Answered step by step

Verified Expert Solution

Question

1 Approved Answer

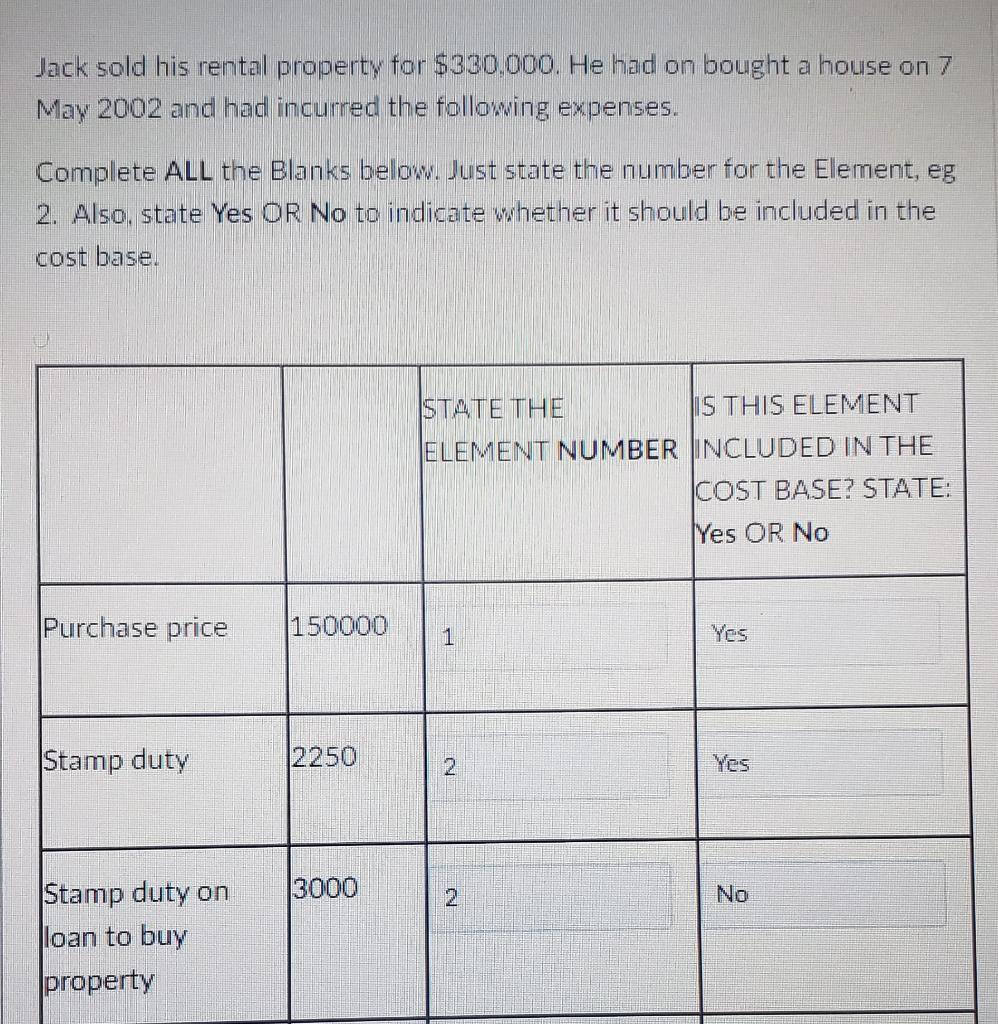

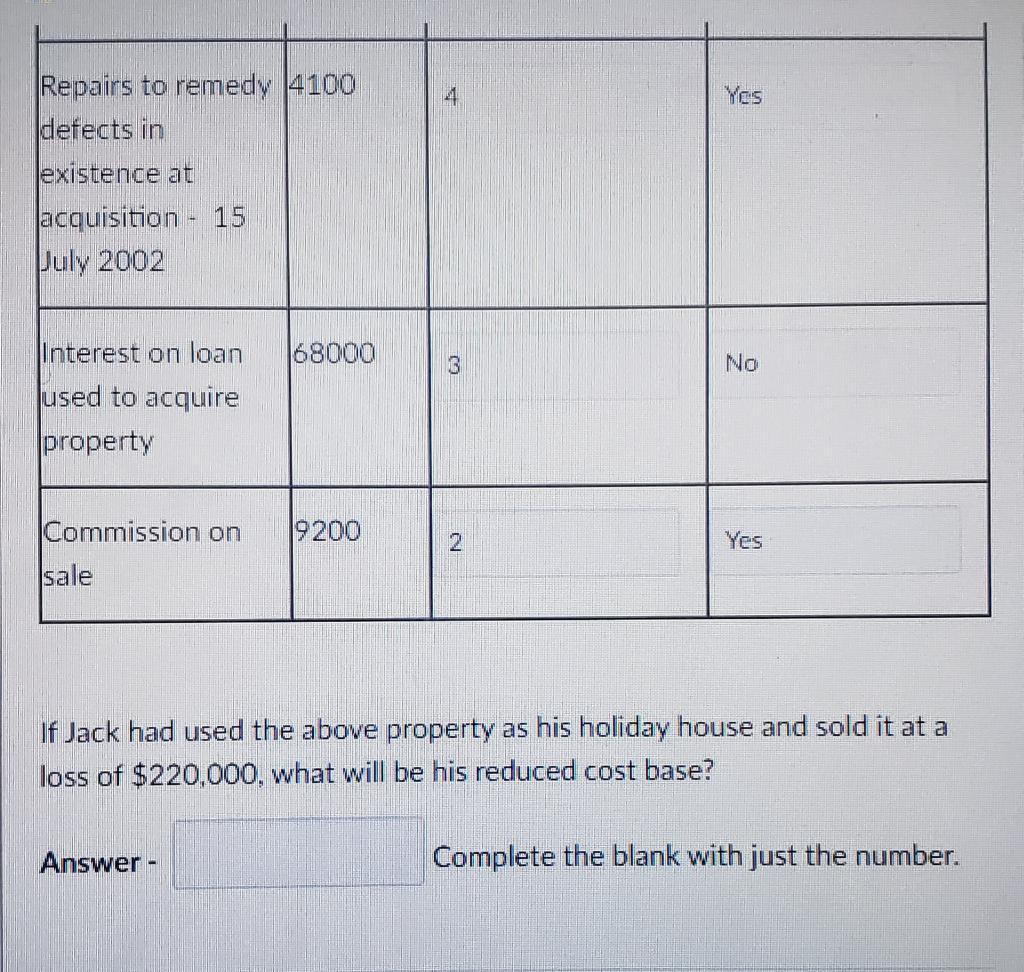

Jack sold his rental property for $330,000. He had on bought a house on 7 May 2002 and had incurred the following expenses. Complete

Jack sold his rental property for $330,000. He had on bought a house on 7 May 2002 and had incurred the following expenses. Complete ALL the Blanks below. Just state the number for the Element, eg 2. Also, state Yes OR No to indicate whether it should be included in the cost base. Purchase price Stamp duty Stamp duty on loan to buy property 150000 2250 3000 STATE THE ELEMENT NUMBER 1 2 2 IS THIS ELEMENT INCLUDED IN THE COST BASE? STATE: Yes OR No Yes Yes No Repairs to remedy 4100 defects in existence at acquisition 15 July 2002 Interest on loan used to acquire property Commission on sale 68000 Answer - 9200 4 3 2 Yes No Yes If Jack had used the above property as his holiday house and sold it at a loss of $220,000, what will be his reduced cost base? Complete the blank with just the number.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

State The Element Number Is the element included in the cost base YES or No Purchase Pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started