Question

Jack'sScent Shoppe is the name of a sole proprietorship that carries on a retail business. The business has a December 31 fiscal period and began

Jack'sScent Shoppe is the name of a sole proprietorship that carries on a retail business. The business has a December 31 fiscal period and began in2023. In its first fiscal period?business, sales totalled$162,000 of which$108,000 was received in cash and$53,000 on account. Of the cash?sales,$10,000 represents advance payments for goods that will only be delivered in2024. On December?31,2023?, $19,000 of the accounts receivable are outstanding.Jack identifies$2,100 of the accounts receivables as doubtful of collection. Indicate the2023 business income on the assumption that maximum income tax reserves are claimed.

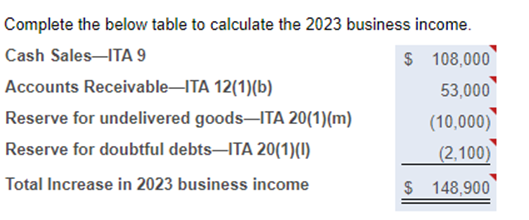

Complete the below table to calculate the 2023 business income. Cash Sales-ITA 9 Accounts Receivable-ITA 12(1)(b) Reserve for undelivered goods-ITA 20(1)(m) Reserve for doubtful debts-ITA 20(1)(1) $ 108,000 53,000 (10,000) (2,100) Total Increase in 2023 business income $ 148,900

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Based on the provided information we can calculate th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started