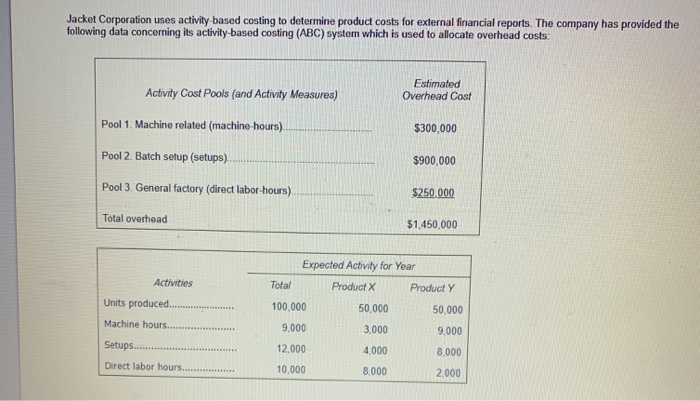

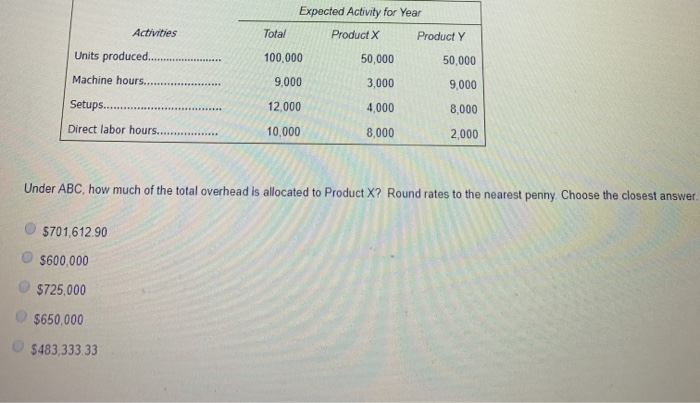

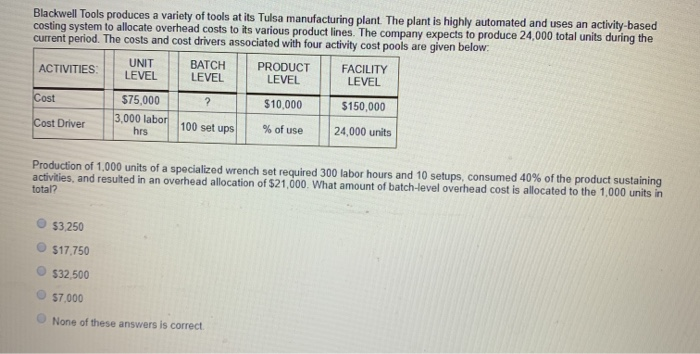

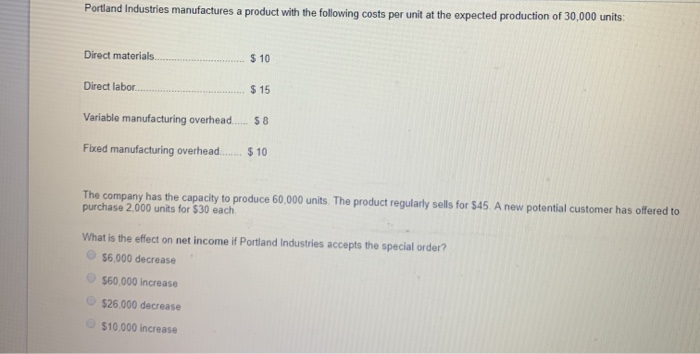

Jacket Corporation uses activity based costing to determine product costs for external financial reports. The company has provided the following data concerning its activity-based costing (ABC) system which is used to allocate overhead costs: Activity Cost Pools (and Activity Measures) Estimated Overhead Cost Pool 1. Machine related (machine hours). $300,000 Pool 2. Batch setup (setups) $900,000 Pool 3. General factory (direct labor-hours) $250.000 Total overhead $1,450,000 Activities Units produced................ Machine hours........ Expected Activity for Year Total Product X Product Y 100,000 50,000 50,000 9,000 3.000 9,000 12.000 4000 8,000 10.000 8,000 2,000 Setups... Direct labor hours..... Activities Units produced...... Machine hours........ Expected Activity for Year Total Product Product Y 100,000 50,000 50,000 9,000 3,000 9,000 12.000 4,000 8,000 10,000 8,000 2.000 Setups...... Direct labor hours......... Under ABC, how much of the total overhead is allocated to Product X? Round rates to the nearest penny. Choose the closest answer $701,612.90 5600,000 $725,000 $650,000 5483,333 33 Blackwell Tools produces a variety of tools at its Tulsa manufacturing plant. The plant is highly automated and uses an activity-based costing system to allocate overhead costs to its various product lines. The company expects to produce 24,000 total units during the current period. The costs and cost drivers associated with four activity cost pools are given below ACTIVITIES UNIT LEVEL BATCH LEVEL PRODUCT LEVEL FACILITY LEVEL Cost $75,000 $10.000 $150,000 Cost Driver 3.000 labor hrs 100 set ups % of use 24,000 units Production of 1,000 units of a specialized wrench set required 300 labor hours and 10 setups, consumed 40% of the product sustaining activities, and resulted in an overhead allocation of $21,000. What amount of batch-level overhead cost is allocated to the 1,000 units in total? $3,250 $17.750 $32.500 $7.000 None of these answers is correct. Portland Industries manufactures a product with the following costs per unit at the expected production of 30,000 units Direct materials $ 10 Direct labor.. $ 15 Variable manufacturing overhead..... 58 Fixed manufacturing overhead........$10 The company has the capacity to produce 60,000 units. The product regularly sells for $45 A new potential customer has offered to purchase 2.000 units for $30 each What is the effect on net income if Portland Industries accepts the special order? $6.000 decrease 550.000 increase $26.000 decrease $10.000 increase