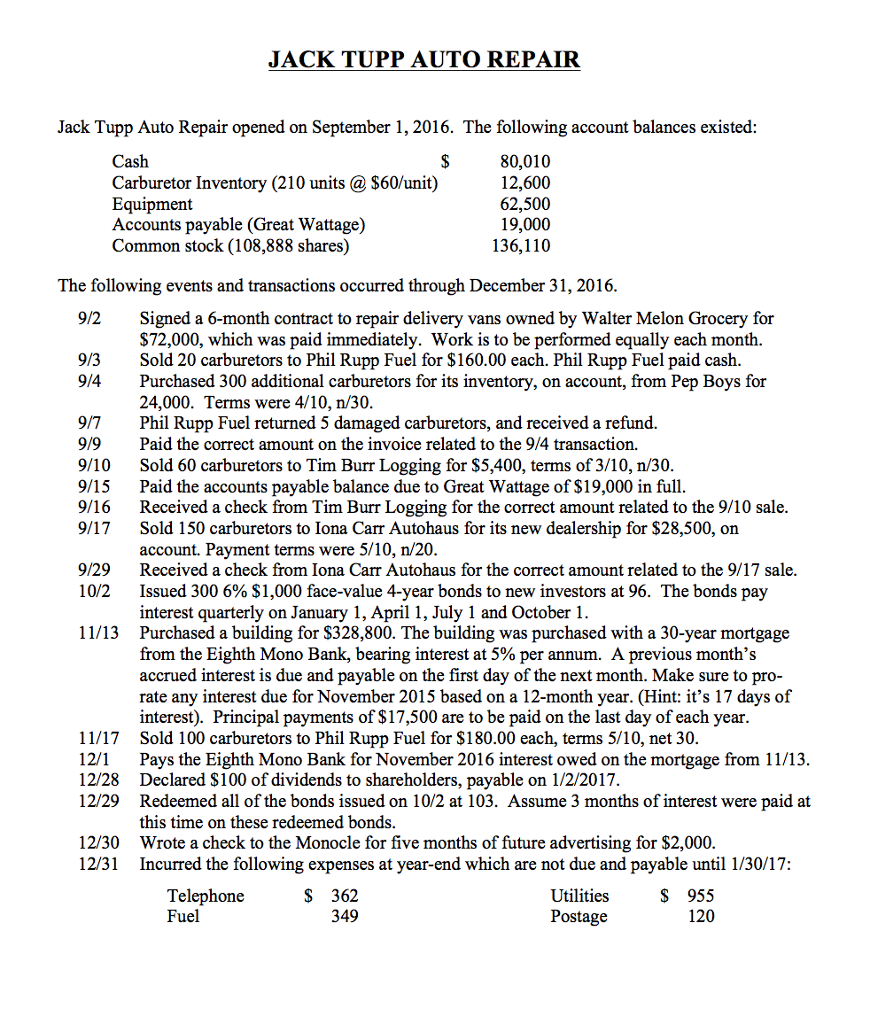

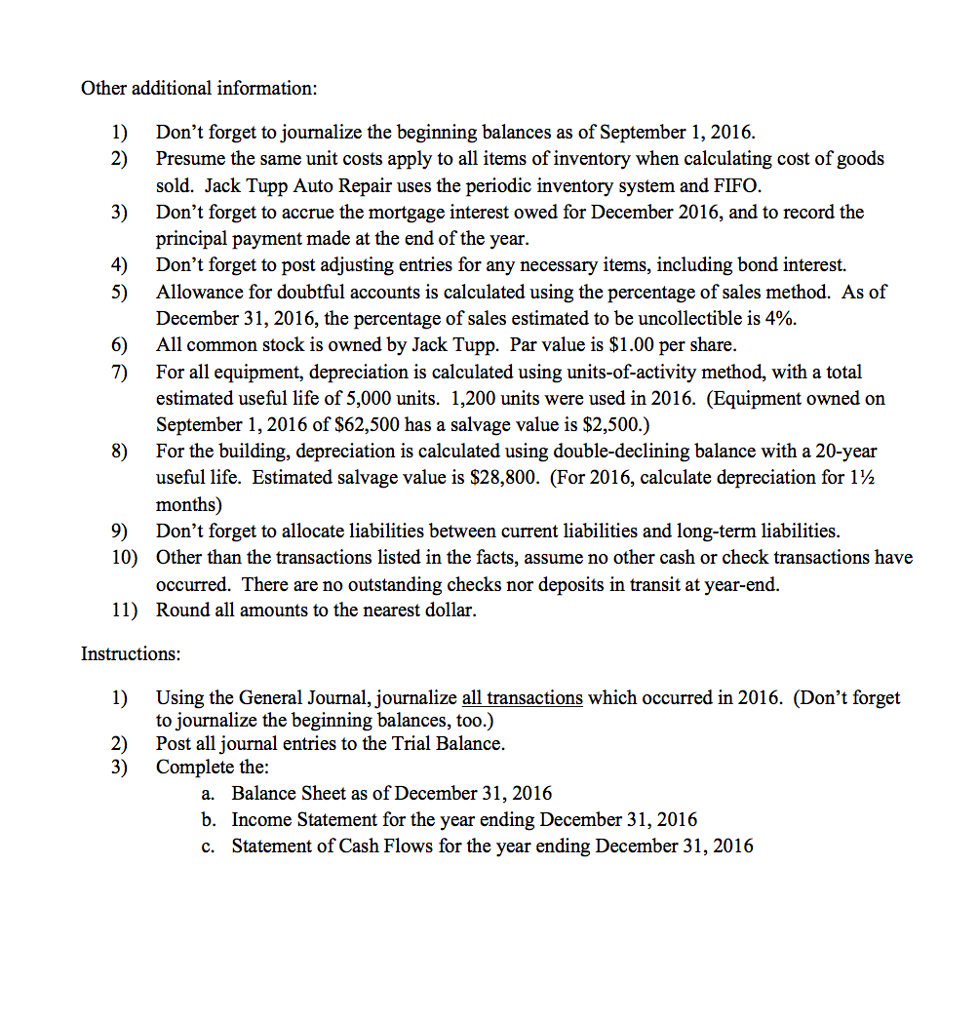

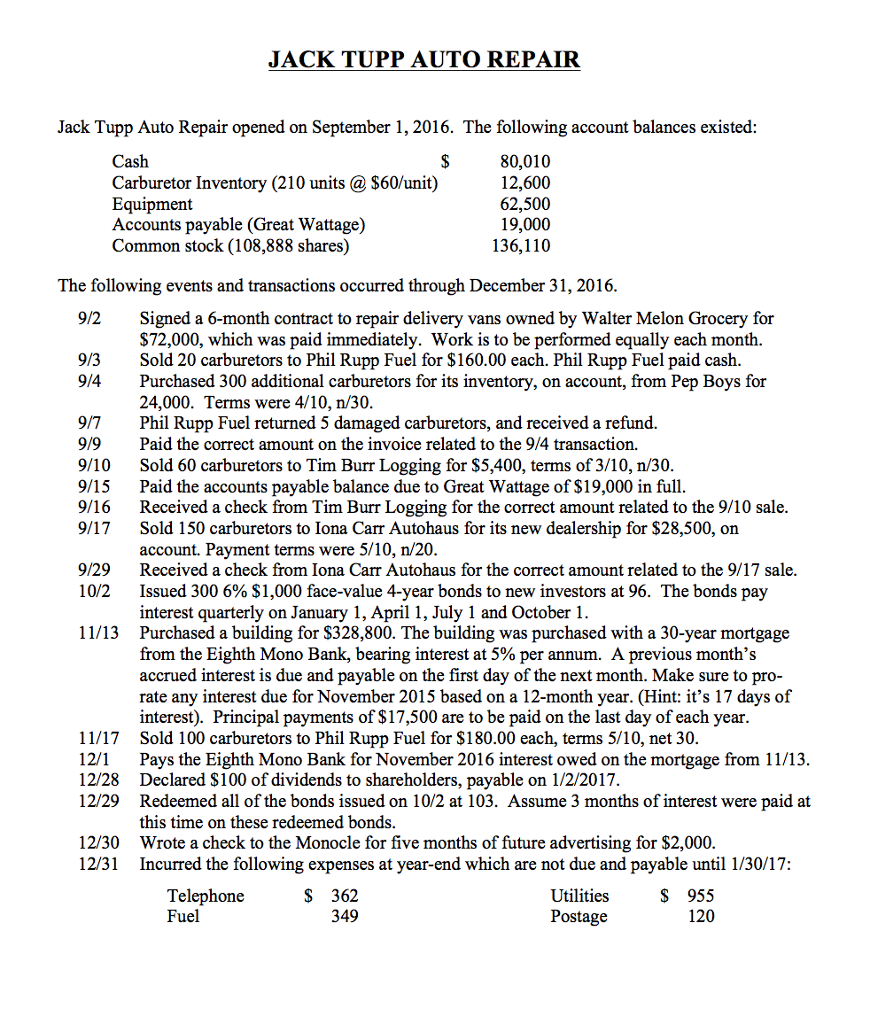

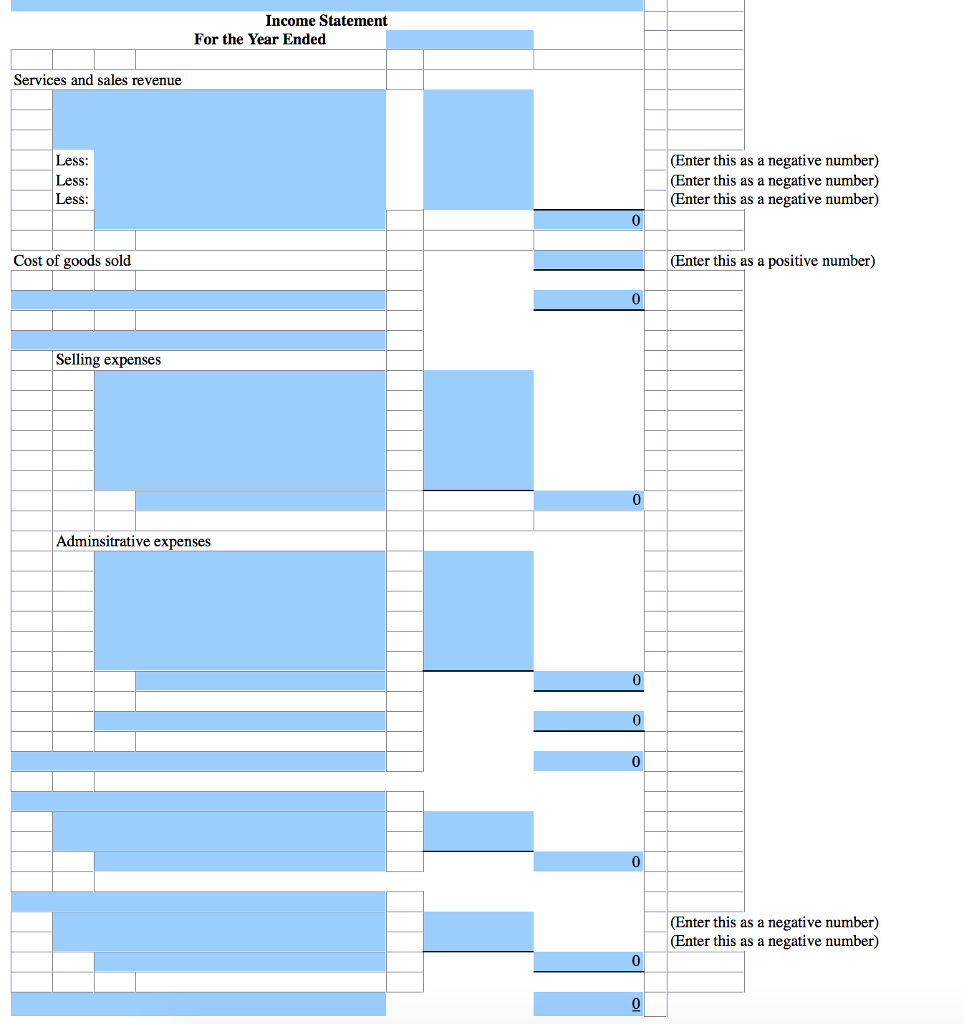

JACK TUPP AUTO REPAIR Jack Tupp Auto Repair opened on September 1, 2016. The following account balances existed: Cash 80,010 Carburetor Inventory (210 units $60/unit) 12,600 62,500 Equipment Accounts payable (Great Wattage) 19,000 Common stock (108,888 shares) 136,110 The following events and transactions occurred through December 31,2016 9/2 Signed a 6-month contract to repair delivery vans owned by Walter Melon Grocery for $72,000, which was paid immediately. Work is to be performed equally each month. 9/3 sold 20 carburetors to Phil Rupp Fuel for $160.00 each. Phil Rupp Fuel paid cash. 9/4 Purchased 300 additional carburetors for its inventory, on account, from Pep Boys for 24,000. Terms were 4/10, n/30 9/7 Phil Rupp Fuel returned 5 damaged carburetors, and received a refund. 9/9 Paid the correct amount on the invoice related to the 9/4 transaction 9/10 Sold 60 carburetors to Tim Burr Logging for $5,400, terms of 3/10, n/30 9/15 Paid the accounts payable balance due to Great Wattage of $19,000 in full 9/16 Received a check from Tim Burr Logging for the correct amount related to the 9/10 sale 9/17 Sold 150 carburetors to Iona Carr Autohaus for its new dealership for $28,500, on account. Payment terms were 5/10, n/20. 9/29 Received a check from Iona Carr Autohaus for the correct amount related to the 9/17 sale 10/2 Issued 300 6% $1,000 face-value 4-year bonds to new investors at 96. The bonds pay interest quarterly on January 1, April 1, July 1 and October 1 11/13 Purchased a building for $328,800. The building was purchased with a 30-year mortgage from the Eighth Mono Bank, bearing interest at 5% per annum. A previous month's accrued interest is due and payable on the first day of the next month. Make sure to pro- rate any interest due for November 2015 based on a 12-month year. (Hint: it's 17 days of interest). Principal payments of $17,500 are to be paid on the last day ofeach year 11/17 Sold 100 carburetors to Phil Rupp Fuel for $180.00 each, terms 5/10, net 30 12/1 Pays the Eighth Mono Bank for November 2016 interest owed on the mortgage from 11/13 12/28 Declared $100 of dividends to shareholders, payable on 1/2/2017 12/29 Redeemed all of the bonds issued on 10/2 at 103. Assume 3 months of interest were paid at this time on these redeemed bonds. 12/30 Wrote a check to the Monocle for five months of future advertising for $2,000. 12/31 Incurred the following expenses at year-end which are not due and payable until 1/30/17 Utilities Telephone 362 955 Fuel 349 Postage 120