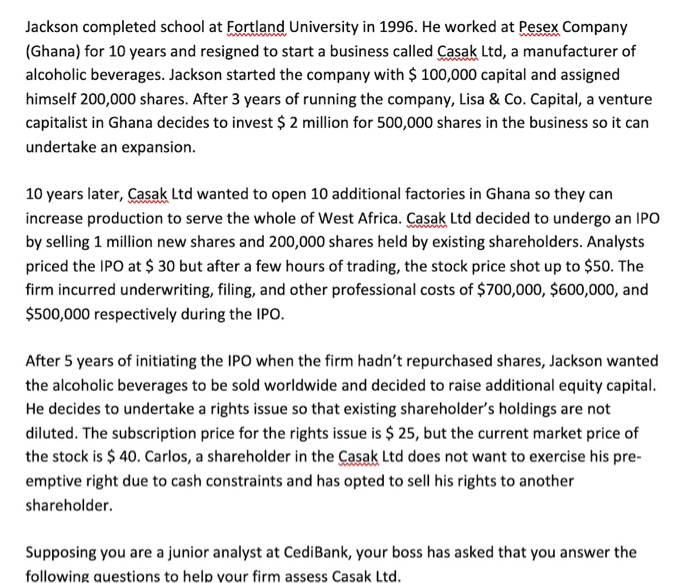

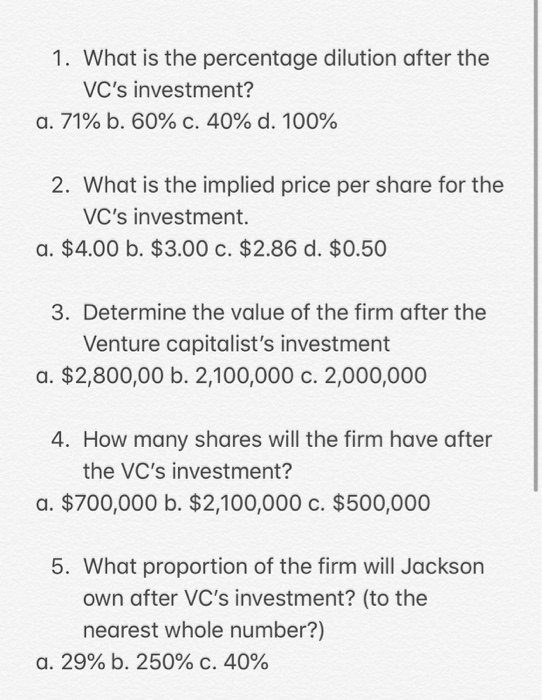

Jackson completed school at Fortland University in 1996. He worked at Pesex Company (Ghana) for 10 years and resigned to start a business called Casak Ltd, a manufacturer of alcoholic beverages. Jackson started the company with $ 100,000 capital and assigned himself 200,000 shares. After 3 years of running the company, Lisa & Co. Capital, a venture capitalist in Ghana decides to invest $ 2 million for 500,000 shares in the business so it can undertake an expansion. 10 years later, Casak Ltd wanted to open 10 additional factories in Ghana so they can increase production to serve the whole of West Africa. Casak Ltd decided to undergo an IPO by selling 1 million new shares and 200,000 shares held by existing shareholders. Analysts priced the IPO at $ 30 but after a few hours of trading, the stock price shot up to $50. The firm incurred underwriting, filing, and other professional costs of $700,000, $600,000, and $500,000 respectively during the IPO. After 5 years of initiating the IPO when the firm hadn't repurchased shares, Jackson wanted the alcoholic beverages to be sold worldwide and decided to raise additional equity capital. He decides to undertake a rights issue so that existing shareholder's holdings are not diluted. The subscription price for the rights issue is $ 25, but the current market price of the stock is $ 40. Carlos, a shareholder in the Casak Ltd does not want to exercise his pre- emptive right due to cash constraints and has opted to sell his rights to another shareholder Supposing you are a junior analyst at CediBank, your boss has asked that you answer the following questions to help your firm assess Casak Ltd. 1. What is the percentage dilution after the VC's investment? a. 71% b. 60% c. 40% d. 100% 2. What is the implied price per share for the VC's investment. a. $4.00 b. $3.00 c. $2.86 d. $0.50 3. Determine the value of the firm after the Venture capitalist's investment a. $2,800,00 b. 2,100,000 c. 2,000,000 4. How many shares will the firm have after the VC's investment? a. $700,000 b. $2,100,000 c. $500,000 5. What proportion of the firm will Jackson own after VC's investment? (to the nearest whole number?) a. 29% b. 250% c. 40%