Answered step by step

Verified Expert Solution

Question

1 Approved Answer

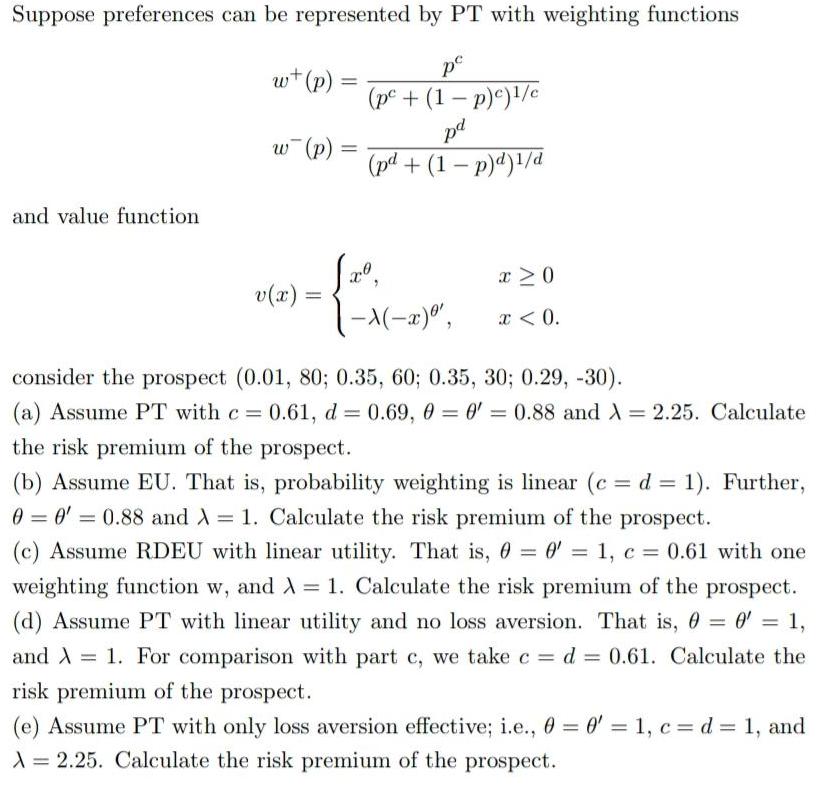

Suppose preferences can be represented by PT with weighting functions p (pc + (1 - p)c)/c pd (pd + (1 - p)d)1/d and value

Suppose preferences can be represented by PT with weighting functions p (pc + (1 - p)c)/c pd (pd + (1 - p)d)1/d and value function. w+ (p) = w (p) v(x) = = = [a", 1-X (-x) , x 0 x < 0. consider the prospect (0.01, 80; 0.35, 60; 0.35, 30; 0.29, -30). (a) Assume PT with c = 0.61, d = 0.69, 0 = 0 = 0.88 and A = 2.25. Calculate the risk premium of the prospect. (b) Assume EU. That is, probability weighting is linear (c= d =1). Further, 00' 0.88 and X = 1. Calculate the risk premium of the prospect. = (c) Assume RDEU with linear utility. That is, 0 = 0 = 1, c = 0.61 with one weighting function w, and = 1. Calculate the risk premium of the prospect. (d) Assume PT with linear utility and no loss aversion. That is, 0 = 0 = 1, and X 1. For comparison with part c, we take cd = 0.61. Calculate the risk premium of the prospect. = (e) Assume PT with only loss aversion effective; i.e., 0 = 0 = 1, c= d = 1, and A = 2.25. Calculate the risk premium of the prospect.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The question presented refers to different methods of evaluating risky prospects according to Prospect Theory PT Expected Utility Theory EU and RankDependent Expected Utility RDEU taking into account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started