships with clients, and he believed that many of them would follow him if he were to leave his current employer. As part of a New Year's resolution, Jack decided he would finally do it. Jack put his business plan together, and, on January 1 of this year, Jack opened his doors for business as a C corporation called Geo-Jack (G). Jack is the sole shareholder Jack reported the following financial information for the year (assume GJ reports on a calendar year, uses the accrual method of accounting, and elects to account for inventory). 1. In January, GJ rented a small business office about 12 miles from Jack's home. GJ paid $17500, which represented a damage deposit of $7,000 and rent for two years ( $5,250 annually). 2. GJ earned and collected $415,000 performing geological-related services and seling its specialized digging tool. 3. 6J received $65 interest from municipal bonds and $2,350 interest from other investments. 4. GJ purchased some new equipment in February for $55,000. It claimed depreciation on these assets during the year in the amount of $8,415. 5. GJ paid \$8,250 to buy luxury season tickets for Jack's parents for State U football games. 6. GJ paid Jacks father $15,000 for services that would have cost no more than $9,000 if Jack had hired any other local business to perform the services. While Jack's dad was competent, he does not command such a premium from his other clients: 7. In an attempt to get his name and new business recognized, GJ poid $8.250 for a one-poge ad in the Gealogic Survey, it also paid $17,500 in radio ads to be run through the end of December. 8. GJ leased additional office space in a bulding downtown. GJ paid rent of $33,250 for the year. 9. In November, Jack's office was broken into and equipment valued at $6,250 was stolen. The tax basis of the equipment was $6,750. Jack recelved $2,500 of insurance proceeds from the thef. 10. GJ incurred a $4,625 fine from the state government for digging in an unauthorized digging zone. 11. GJ contributed $3,500 to lobbysts for their help in persuading the state government to authorize certain unauthorized digging zones. 12. On July 1, GJ paid $1,800 for an 18 -month insurance policy for its business equipment. The policy covers the period July 1 of this year through December 31 of next yeac. 13. G. borrowed $20.000 to help with the comparyys intial funding needs. 6J used $2.000 of funds to invest in municipal bonds. At the end of the year, GJ paid the $1,200 of interest expense thot accrued on the loan during the year. 14. Jack tives 12 miles from the office. He carefuly tracked his mileoge and diove his truck 6280 maes between the office and his home. He also drove an add tianal 7,200 miles lraveling between the office and client sites. Jack did not use the truck for any other purposes. He did not heed track of the specific expenses associated with the truck. However, while traveling to a cilent site, Jack 14. Jack lives 12 miles from the office. He carefully tracked his mileage and drove his truck 6,280 miles between the office and his home. He also drove an additionat 7,200miles traveling between the office and client sites. Jack did not use the truck for ary other purposes. He did not keep track of the specific expenses associated with the truck. However, while traveling to a client site, Jack received a $275 speeding ticket. GJ reimbursed Jack for business m lleage and for the speeding ticket. 15. GJ purchased two season tickets (20 games) to attend State U basebail games for a total of $1,600. Jack took existing and prospective clients to the games to maintain contact and find further work. This was very successful for Jack as GJ gained many new projects through substantial discussions with the clients following the games: 16. GJ paid $4.000 for meals at restaurants when sales employees met with prospective clients. 17. GJ had a client who needed Jack to perform work in Florida. Because Jack had never been to Florida before, he booked an extra day and night for sightseeing. Jack spent $650 for airfare and booked a hotel for three nights (\$245ight). (Jack stayed two days for business purposes and one day for personal purposes.) He also rented a car for $170 per doy. The client provided Jack's meals while Jack was doing business, but GJ paid all expenses. 18. GJ paid a total of $35,000 of wages to employees during the year, and cost of goods sold was $40,000. Required: a. What is GJ 's net business income for tax purposes for the year? b. As a C corporation, does G J have a required tax year? If so, what would it be? c. H GJ were a sole proprietorship, would it have a required tax year-end? if so, what would it be? d. If GJ were an S corporation, would it have a required tax year-end? If so, what would it be? Complete this question by entering your answers in the tabs below. What is G 's net business income for tax purposes for the year