Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jack buys an asset for $80. To hedge its risk, Jack buys a one year put option for $2 with the strike price of $80

Jack buys an asset for $80. To hedge its risk, Jack buys a one year put option for $2 with the strike price of $80 on the same asset.

Draw both positions (long position in the asset and the long put option) on the same graph.

Graph: Label all points

What are the value of Jack's investment (both his asset and the put) for 0 ST $80, 80 ST ST > $82 at the expiration of this option? Assume 0% interest rate.

What type of contract is the combined (total) positions (draw the combined position on the same graph)?

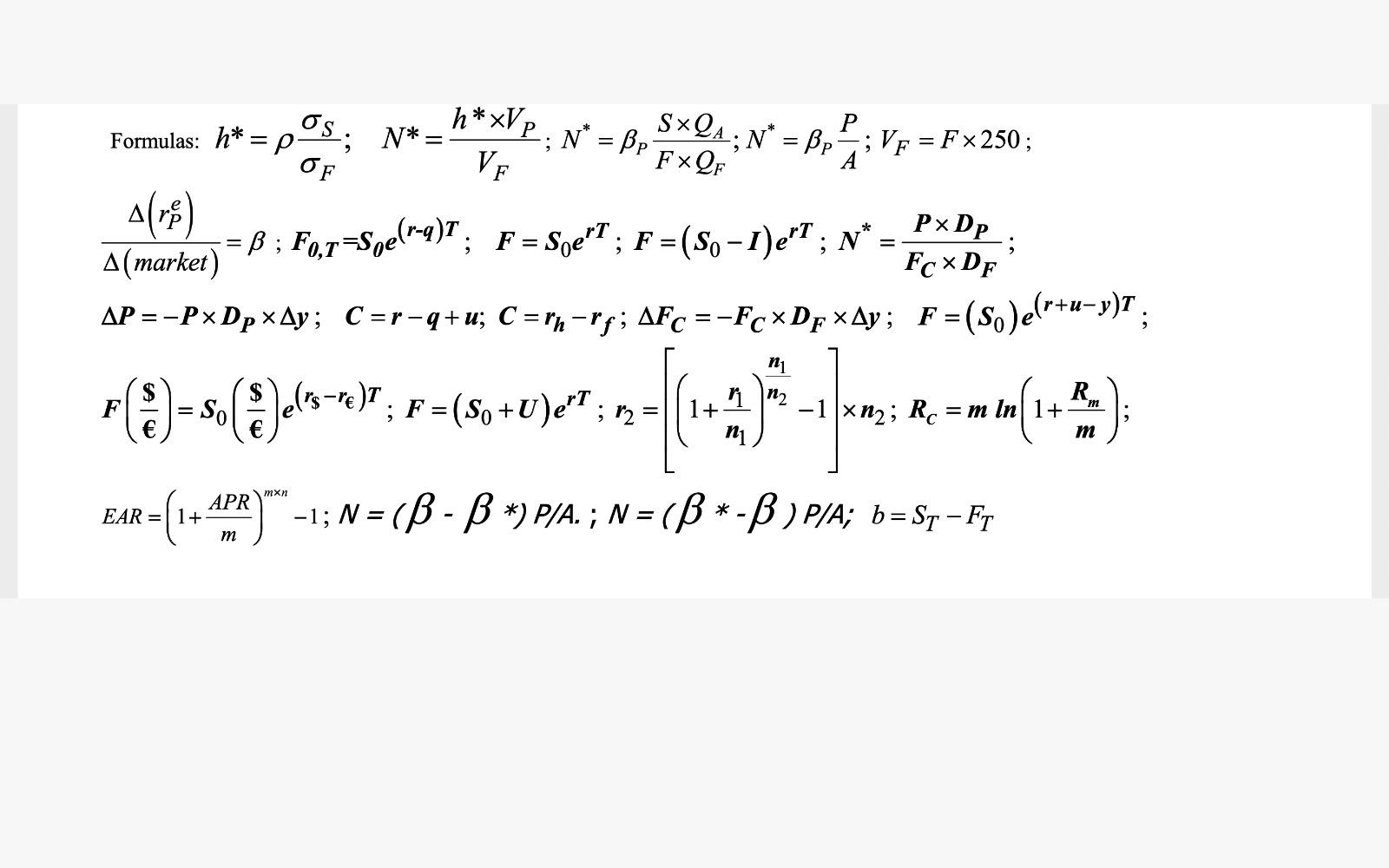

Os. N*= OF h*xVP; N = BP FXQF mxn 2 = (1+ APR)* - 1; N m EAR Formulas: h*=p- A(re) = ; F,r=Soe(r-a)T; F = SoerT; F = (S-1)erT; N* = PxDp; A (market) FCXDF AP=-PxDpx Ay; C =r=q+u; C = r=rg; AFC =-FcxDxAy; F = (S)e(r +u-y)T; F ( ) = So ( )e('s-e) ; F = (So + U)eT ; VE F SXQAN* = PP 12 = P -; VF = Fx250; A n1 112 -1 xn; Rc ; Re-mix(1 + R) m =m In 1+ m -1; N = ( - B *) P/A.; N = ( * - ) P/A; b=S-F

Step by Step Solution

★★★★★

3.41 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Long Asset Position Value 0 80 Strike Price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started