Question

Jackson Automotive case study. It was early June 2013. The vice president of the local bank, was considering a loan request from a longtime client,

Jackson Automotive case study.

It was early June 2013. The vice president of the local bank, was considering a loan request from a longtime client, Jackso Automotive systems. Jackson has requested the renewal of an exisiting term loan with the bank in the amount of $5million that was originally scheduled to be repaid at the end of the month. Jackson was also seeking to borrow an additional $2.4 million to fund acquisition of a new equipment. Both loans will equal $7.4 million and repayable on September 30th 2013.

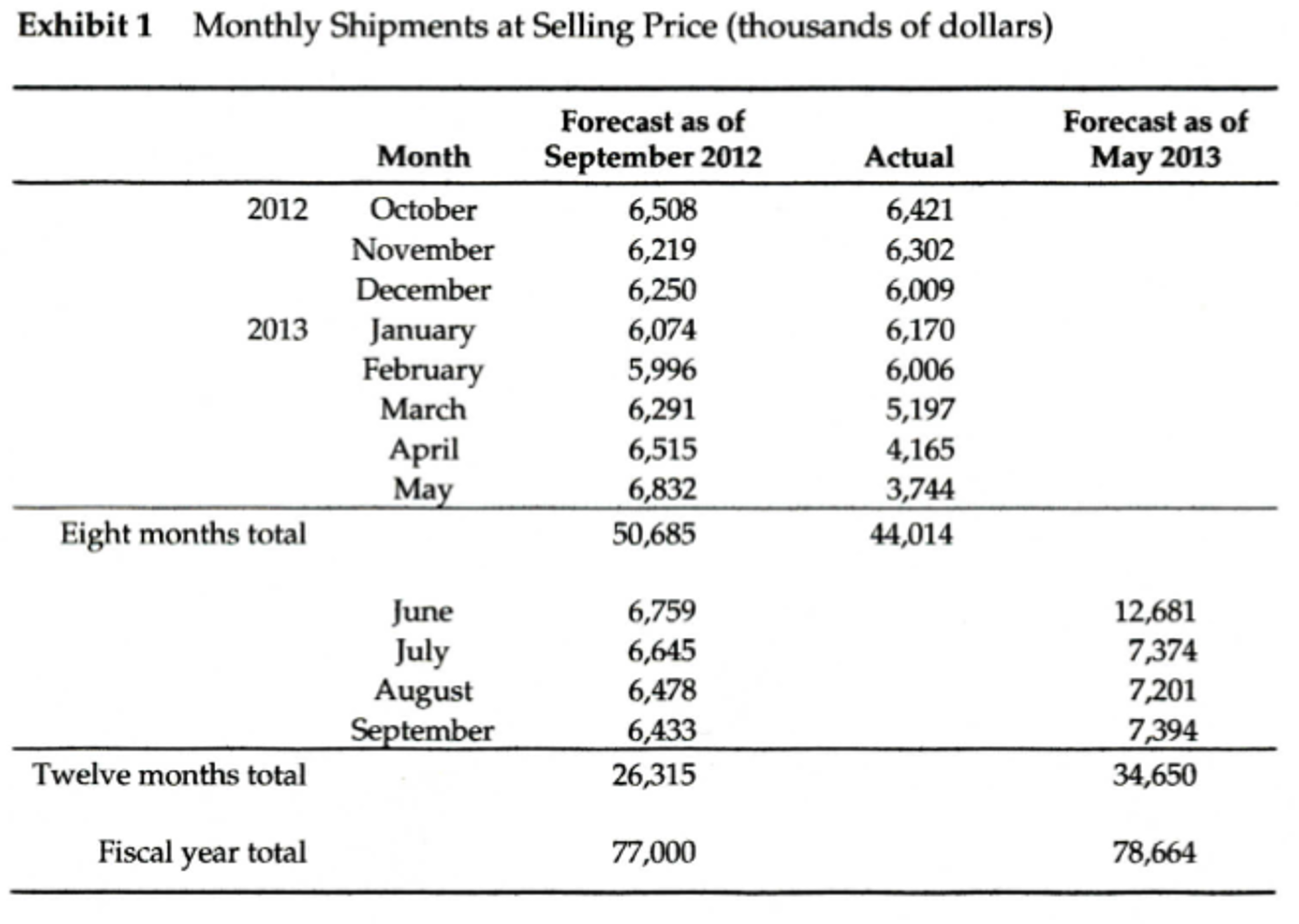

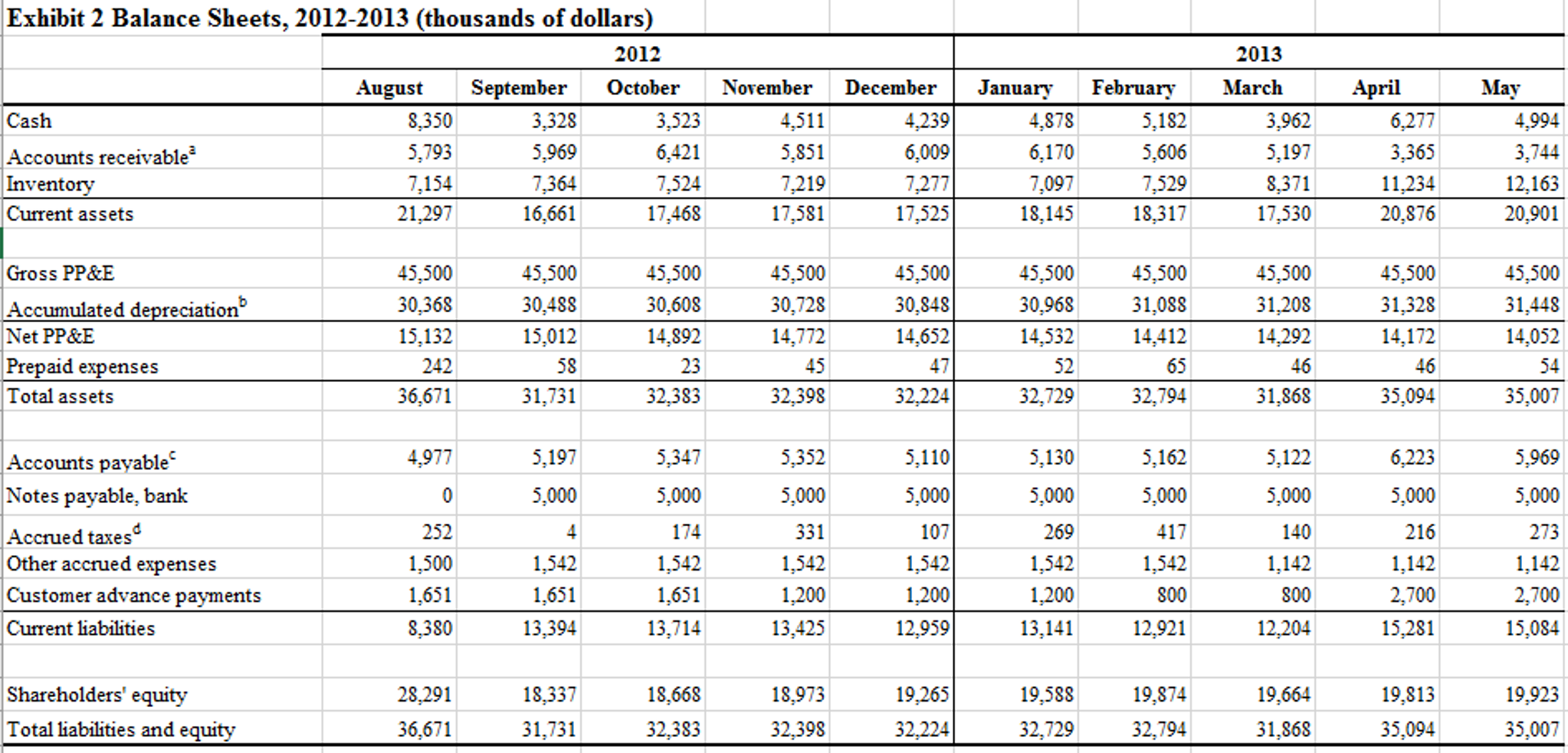

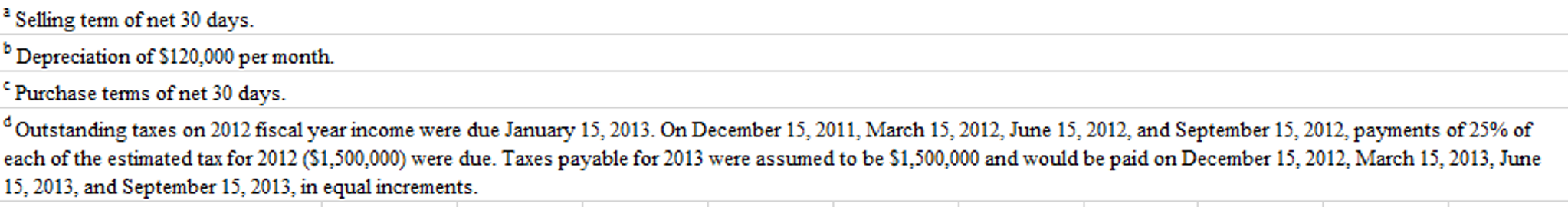

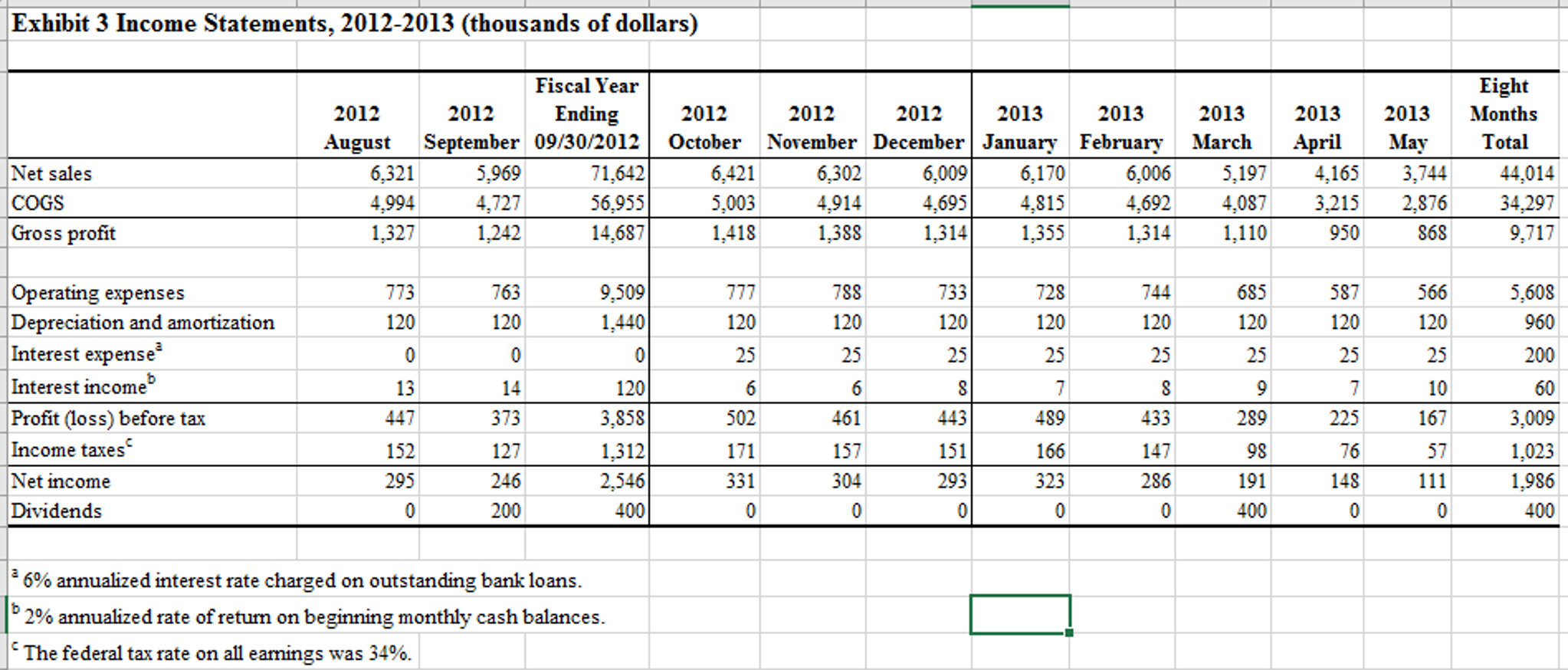

As support for his loan request, Jackson;s VP is submitting a forecast of monthly shipments for the fiscal year 2013 (exhibit 1), a balance sheet as of Aug 2012 (exhibit 2) and documentation on the backlog of sales orders. Conditions on the loan were such that Jackson was to make monthly interest payments at a annual rate of 6% (0.5% per month) on the principal and to pay off the balance of the loan at the end of june 2013.

At the beginning of June 2013, Jackson did not have enough cash to repay its outstanding term loan but it also needed to expand its credit to service normal operations. Given this shortfall, Jackson requested to the bank an extension of the existing loan until the end of September 2013 plus an additional $2.4 million to finance a new equipment purchase. The additional loan would be needed by the end of July and would be payable at the end of September with monthly interest payments remaining at 0.5% of principal. This new equipment have an estimated life of 20 years, no salvage value and be depreciated on a straight line basis over the duration of its scheduled use.

The following information was provided to the VP of the local bank:

Given a raise on the economic market, Jackson anticipated better-than expected sales for the last 4 motnhs of the fiscal year 2013. Jackson explained that April-May actual sales shortfalls were due to recent interruption of shipments and delay in their order fulfillment. Jackson was expecting to reduce the work in progress of $5.040,000 in June. The remainder of the WIP inventory would remain stable until the end of the fiscal year due to production capacity. Jackson has been producing at capacity over the past few months and expected to continue at that rate through the end of the fiscal year. As of May 31st 2013 Jacksons backlog of unfilled orders from customers was 90% of the companys annual capacity. The company also provided the bank with 9 month period balance sheet aug2013-may2013 (exhibit 2 and 3). As of May 31st 2013 the cash balance was $4,994,000.

Upon completion and shipment of orders which advances had been paid, Jackson deducted the amount of the advance from the billed to the customer. A large advance order of $4.2 million was received and an advanced of $2.7 million was received in april. Theactual order shipment would be $1.8 million in june, $1.8 million in july and the remaining $600,00 in august.

Jackson brought raw materials beyond its needs in april and may to ensure orders were to be completed for the remaining of the summer. The accumulated materials amounted $2,440,000 above normal inventory levels and the extra amount would be used up by the end of the fiscal year.

The monthly operating expenses were $750,000 for the last 4 month of the fiscal year 2013 and both prepaid and accrued expenses would remain the same as the end of may. Corporate tax was 34%

Since Jackson is very confident all money will be paid on time, they are also planning to pay $1.2 million in dividends to shareholders in September 2013.

Below the exhibit 1,2 and 3. Please show calculations, formulas.

FIND:

a) Prepare a sources and uses of funds statement for August 2012 through May 2013.

b) Prepare a cash budget and pro forma income statements and balance sheets for the last four months of the fiscal year. Do the cash budget and pro forma financial statements yield the same results? Why or why not?

c) Critically evaluate the assumptions on which your forecasts are based and perform sensitivity analysis on the fiscal year-end cash balance when sales forecasts vary from expectations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started