Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jackson Automotive case Should the bank extend the loan and offer the company the other loan? CONSIDER THESE FACTORS Good at getting through hard times,

Jackson Automotive case

Should the bank extend the loan and offer the company the other loan?

CONSIDER THESE FACTORS

Good at getting through hard times, having survived the recession

Use innovative and efficient equipment

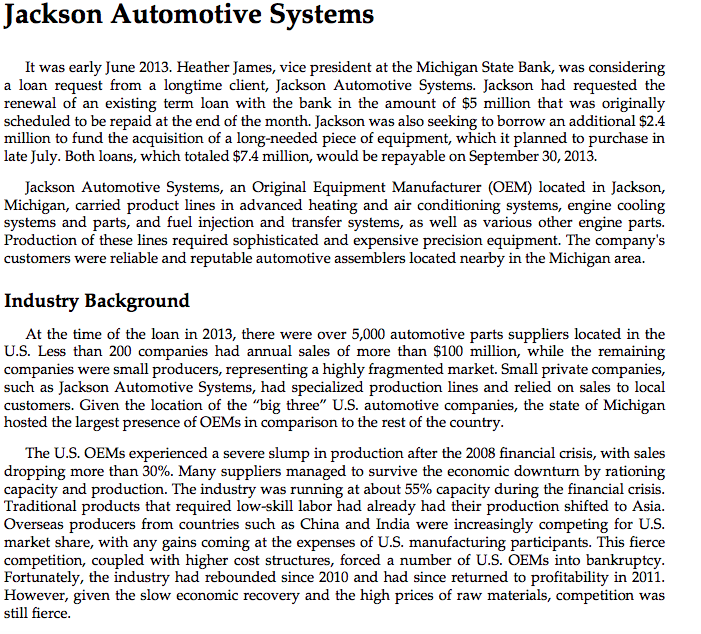

Good customers with great payment history (paid in advance)

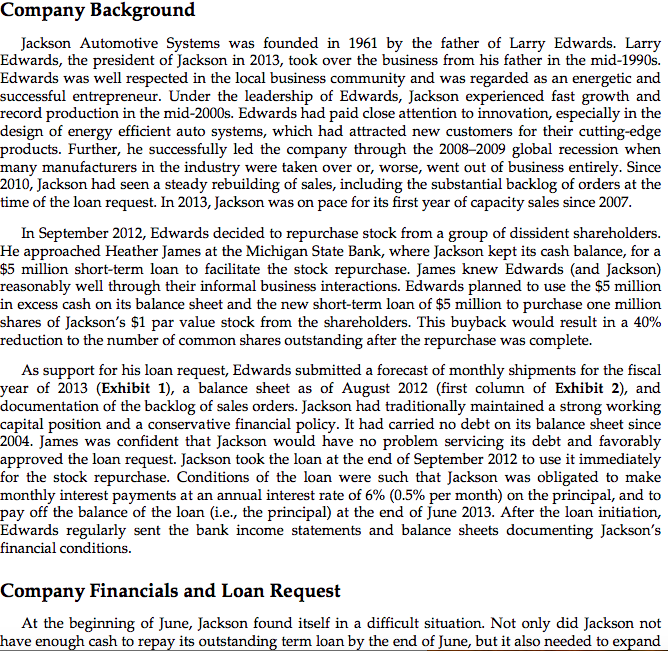

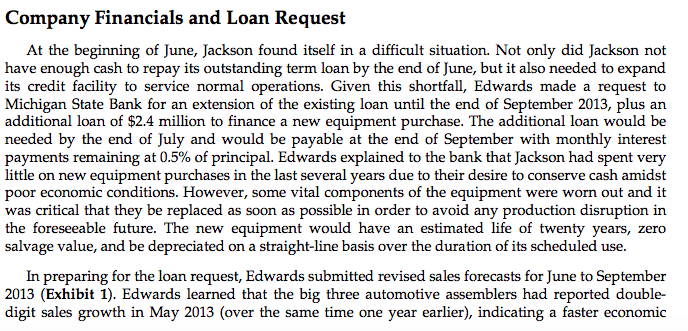

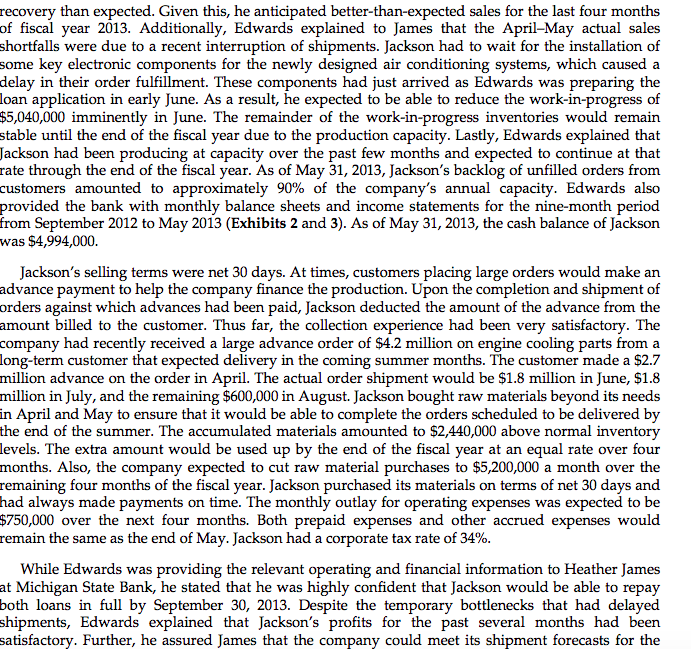

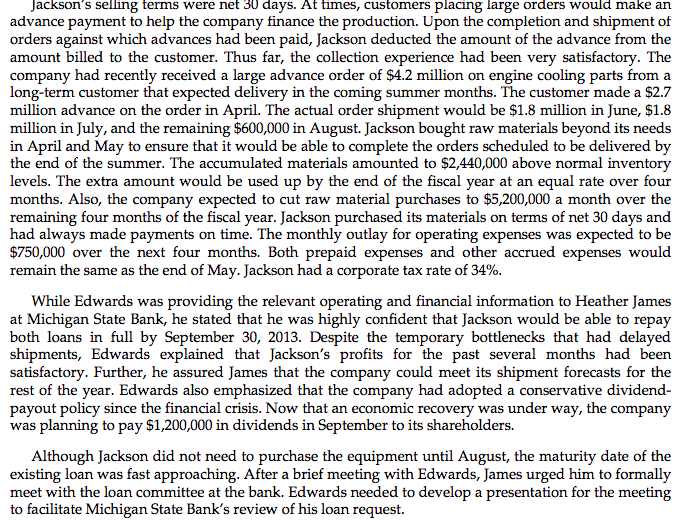

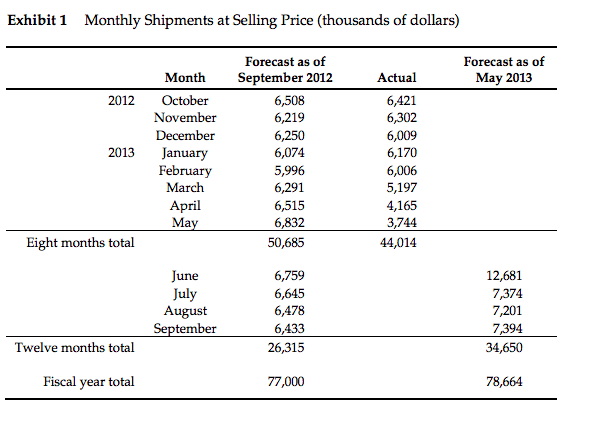

Jackson Automotive System:s It was early June 2013. Heather James, vice president at the Michigan State Bank, was considering a loan request from a longtime client, Jackson Automotive Systems. Jackson had requested the renewal of an existing term loan with the bank in the amount of $5 million that was originally scheduled to be repaid at the end of the month. Jackson was also seeking to borrow an additional $2.4 million to fund the acquisition of a long-needed piece of equipment, which it planned to purchase in late July. Both loans, which totaled $7.4 million, would be repayable on September 30, 2013. Jackson Automotive Systems, an Original Equipment Manufacturer (OEM) located in Jackson, Michigan, carried product lines in advanced heating and air conditioning systems, engine cooling systems and parts, and fuel injection and transfer systems, as well as various other engine parts. Production of these lines required sophisticated and e customers were reliable and reputable automotive assemblers located nearby in the Michigan area. xpensive precision equipment. The company's Industry Background At the time of the loan in 2013, there were over 5,000 automotive parts suppliers located in the U.S. Less than 200 companies had annual sales of more than $100 million, while the remaining companies were small producers, representing a highly fragmented market. Small private companies, such as Jackson Automotive Systems, had specialized production lines and relied on sales to local customers. Given the location of the "big three" U.S. automotive companies, the state of Michigan hosted the largest presence of OEMs in comparison to the rest of the country The U.S. OEMs experienced a severe slump in production after the 2008 financial crisis, with sales dropping more than 30%. Many suppliers managed to survive the economic downturn by rationing capacity and production. The industry was running at about 55% capacity during the financial crisis. Traditional products that required low-skill labor had already had their production shifted to Asia. Overseas producers from countries such as China and India were increasingly competing for U.S market share, with any gains coming at the expenses of U.S. manufacturing participants. This fierce competition, coupled with higher cost structures, forced a number of U.S. OEMs into bankruptcy Fortunately, the industry had rebounded since 2010 and had since returned to profitability in 2011 However, given the slow economic recovery and the high prices of raw materials, competition was still fierceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started