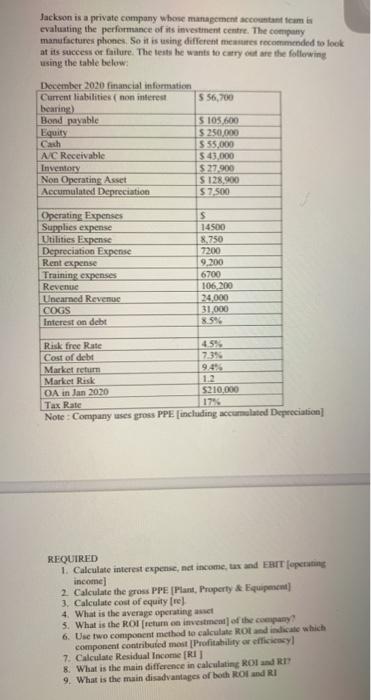

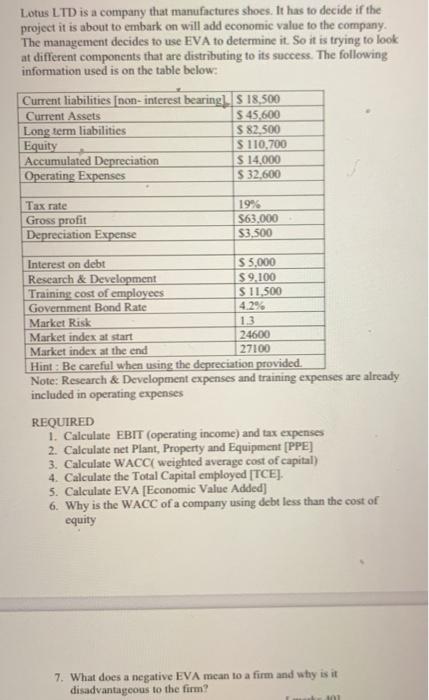

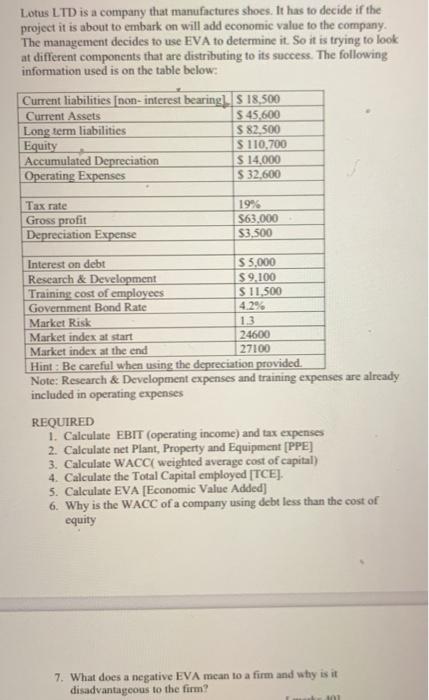

Jackson is a private company whose management accountant mis evaluating the performance of its investment centre. The company manufactures phones. So it is using different measures recommended to look at its success or failure. The tests he wants to carry out are the following using the table below 5 56,700 December 2020 financial information Current liabilities (non interest bearing) Bond payable Equity A/C Receivable Inventory Non Operating Asset Accumulated Depreciation 5 105.600 $ 250,000 $ 55,000 $ 43,000 $27.900 S 128.900 S 7500 Operating Expenses Supplies expense Utilities Expense Depreciation Expense Rent expense Training expenses Revenue Unearned Revenue COGS Interest on debt S 14500 8.750 7200 9,200 6700 106.200 24,000 31000 8594 Risk free Rate 4.5% Cost of debt 739 Market return 9.49 Market Risk 1.2 OA in Jan 2020 5210,000 Tax Rate 174 Note: Company uses gross PPE (including accumulated Depreciation REQUIRED 1. Calculate interest expense, net income tax and EBIT (operating income] 2. Calculate the gross PPE [Piant, Property & Equipement] 3. Calculate cost of equity fre) 4. What is the average operating and 5. What is the ROI retum en investment of the company 6. Use two component method to calculate Round indicate which component contributed most Profitability or efficiency 7. Calculate Residual Income RI 8. What is the main difference in calculating Roland ! 9. What is the main disadvantages of both Roland RI Lotus LTD is a company that manufactures shoes. It has to decide if the project it is about to embark on will add economic value to the company The management decides to use EVA to determine it. So it is trying to look at different components that are distributing to its success. The following information used is on the table below: Current liabilities (non-interest bearing). S 18,500 Current Assets $ 45,600 Long term liabilities $ 82.500 Equity $ 110,700 Accumulated Depreciation $ 14,000 Operating Expenses S 32.600 Tax rate Gross profit Depreciation Expense 19% $63.000 $3,500 Interest on debt $5,000 Research & Development $9.100 Training cost of employees S 11,500 Government Bond Rate 4.29 Market Risk 13 Market index at start 24600 Market index at the end 27100 Hint: Be careful when using the depreciation provided. Note: Research & Development expenses and training expenses are already included in operating expenses REQUIRED 1. Calculate EBIT (operating income) and tax expenses 2. Calculate net Plant, Property and Equipment (PPE) 3. Calculate WACC weighted average cost of capital) 4. Calculate the Total Capital employed [TCEJ. 5. Calculate EVA [Economic Value Added] 6. Why is the WACC of a company using debt less than the cost of equity 7. What does a negative EVA mean to a firm and why is it disadvantageous to the firm