Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jack and Jills Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town, it

Jack and Jills Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town, it has a well rather than a city water supply. Lately, the well has become unreliable, and the school has had to bring in bottled drinking water. The schools governing board is considering drilling a new well (at the top of the hill, naturally). The board estimates that a new well would cost $3,687 and save the school $600 annually for 10 years. The schools hurdle rate is 7 percent.

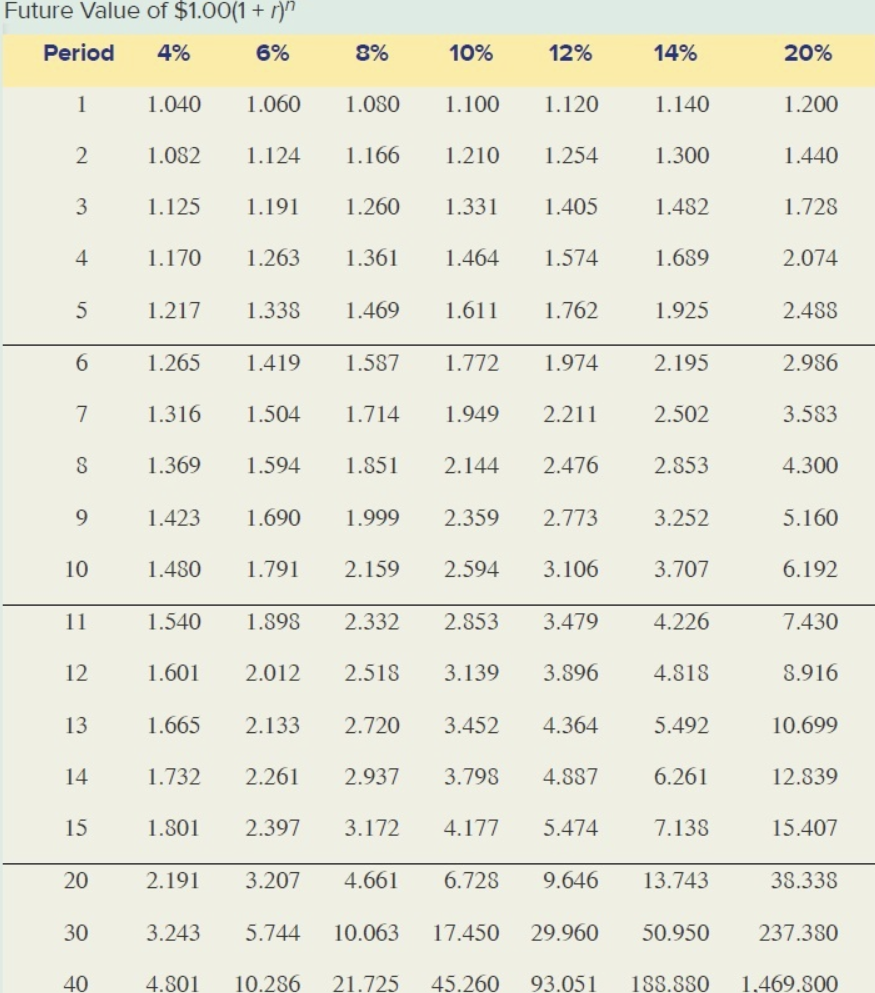

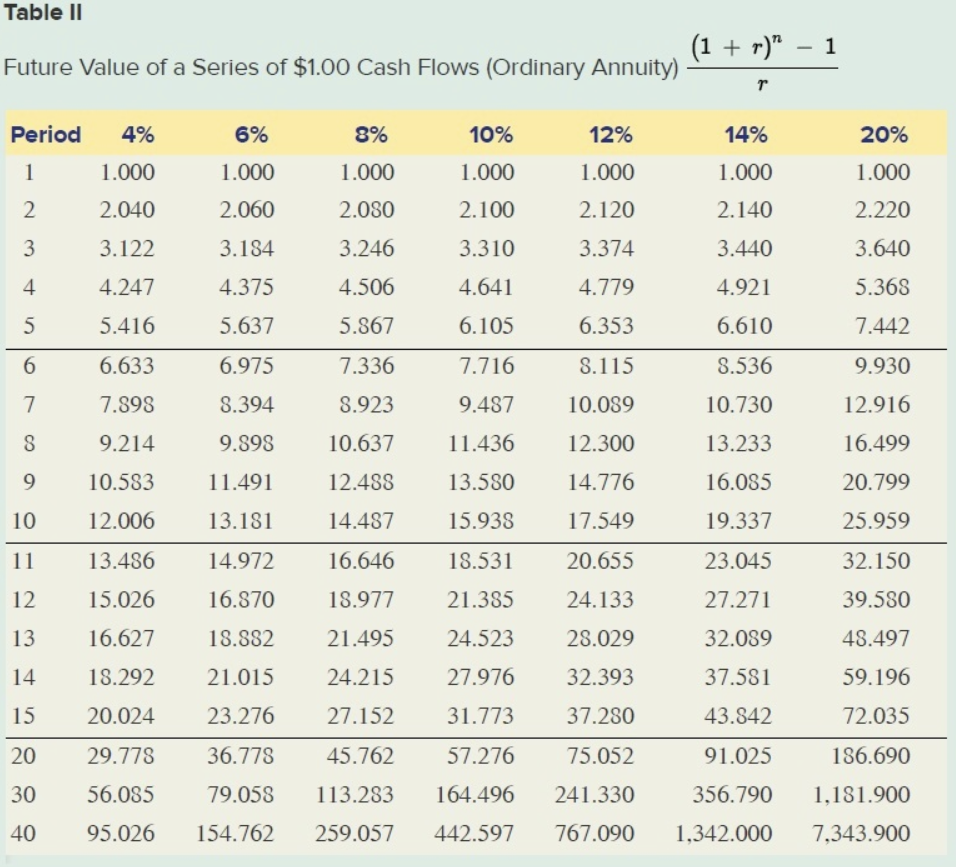

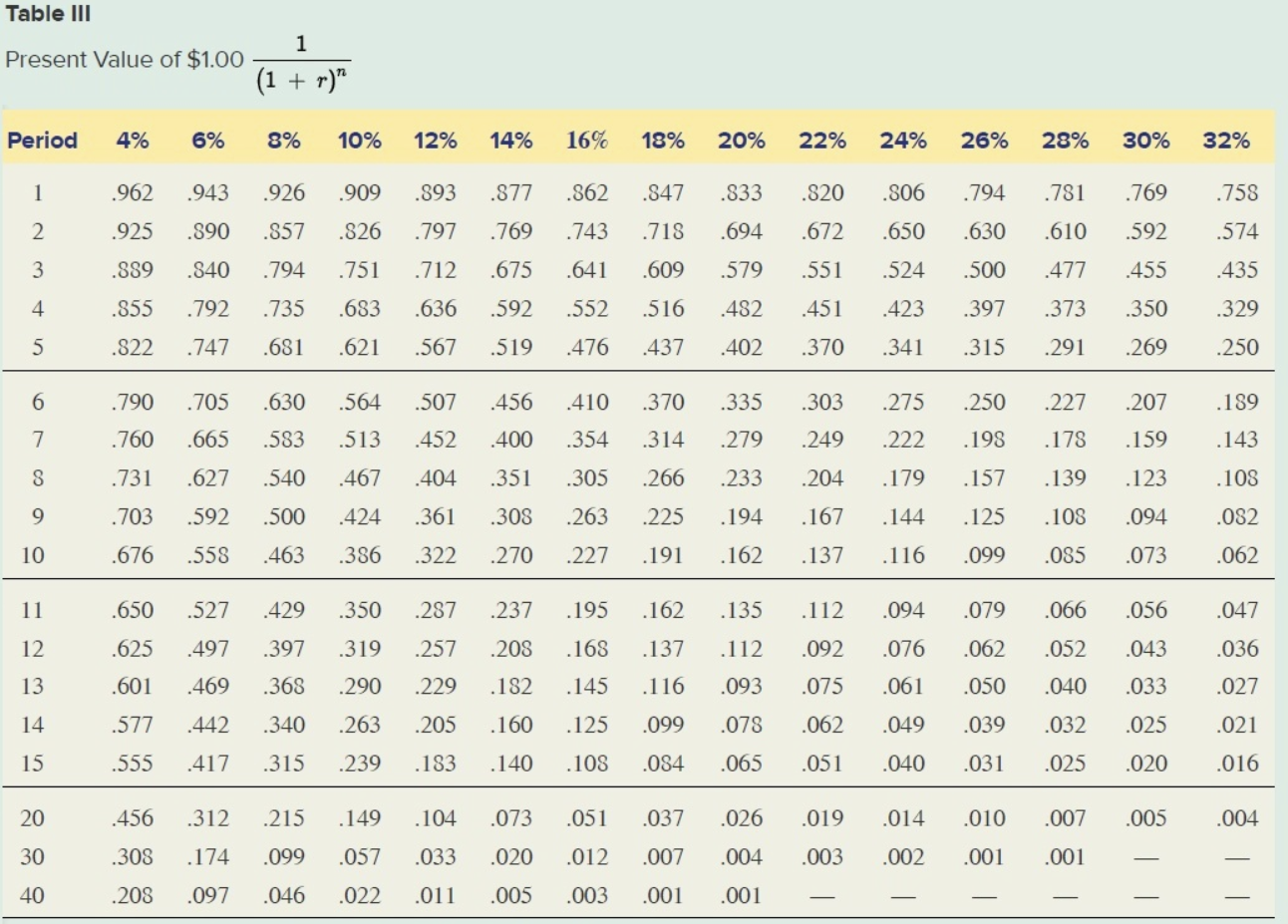

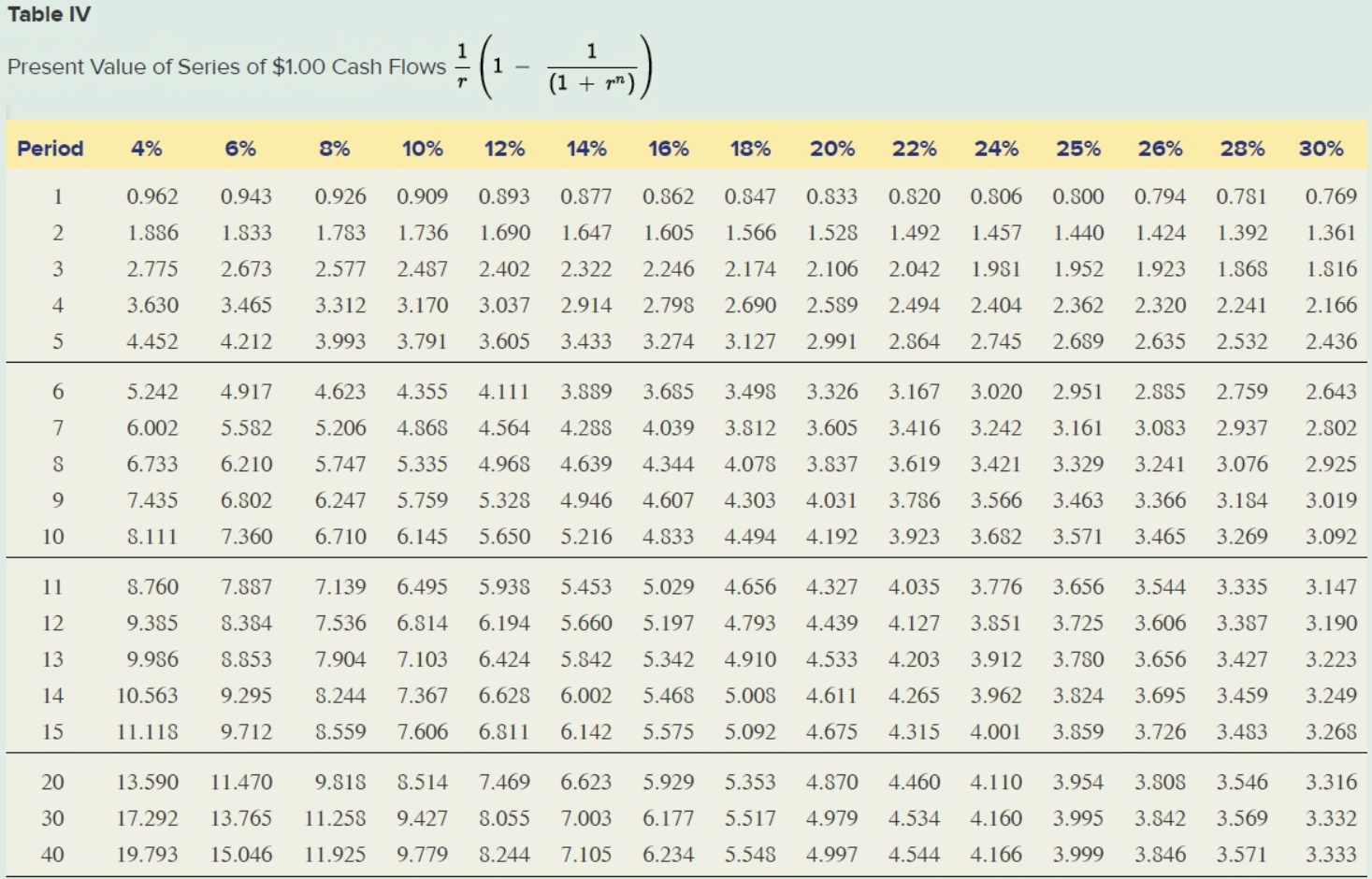

Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the internal rate of return on the new well. Should the governing board approve the new well Future Value of \\( \\$ 1.00(1+r)^{n} \\) \\begin{tabular}{rrrrrrrr} Period & \mathbf4 & \mathbf6 & \mathbf8 & \mathbf10 & \mathbf12 & \mathbf14 & \\( \\mathbf{2 0 \\%} \\) \\\\ 1 & 1.040 & 1.060 & 1.080 & 1.100 & 1.120 & 1.140 & 1.200 \\\\ 2 & 1.082 & 1.124 & 1.166 & 1.210 & 1.254 & 1.300 & 1.440 \\\\ 3 & 1.125 & 1.191 & 1.260 & 1.331 & 1.405 & 1.482 & 1.728 \\\\ 4 & 1.170 & 1.263 & 1.361 & 1.464 & 1.574 & 1.689 & 2.074 \\\\ 5 & 1.217 & 1.338 & 1.469 & 1.611 & 1.762 & 1.925 & 2.488 \\\\ \\hline 6 & 1.265 & 1.419 & 1.587 & 1.772 & 1.974 & 2.195 & 2.986 \\\\ \\hline 7 & 1.316 & 1.504 & 1.714 & 1.949 & 2.211 & 2.502 & 3.583 \\\\ \\hline 8 & 1.369 & 1.594 & 1.851 & 2.144 & 2.476 & 2.853 & 4.300 \\\\ \\hline 9 & 1.423 & 1.690 & 1.999 & 2.359 & 2.773 & 3.252 & 5.160 \\\\ \\hline 10 & 1.480 & 1.791 & 2.159 & 2.594 & 3.106 & 3.707 & 6.192 \\\\ \\hline 11 & 1.540 & 1.898 & 2.332 & 2.853 & 3.479 & 4.226 & 7.430 \\\\ \\hline 12 & 1.601 & 2.012 & 2.518 & 3.139 & 3.896 & 4.818 & 8.916 \\\\ \\hline 13 & 1.665 & 2.133 & 2.720 & 3.452 & 4.364 & 5.492 & 10.699 \\\\ \\hline 14 & 1.732 & 2.261 & 2.937 & 3.798 & 4.887 & 6.261 & 12.839 \\\\ \\hline 15 & 1.801 & 2.397 & 3.172 & 4.177 & 5.474 & 7.138 & 15.407 \\\\ \\hline 20 & 2.191 & 3.207 & 4.661 & 6.728 & 9.646 & 13.743 & 38.338 \\\\ \\hline 30 & 3.243 & 5.744 & 10.063 & 17.450 & 29.960 & 50.950 & 237.380 \\\\ \\hline 40 & 4.801 & 10.286 & 21.725 & 45.260 & 93.051 & 188.880 & 1.469 .800 \\end{tabular} \\( \\frac{1}{r}\\left(1-\\frac{1}{\\left(1, m_{n}\ ight)}\ ight) \\) Drncont V/al\u0131n of \\( \\$ 1 \\cap n \\ldots \\) Future Value of a Series of \\( \\$ 1.00 \\) Cash Flows (Ordinary Annuity) \\( \\underline{(1+r)^{n}-1} \\)

Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the internal rate of return on the new well. Should the governing board approve the new well Future Value of \\( \\$ 1.00(1+r)^{n} \\) \\begin{tabular}{rrrrrrrr} Period & \mathbf4 & \mathbf6 & \mathbf8 & \mathbf10 & \mathbf12 & \mathbf14 & \\( \\mathbf{2 0 \\%} \\) \\\\ 1 & 1.040 & 1.060 & 1.080 & 1.100 & 1.120 & 1.140 & 1.200 \\\\ 2 & 1.082 & 1.124 & 1.166 & 1.210 & 1.254 & 1.300 & 1.440 \\\\ 3 & 1.125 & 1.191 & 1.260 & 1.331 & 1.405 & 1.482 & 1.728 \\\\ 4 & 1.170 & 1.263 & 1.361 & 1.464 & 1.574 & 1.689 & 2.074 \\\\ 5 & 1.217 & 1.338 & 1.469 & 1.611 & 1.762 & 1.925 & 2.488 \\\\ \\hline 6 & 1.265 & 1.419 & 1.587 & 1.772 & 1.974 & 2.195 & 2.986 \\\\ \\hline 7 & 1.316 & 1.504 & 1.714 & 1.949 & 2.211 & 2.502 & 3.583 \\\\ \\hline 8 & 1.369 & 1.594 & 1.851 & 2.144 & 2.476 & 2.853 & 4.300 \\\\ \\hline 9 & 1.423 & 1.690 & 1.999 & 2.359 & 2.773 & 3.252 & 5.160 \\\\ \\hline 10 & 1.480 & 1.791 & 2.159 & 2.594 & 3.106 & 3.707 & 6.192 \\\\ \\hline 11 & 1.540 & 1.898 & 2.332 & 2.853 & 3.479 & 4.226 & 7.430 \\\\ \\hline 12 & 1.601 & 2.012 & 2.518 & 3.139 & 3.896 & 4.818 & 8.916 \\\\ \\hline 13 & 1.665 & 2.133 & 2.720 & 3.452 & 4.364 & 5.492 & 10.699 \\\\ \\hline 14 & 1.732 & 2.261 & 2.937 & 3.798 & 4.887 & 6.261 & 12.839 \\\\ \\hline 15 & 1.801 & 2.397 & 3.172 & 4.177 & 5.474 & 7.138 & 15.407 \\\\ \\hline 20 & 2.191 & 3.207 & 4.661 & 6.728 & 9.646 & 13.743 & 38.338 \\\\ \\hline 30 & 3.243 & 5.744 & 10.063 & 17.450 & 29.960 & 50.950 & 237.380 \\\\ \\hline 40 & 4.801 & 10.286 & 21.725 & 45.260 & 93.051 & 188.880 & 1.469 .800 \\end{tabular} \\( \\frac{1}{r}\\left(1-\\frac{1}{\\left(1, m_{n}\ ight)}\ ight) \\) Drncont V/al\u0131n of \\( \\$ 1 \\cap n \\ldots \\) Future Value of a Series of \\( \\$ 1.00 \\) Cash Flows (Ordinary Annuity) \\( \\underline{(1+r)^{n}-1} \\) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started