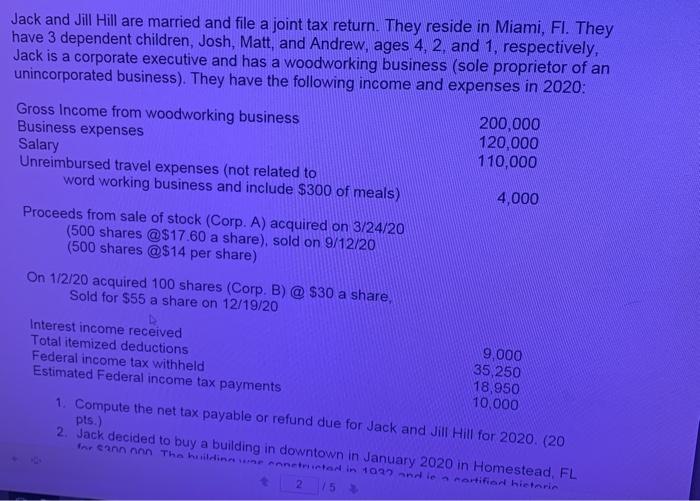

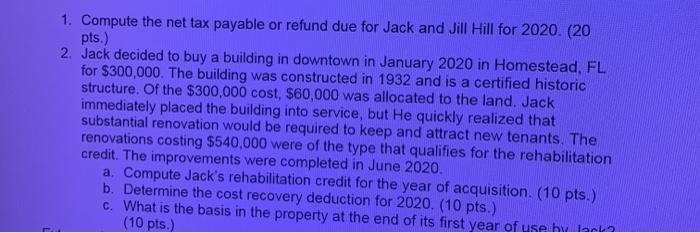

Jack and Jill Hill are married and file a joint tax return. They reside in Miami, Fl. They have 3 dependent children, Josh, Matt, and Andrew, ages 4, 2, and 1, respectively, Jack is a corporate executive and has a woodworking business (sole proprietor of an unincorporated business). They have the following income and expenses in 2020: Gross Income from woodworking business 200,000 Business expenses 120,000 Salary 110,000 Unreimbursed travel expenses (not related to word working business and include $300 of meals) 4,000 Proceeds from sale of stock (Corp. A) acquired on 3/24/20 (500 shares @$17.60 a share), sold on 9/12/20 (500 shares @$14 per share) On 1/2/20 acquired 100 shares (Corp. B) @ $30 a share, Sold for $55 a share on 12/19/20 Interest income received Total itemized deductions Federal income tax withheld Estimated Federal income tax payments 9,000 35,250 18,950 10,000 1. Compute the net tax payable or refund due for Jack and Jill Hill for 2020. (20 pts.) 2. Jack decided to buy a building in downtown in January 2020 in Homestead, FL In cannon The buildina ennetieto in 1022 and le mortified hietarin 275 1. Compute the net tax payable or refund due for Jack and Jill Hill for 2020. (20 pts.) 2. Jack decided to buy a building in downtown in January 2020 in Homestead, FL for $300,000. The building was constructed in 1932 and is a certified historic structure. Of the $300,000 cost, $60,000 was allocated to the land. Jack immediately placed the building into service, but He quickly realized that substantial renovation would be required to keep and attract new tenants. The renovations costing $540,000 were of the type that qualifies for the rehabilitation credit. The improvements were completed in June 2020. a. Compute Jack's rehabilitation credit for the year of acquisition. (10 pts.) b. Determine the cost recovery deduction for 2020. (10 pts.) c. What is the basis in the property at the end of its first year of use hwlane (10 pts.) Jack and Jill Hill are married and file a joint tax return. They reside in Miami, Fl. They have 3 dependent children, Josh, Matt, and Andrew, ages 4, 2, and 1, respectively, Jack is a corporate executive and has a woodworking business (sole proprietor of an unincorporated business). They have the following income and expenses in 2020: Gross Income from woodworking business 200,000 Business expenses 120,000 Salary 110,000 Unreimbursed travel expenses (not related to word working business and include $300 of meals) 4,000 Proceeds from sale of stock (Corp. A) acquired on 3/24/20 (500 shares @$17.60 a share), sold on 9/12/20 (500 shares @$14 per share) On 1/2/20 acquired 100 shares (Corp. B) @ $30 a share, Sold for $55 a share on 12/19/20 Interest income received Total itemized deductions Federal income tax withheld Estimated Federal income tax payments 9,000 35,250 18,950 10,000 1. Compute the net tax payable or refund due for Jack and Jill Hill for 2020. (20 pts.) 2. Jack decided to buy a building in downtown in January 2020 in Homestead, FL In cannon The buildina ennetieto in 1022 and le mortified hietarin 275 1. Compute the net tax payable or refund due for Jack and Jill Hill for 2020. (20 pts.) 2. Jack decided to buy a building in downtown in January 2020 in Homestead, FL for $300,000. The building was constructed in 1932 and is a certified historic structure. Of the $300,000 cost, $60,000 was allocated to the land. Jack immediately placed the building into service, but He quickly realized that substantial renovation would be required to keep and attract new tenants. The renovations costing $540,000 were of the type that qualifies for the rehabilitation credit. The improvements were completed in June 2020. a. Compute Jack's rehabilitation credit for the year of acquisition. (10 pts.) b. Determine the cost recovery deduction for 2020. (10 pts.) c. What is the basis in the property at the end of its first year of use hwlane (10 pts.)