Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jackson Ltd has budgeted the monthly sales for January to April 2023: (i) The cash balance on 1 February 2023 is ( $ 50,000 ).

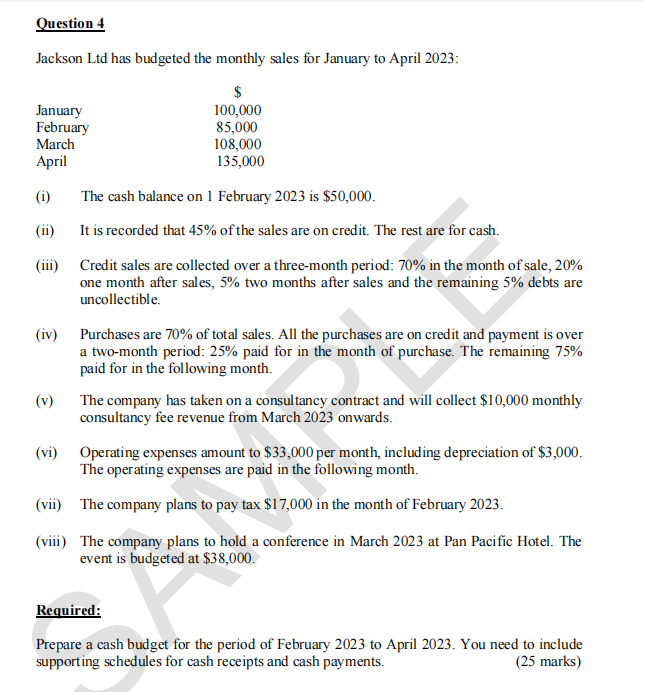

Jackson Ltd has budgeted the monthly sales for January to April 2023: (i) The cash balance on 1 February 2023 is \\( \\$ 50,000 \\). (ii) It is recorded that \45 of the sales are on credit. The rest are for cash. (iii) Credit sales are collected over a three-month period: \70 in the month of sale, \20 one month after sales, \5 two months after sales and the remaining \5 debts are uncollectible. (iv) Purchases are \70 of total sales. All the purchases are on credit and payment is over a two-month period: \25 paid for in the month of purchase. The remaining \75 paid for in the following month. (v) The company has taken on a consultancy contract and will collect \\( \\$ 10,000 \\) monthly consultancy fee revenue from March 2023 onwards. (vi) Operating expenses amount to \\( \\$ 33,000 \\) per month, including depreciation of \\( \\$ 3,000 \\). The operating expenses are paid in the following month. (vii) The company plans to pay tax \\( \\$ 17,000 \\) in the month of February 2023. (viii) The company plans to hold a conference in March 2023 at Pan Pacific Hotel. The event is budgeted at \\( \\$ 38,000 \\). Required: Prepare a cash budget for the period of February 2023 to April 2023. You need to include supporting schedules for cash receipts and cash payments. (25 marks)

Jackson Ltd has budgeted the monthly sales for January to April 2023: (i) The cash balance on 1 February 2023 is \\( \\$ 50,000 \\). (ii) It is recorded that \45 of the sales are on credit. The rest are for cash. (iii) Credit sales are collected over a three-month period: \70 in the month of sale, \20 one month after sales, \5 two months after sales and the remaining \5 debts are uncollectible. (iv) Purchases are \70 of total sales. All the purchases are on credit and payment is over a two-month period: \25 paid for in the month of purchase. The remaining \75 paid for in the following month. (v) The company has taken on a consultancy contract and will collect \\( \\$ 10,000 \\) monthly consultancy fee revenue from March 2023 onwards. (vi) Operating expenses amount to \\( \\$ 33,000 \\) per month, including depreciation of \\( \\$ 3,000 \\). The operating expenses are paid in the following month. (vii) The company plans to pay tax \\( \\$ 17,000 \\) in the month of February 2023. (viii) The company plans to hold a conference in March 2023 at Pan Pacific Hotel. The event is budgeted at \\( \\$ 38,000 \\). Required: Prepare a cash budget for the period of February 2023 to April 2023. You need to include supporting schedules for cash receipts and cash payments. (25 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started