Question

Jackson Toy Products Company began business on January 1, 2021. During the year, the following transactions occurred: Jan 1 Issued common stock in exchange for

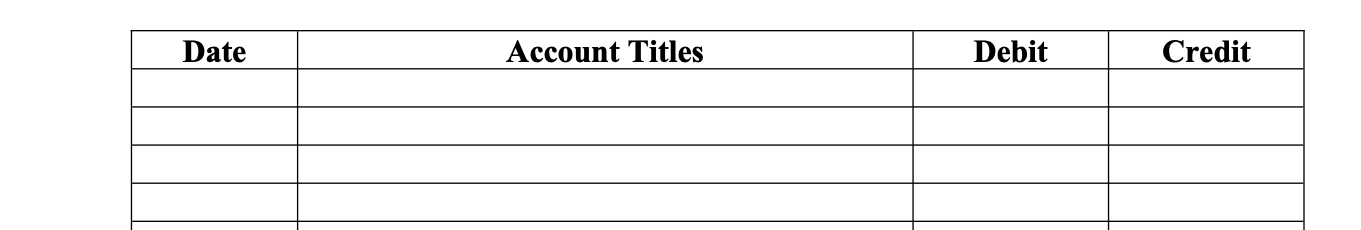

Jackson Toy Products Company began business on January 1, 2021. During the year, the following transactions occurred: Jan 1 Issued common stock in exchange for $55,000 equipment and $20,000 cash. Jan 2 Purchased inventory on account for $15,000 to be sold for $45,000 at a later date (use perpetual inventory system). Jan 4 Paid rent in the amount $6,400 for a 12 month period beginning Feb 1. Jan 10 Sold merchandise for a total of $18,000; $8,000 on account and the remainder paid in cash. The cost of merchandise was $10,000. Jan 15 Paid employees $10,000 salaries for the first half of the month. Part 1: Prepare general journal entries to record each transaction. Omit explanation.

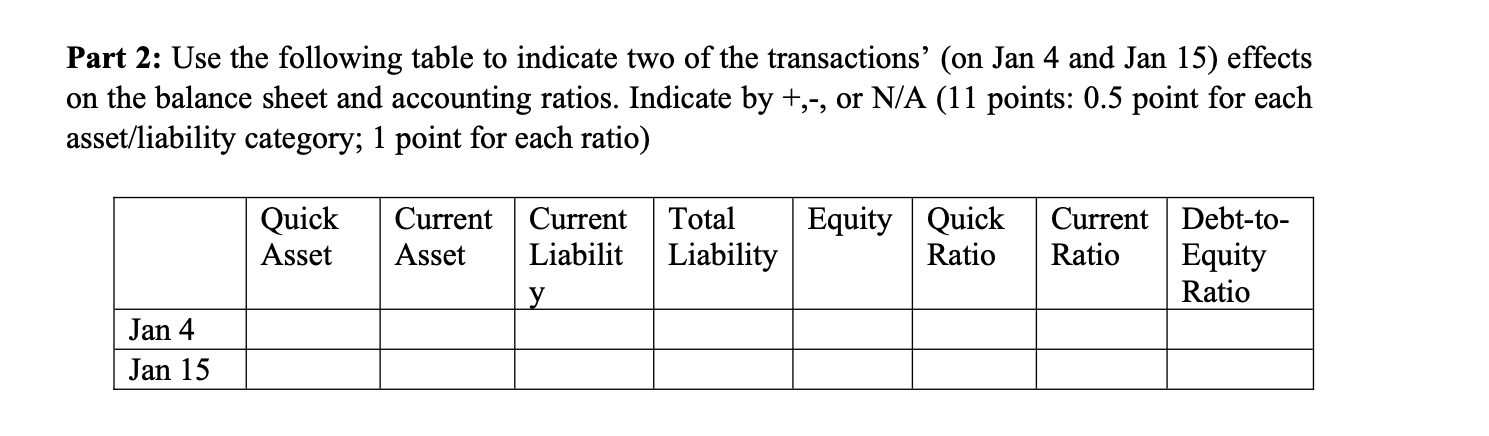

Part 2: Use the following table to indicate two of the transactions (on Jan 4 and Jan 15) effects on the balance sheet and accounting ratios. Indicate by +,-, or N/A (11 points: 0.5 point for each asset/liability category; 1 point for each ratio)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started