Answered step by step

Verified Expert Solution

Question

1 Approved Answer

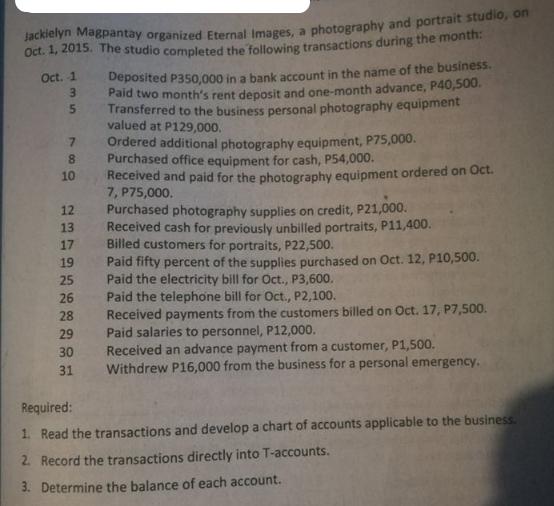

Jackielyn Magpantay organized Eternal Images, a photography and portrait studio, on Oct. 1, 2015. The studio completed the following transactions during the month: Oct.

Jackielyn Magpantay organized Eternal Images, a photography and portrait studio, on Oct. 1, 2015. The studio completed the following transactions during the month: Oct. -1 3 7 8 10 12 13 17 19 25 26 28 29 30 31 Deposited P350,000 in a bank account in the name of the business. Paid two month's rent deposit and one-month advance, P40,500. Transferred to the business personal photography equipment valued at P129,000. Ordered additional photography equipment, P75,000. Purchased office equipment for cash, P54,000. Received and paid for the photography equipment ordered on Oct. 7, P75,000. Purchased photography supplies on credit, P21,000. Received cash for previously unbilled portraits, P11,400. Billed customers for portraits, P22,500. Paid fifty percent of the supplies purchased on Oct. 12, P10,500. Paid the electricity bill for Oct., P3,600. Paid the telephone bill for Oct., P2,100. Received payments from the customers billed on Oct. 17, P7,500. Paid salaries to personnel, P12,000. Received an advance payment from a customer, P1,500. Withdrew P16,000 from the business for a personal emergency. Required: 1. Read the transactions and develop a chart of accounts applicable to the business. 2. Record the transactions directly into T-accounts. 3. Determine the balance of each account.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Based on the transactions provided here is the chart of accounts applicable to Eternal Images 1 Assets Cash Bank Account Personal Photography Equipmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started