Question

Jackson and Kelsea met in College Station, Texas at a student investment club while attending A&M. They are now a married couple still living in

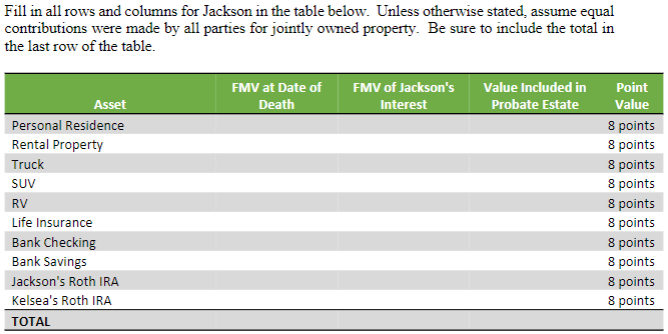

Jackson and Kelsea met in College Station, Texas at a student investment club while attending A&M. They are now a married couple still living in Texas with two children, Maryn, age 6, and Miles, age 4. Jackson and Kelsea are young professionals who maintain a healthy and active lifestyle. Unfortunately Jackson passed away unexpectedly from a car accident. On the day that Jackson died, he and Kelsea owned the following assets. Fortunately Jackson and Kelsea had recently worked with an attorney to draft a valid will that leaves everything to each other. 1. Home and shop located on 2 acres valued at $676,000 owned as community property with Jackson and Kelsea. 2. A 4-plex rental property valued at 370,000 owned as Tenants in Common with Jackson and his brother Cole. The property was originally purchased for $200,000 with Jackson paying $150,000 and Cole paying $50,000 of the purchase price. 3. Jacksons truck valued at 60,000 held in fee simple by Jackson. 4. Kelseas SUV valued at $44,000 held as joint tenants with right of survivorship (JTWROS) with Jackson. 5. Recreational Vehicle (RV) use for camping and A&M tailgates, valued at $52,000 owned as Tenants in Common between Jackson and his brother Cole equally. The original purchase price was $75,000 with Jackson paying $25,000 and Cole paying $50,000. 6. Life insurance policy, owned by Jackson on his own life with Kelsea as the primary beneficiary. Premiums for the policy have always been paid from the JTWROS checking account below. The policy death benefit is $1,000,000 and the fair market value is $500,000. 7. Bank checking account held as joint tenants with right of survivorship (JTWROS) with Jackson and Kelsea. Both Jackson and Kelsea have their paycheck direct deposited into this account each pay period. Valued at $14,000. 8. Bank savings account that Jackson accumulated prior to his marriage to Kelsea from earnings he made showing animals at the local county fair. This account is held as POD to Jacksons kids, Maryn and Miles equally. No deposits have been added to the account since Jackson married Kelsea. When their kids are old enough, Jackson plans to use the funds to help them get started with their own animal projects in the local county fair. Valued at $42,000. 9. Jacksons Roth IRA that he started in college from earnings from his part-time job. He has been contributing to the account every year since then with money from the JTWROS checking account. He never got around to adding a beneficiary on the account. Valued at $153,000. 10. Kelseas Roth IRA that she started in college from earnings from her part time job. She has been contributing to the account every year since then with money from the JTWROS checking account. She updated the beneficiary to Jackson after they married. Valued at $180,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started