Question

Jack Ma, a foreign exchange trader in Canada, has CAD. 4,000,000 for short-term money market investment and wants to make a profit based on the

Jack Ma, a foreign exchange trader in Canada, has CAD. 4,000,000 for short-term money market investment and wants to make a profit based on the following rates. Explain specific steps that Jack Ma must take to make a covered interest arbitrage.

CAD= Canadian Dollar

JYP= Japanese Yen

| 6-month Canadian interest rate | 1.6% per annum |

| 6-month Yen interest rate | 2.95% per annum |

| Spot rate | JYP 93.1395/CAD |

| 6-month forward rate | JYP 93.8380/CAD |

Step 1

1) Different i for Base rate -Quote rate =

2) Different between Spot and Forward =

(1) + (2) =

invest in _ borrow in _

Step 2 explain using table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

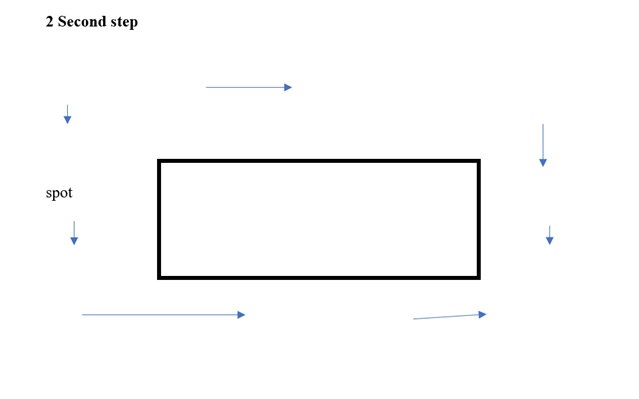

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started