Question

Jack purchased 200 shares of Apple stock earlier this month at the price of $210 per share. Apple stock is trading at $218 today

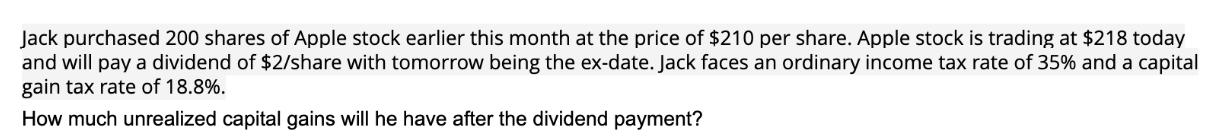

Jack purchased 200 shares of Apple stock earlier this month at the price of $210 per share. Apple stock is trading at $218 today and will pay a dividend of $2/share with tomorrow being the ex-date. Jack faces an ordinary income tax rate of 35% and a capital gain tax rate of 18.8%. How much unrealized capital gains will he have after the dividend payment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Jacks unrealized capital gains after the dividend payment we need to consider the incre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

13th Global Edition

1292153989, 9781292153988

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App