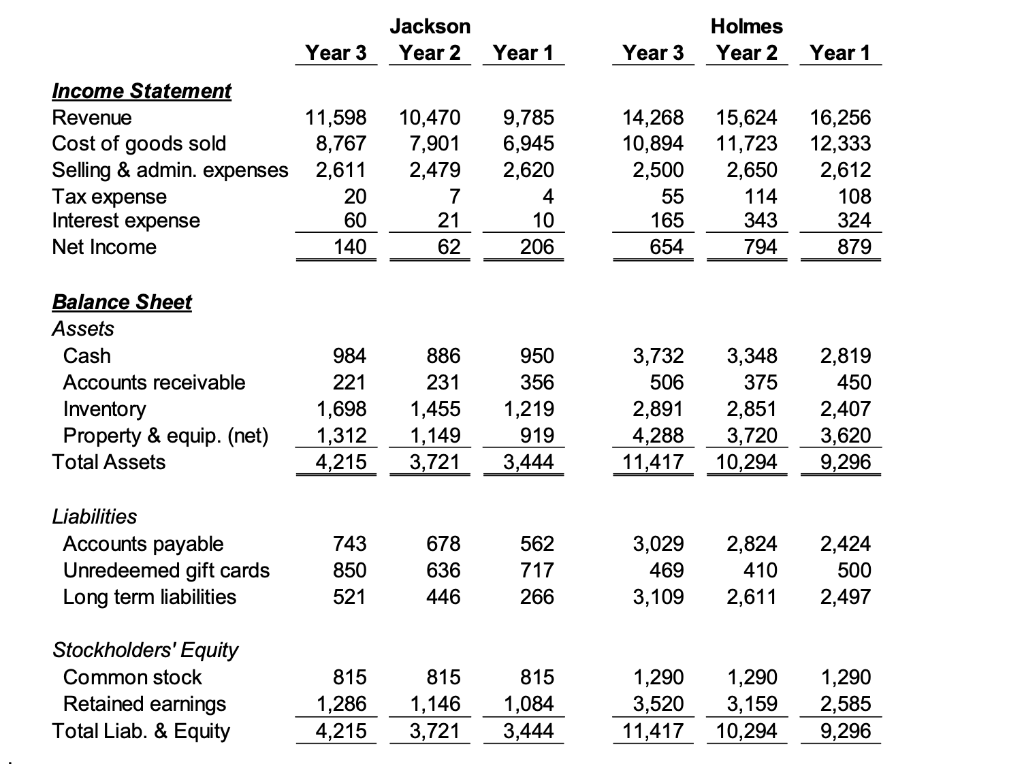

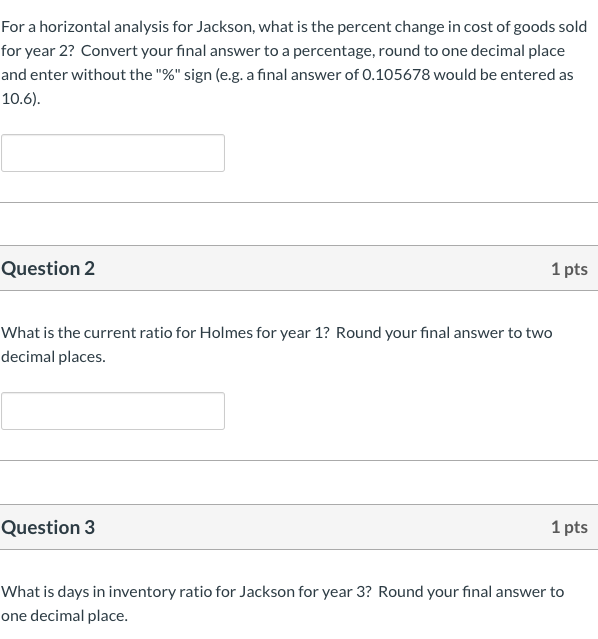

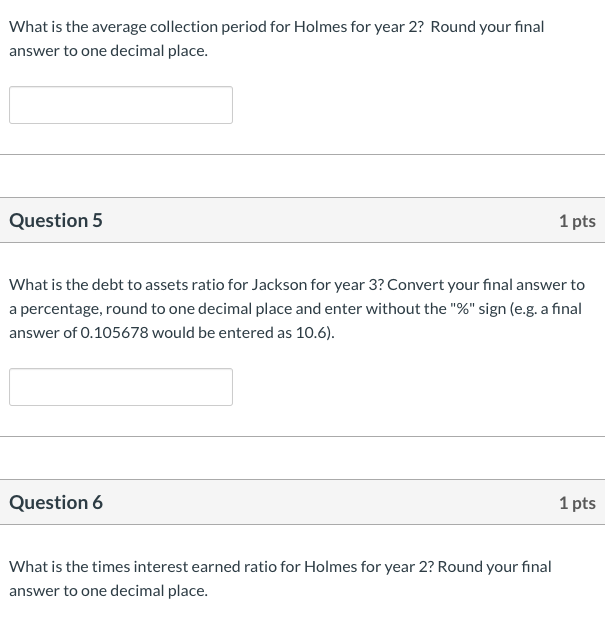

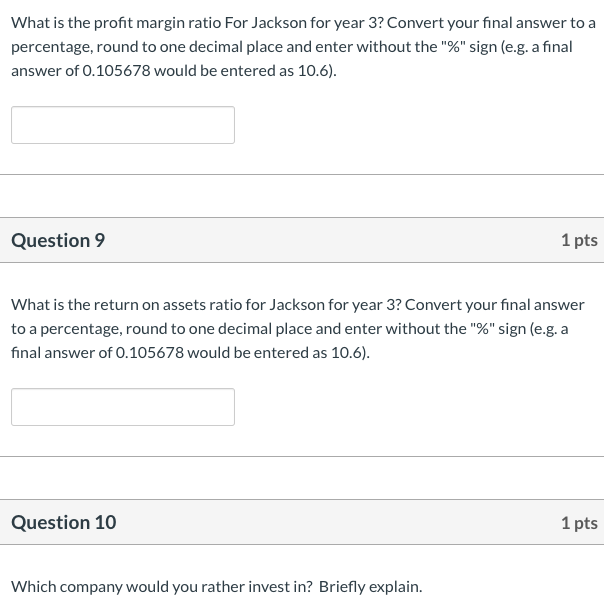

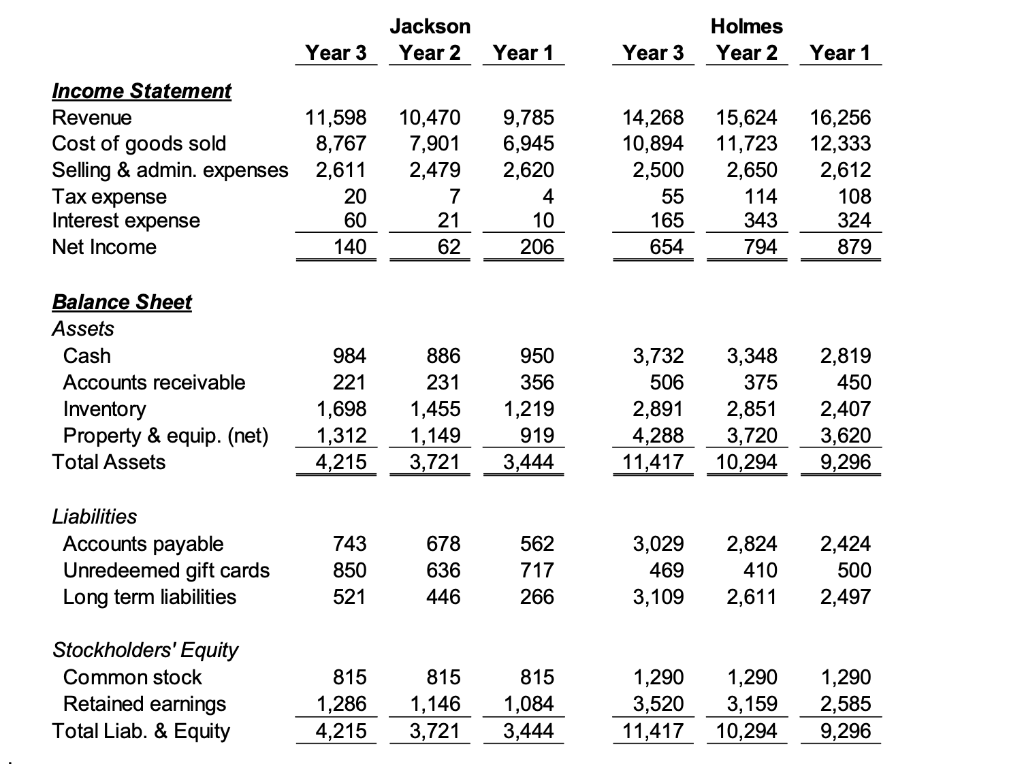

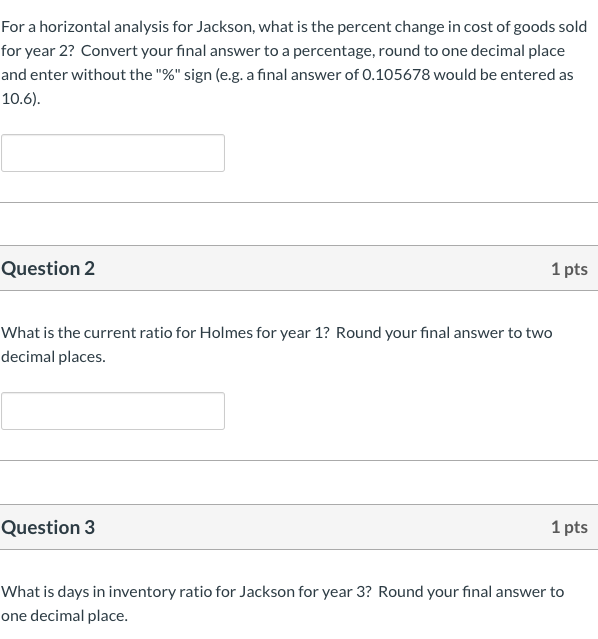

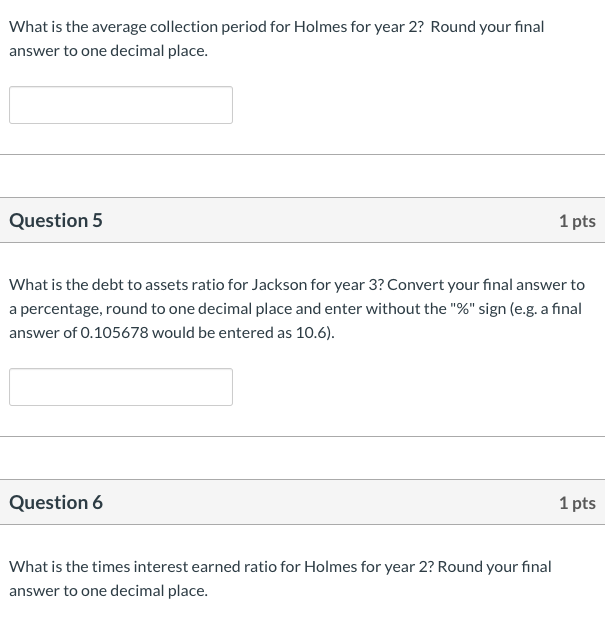

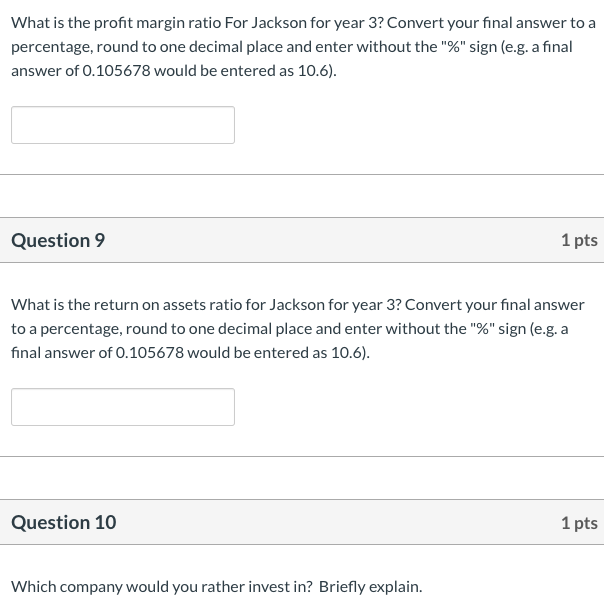

Jackson Year 2 Holmes Year 2 Year 3 Year 1 Year 3 Year 1 Income Statement Revenue Cost of goods sold Selling & admin. expenses Tax expense Interest expense Net Income 11,598 8,767 2,611 20 60 140 10,470 7,901 2,479 7 21 62 9,785 6,945 2,620 4 10 206 14,268 10,894 2,500 55 165 654 15,624 11,723 2,650 114 343 794 16,256 12,333 2,612 108 324 879 Balance Sheet Assets Cash Accounts receivable Inventory Property & equip. (net) Total Assets 984 221 1,698 1,312 886 231 1,455 1,149 950 356 1,219 919 3,444 3,732 506 2,891 4,288 3,348 375 2,851 3,720 2,819 450 2,407 3,620 9,296 Liabilities Accounts payable Unredeemed gift cards Long term liabilities 743 850 678 636 446 562 717 266 3,029 469 3,109 2,824 410 2,611 2,424 500 2,497 521 Stockholders' Equity Common stock Retained earnings Total Liab. & Equity 815 1,286 4,215 815 1,146 3,721 815 1,084 3,444 1,290 3,520 11,417 1,290 3,159 10,294 1,290 2,585 9,296 For a horizontal analysis for Jackson, what is the percent change in cost of goods sold for year 2? Convert your final answer to a percentage, round to one decimal place and enter without the "%" sign (e.g. a final answer of 0.105678 would be entered as 10.6). Question 2 1 pts What is the current ratio for Holmes for year 1? Round your final answer to two decimal places. Question 3 1 pts What is days in inventory ratio for Jackson for year 3? Round your final answer to one decimal place. What is the average collection period for Holmes for year 2? Round your final answer to one decimal place. Question 5 1 pts What is the debt to assets ratio for Jackson for year 3? Convert your final answer to a percentage, round to one decimal place and enter without the "%" sign (e.g. a final answer of 0.105678 would be entered as 10.6). Question 6 1 pts What is the times interest earned ratio for Holmes for year 2? Round your final answer to one decimal place. What is the profit margin ratio For Jackson for year 3? Convert your final answer to a percentage, round to one decimal place and enter without the "%" sign (e.g. a final answer of 0.105678 would be entered as 10.6). Question 9 1 pts What is the return on assets ratio for Jackson for year 3? Convert your final answer to a percentage, round to one decimal place and enter without the "%" sign (e.g. a final answer of 0.105678 would be entered as 10.6). Question 10 1 pts Which company would you rather invest in? Briefly explain