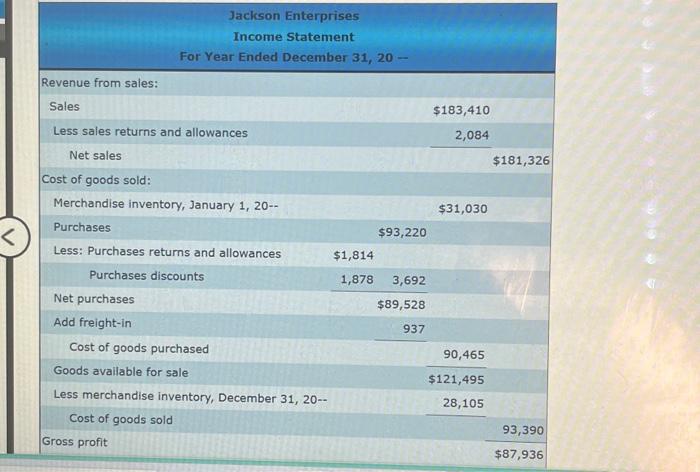

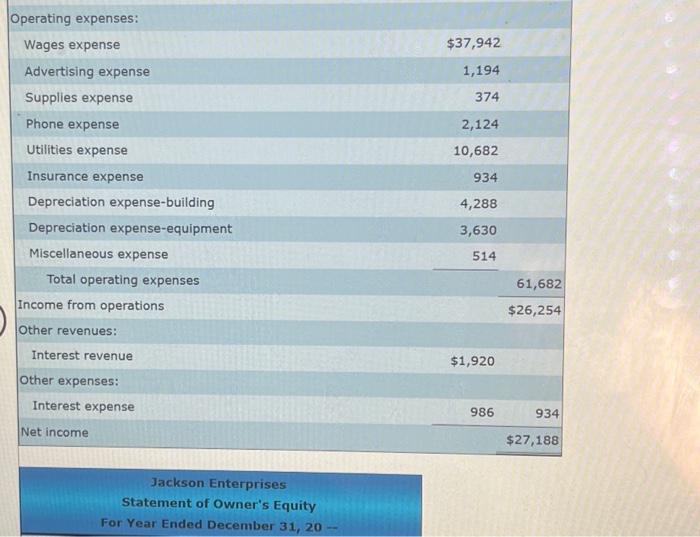

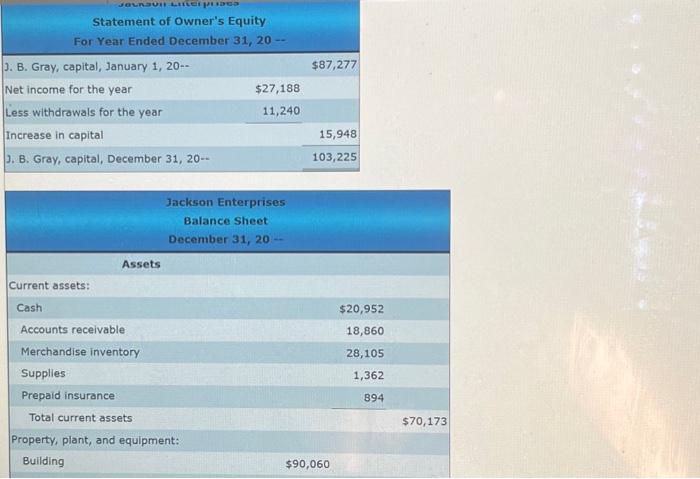

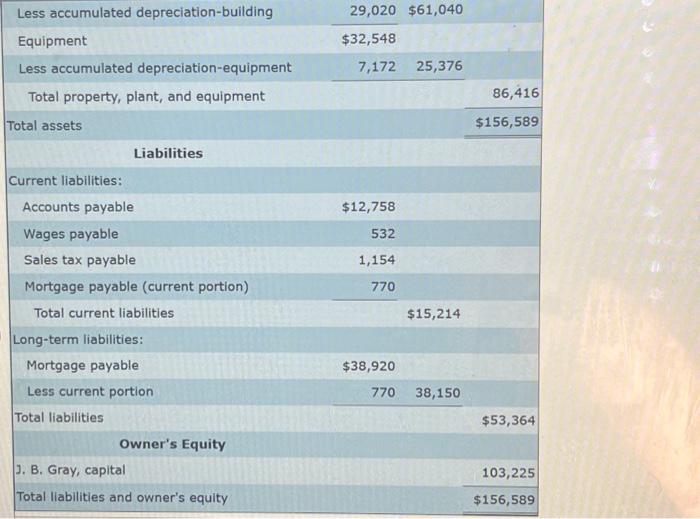

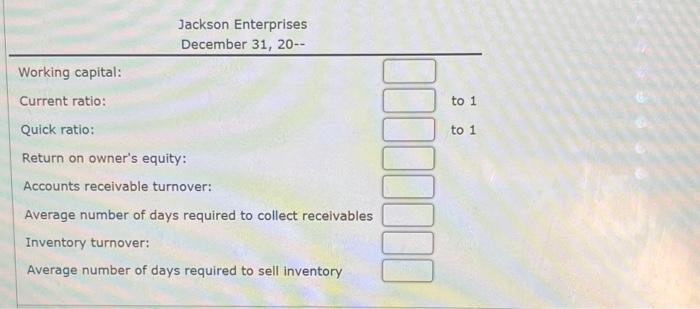

Jackson Enterprises Income Statement For Year Ended December 31,20 - \begin{tabular}{|c|c|c|} \hline Operating expenses: & & . \\ \hline Wages expense & $37,942 & \\ \hline Advertising expense & 1,194 & \\ \hline Supplies expense & 374 & \\ \hline Phone expense & 2,124 & \\ \hline Utilities expense & 10,682 & \\ \hline Insurance expense & 934 & \\ \hline Depreciation expense-building & 4,288 & \\ \hline Depreciation expense-equipment & 3,630 & \\ \hline Miscellaneous expense & 514 & \\ \hline Total operating expenses & & 61,682 \\ \hline Income from operations & & $26,254 \\ \hline \multicolumn{3}{|l|}{ Other revenues: } \\ \hline Interest revenue & $1,920 & \\ \hline \multicolumn{3}{|l|}{ Other expenses: } \\ \hline Interest expense & 986 & 934 \\ \hline Net income & & $27,188 \\ \hline \end{tabular} Jackson Enterprises Statement of Owner's Equity For Year Ended December 31,20 \begin{tabular}{|c|c|c|} \hline \begin{tabular}{l} Statement of Owner \\ For Year Ended Decemt \end{tabular} & ity & \\ \hline 3. B. Gray, capital, January 1, 20-- & & $87,277 \\ \hline Net income for the year & $27,188 & \\ \hline Less withdrawals for the year & 11,240 & \\ \hline Increase in capital & & 15,948 \\ \hline 3. B. Gray, capital, December 31,20 & & 103,225 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Less accumulated depreciation-building & 29,020 & $61,040 & \\ \hline Equipment & $32,548 & & \\ \hline Less accumulated depreciation-equipment & 7,172 & 25,376 & \\ \hline Total property, plant, and equipment & & & 86,416 \\ \hline Total assets & & & $156,589 \\ \hline Liabilities & & & \\ \hline \multicolumn{4}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $12,758 & & \\ \hline Wages payable & 532 & & \\ \hline Sales tax payable & 1,154 & & \\ \hline Mortgage payable (current portion) & 770 & & \\ \hline Total current liabilities & & $15,214 & \\ \hline \multicolumn{4}{|l|}{ Long-term liabilities: } \\ \hline Mortgage payable & $38,920 & & \\ \hline Less current portion & 770 & 38,150 & \\ \hline Total liabilities & & & $53,364 \\ \hline Owner's Equity & & & \\ \hline 3. B. Gray, capital & & & 103,225 \\ \hline Total liabilities and owner's equity & & & $156,589 \\ \hline \end{tabular} Jackson Enterprises December 31, 20-- Working capital: Current ratio: to 1 Quick ratio: to 1 Return on owner's equity: Accounts receivable turnover: Average number of days required to collect receivables Inventory turnover: Average number of days required to sell inventory