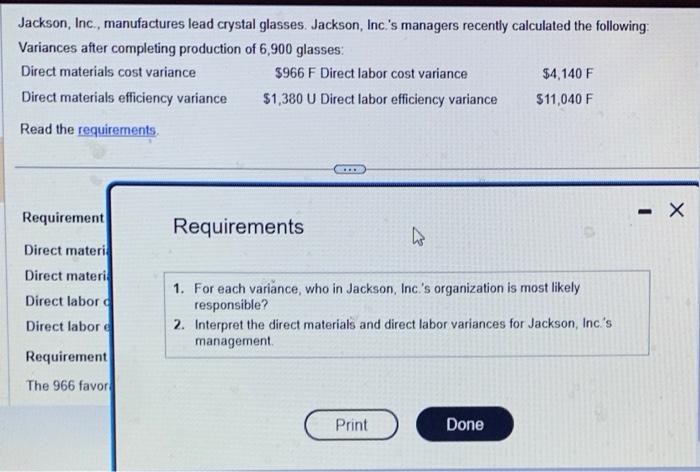

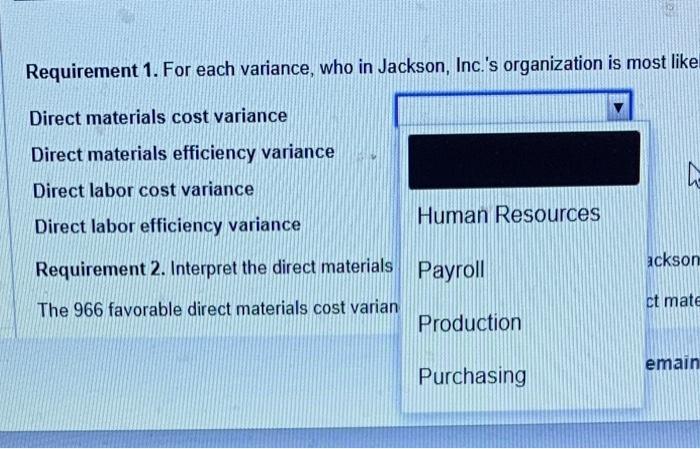

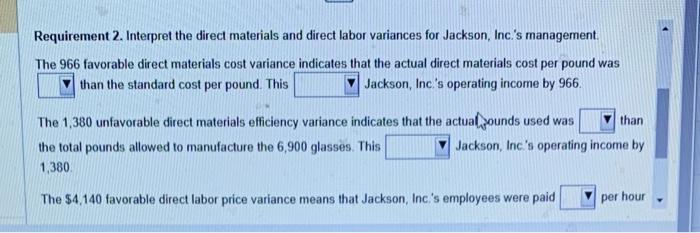

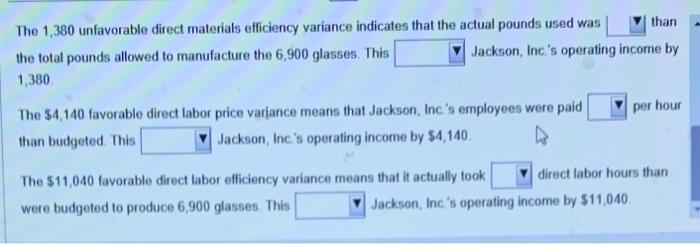

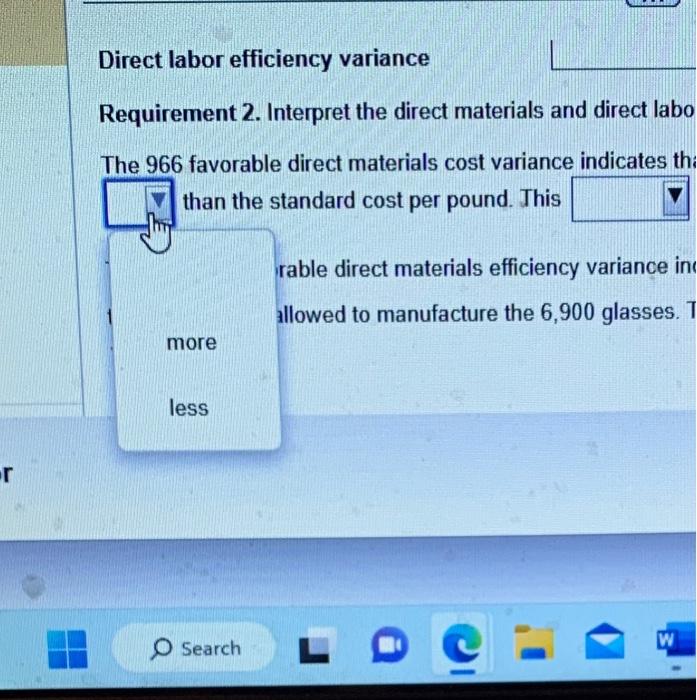

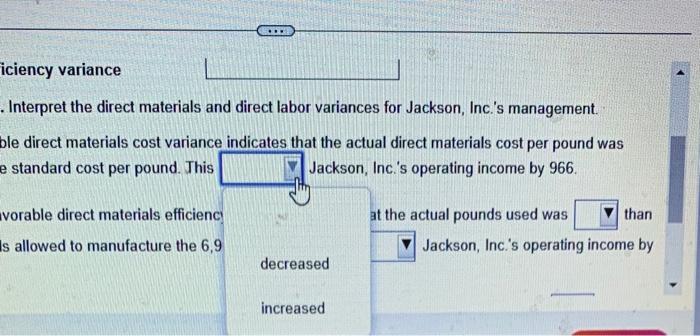

Jackson, Inc., manufactures lead crystal glasses. Jackson, Inc.'s managers recently calculated the following Requirement Requirements Direct materi Direct materi Direct labor o 1. For each variance, who in Jackson, Inc.'s organization is most likely responsible? Direct labor e 2. Interpret the direct materials and direct labor variances for Jackson, Inc.'s management. Requirement 1. For each variance, who in Jackson, Inc.'s organization is most lik Requirement 2. Interpret the direct materials and direct labor variances for Jackson, Inc.'s management. The 966 favorable direct materials cost variance indicates that the actual direct materials cost per pound was than the standard cost per pound. This Jackson, Inc's operating income by 966. The 1,380 unfavorable direct materials efficiency variance indicates that the actuafounds used was than the total pounds allowed to manufacture the 6,900 glasses. This Jackson, Inc's operating income by 1,380 The $4,140 favorable direct labor price variance means that Jackson, Inc:'s employees were paid per hour The 1,380 unfavorable direct materials efficiency variance indicates that the actual pounds used was _ than the total pounds allowed to manufacture the 6,900 glasses. This Jackson, Inc's operating income by 1,380 The $4,140 favorable direct labor price variance means that Jackson, Inc's employees were paid than budgeted This Jackson, Inc's operating income by $4,140. The $11,040 favorable direct labor efficiency variance means that it actually took direct labor hours than were budgeted to produce 6,900 glasses. This Jackson, Inc's operating income by $11,040. Direct labor efficiency variance Requirement 2. Interpret the direct materials and direct labo The 966 favorable direct materials cost variance indicates th than the standard cost per pound. This rable direct materials efficiency variance in Allowed to manufacture the 6,900 glasses. more less iciency variance Interpret the direct materials and direct labor variances for Jackson, Inc.'s management. ble direct materials cost variance indicates that the actual direct materials cost per pound was e standard cost per pound. This Jackson, Inc's operating income by 966. vorable direct materials efficienc: at the actual pounds used was than allowed to manufacture the 6,9 Jackson, Inc.'s operating income by decreased increased