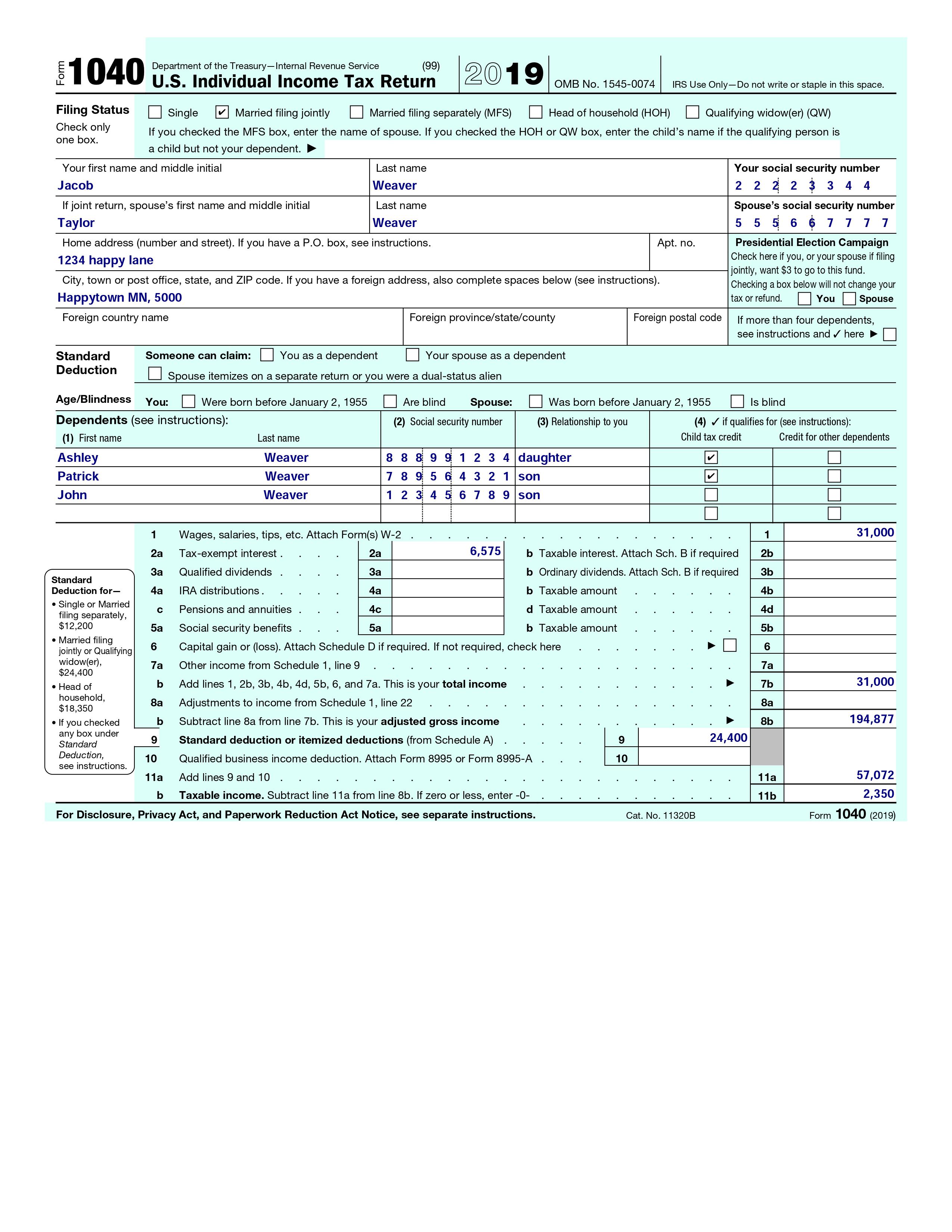

Jacob and Taylor Weaver, ages 45 and 42 respectively, are married and are filing jointly in 2019.

- They have three children, Ashley, age 9; Patrick, age 6; and John, age 17.

- Social Security numbers are: Jacob, 222-33-4444; Taylor, 555-66-7777; Ashley, 888-99-1234; Patrick, 789-56-4321; John, 123-45-6789.

- Taylor works part-time as a paralegal.

- She earned $31,000 in 2019.

- Income Taxes: $4,200 withheld.

- Interest received from Local Bank: $6,575.

- Estimated tax payments: $25,000.

- $350 paid with their 2018 state tax return.

- Jacob and Taylor bought their first house in 2019.

- Home mortgage interest: $12,246.

- Property tax: $12,230.

- Federal income withholding: $2,350.

- Charities: $4,500.

- $435 to rent a moving truck.

- $8,000 to put new siding on the house.

- $11,600 for child care expenses ($5,800 for each child).

- It was paid to Lil Tigers Daycare, 1115 S. Garrison St., Muncie, IN 47305 (EIN 98-7654321).

- Taylor is a part-time student at Ball State University in Muncie.

- She received a 1098-T indicating tuition and fees for 2019 in the amount of $6,011.

- Health insurance for the family, through Taylor's job, cost $7,500 for all 12 months of 2019.

- They paid deductibles and co-payments of $2,550.

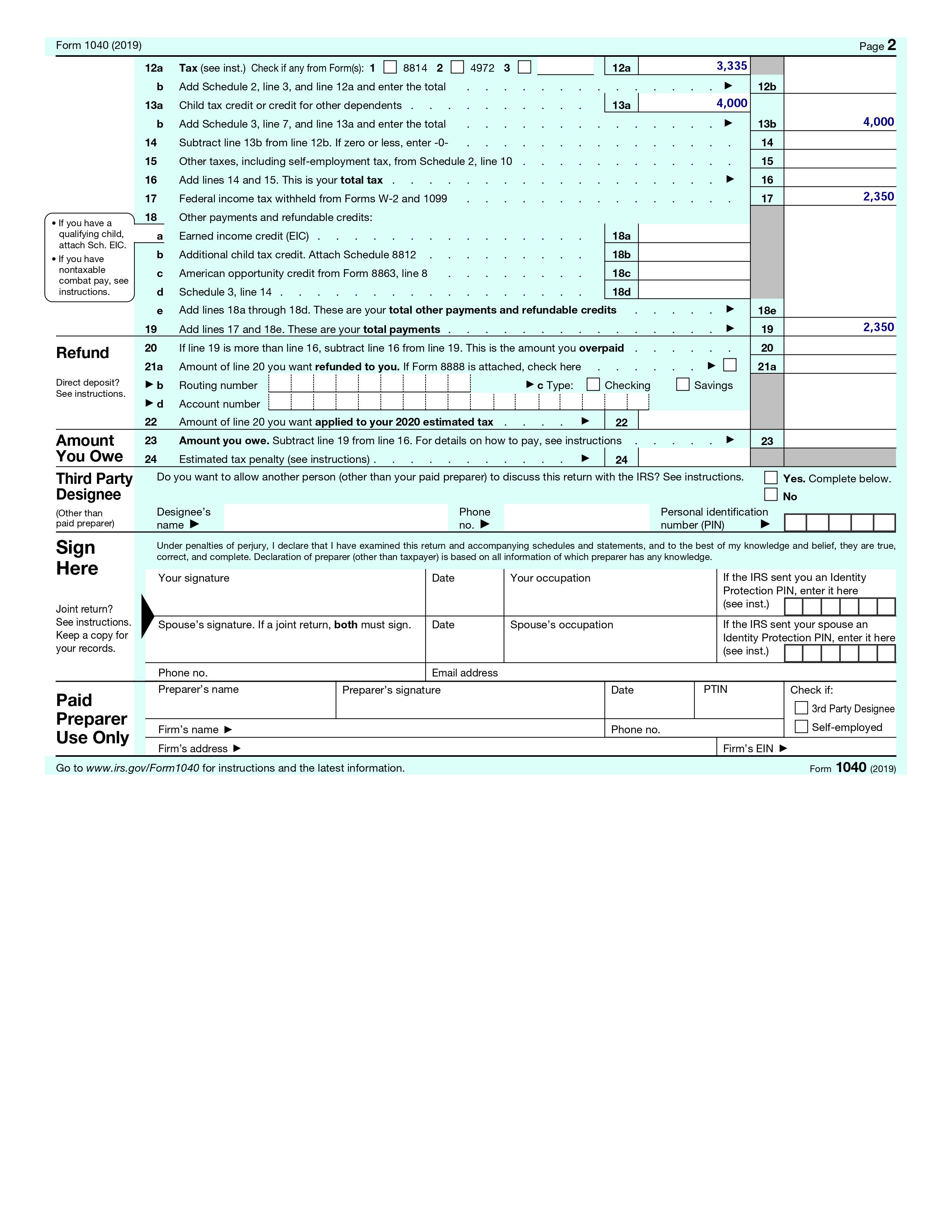

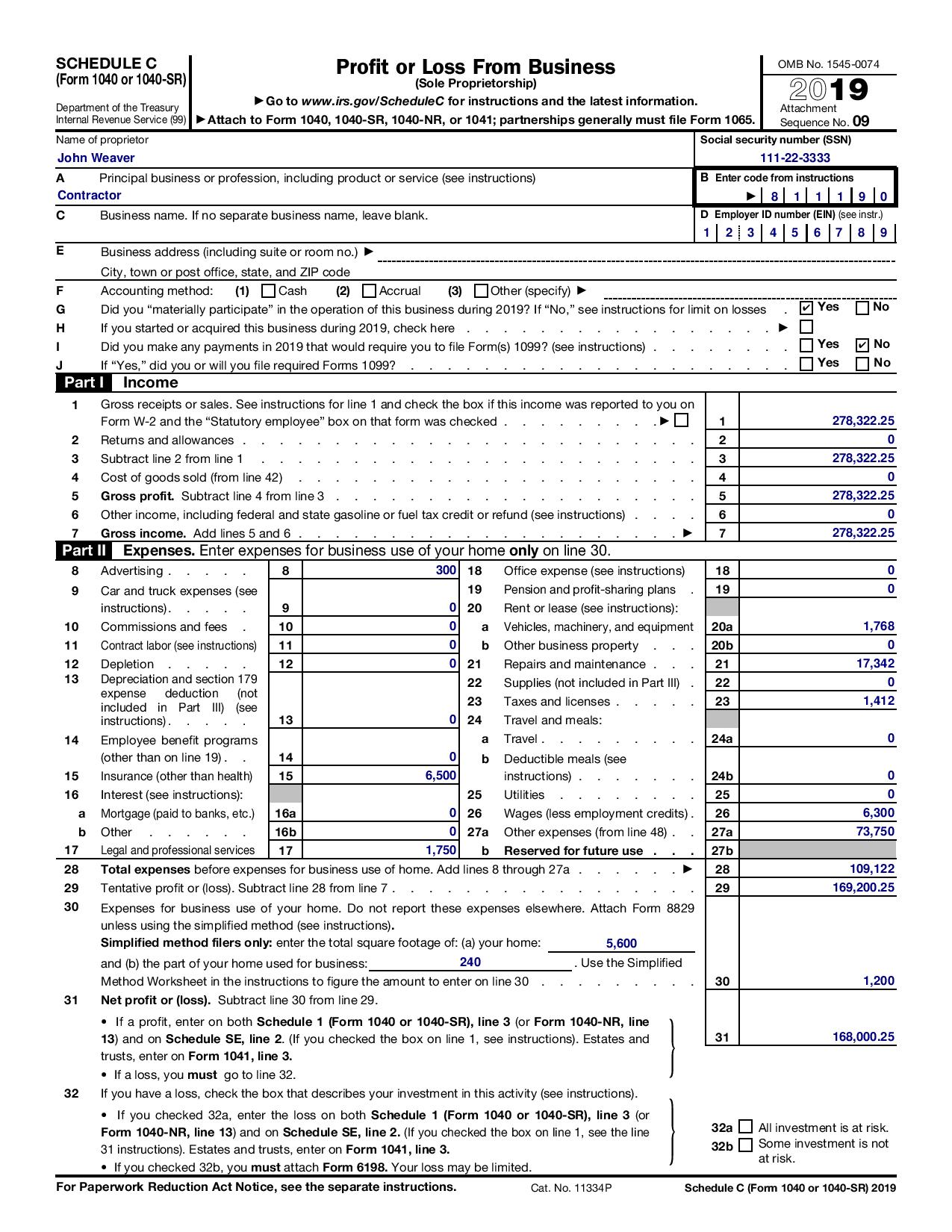

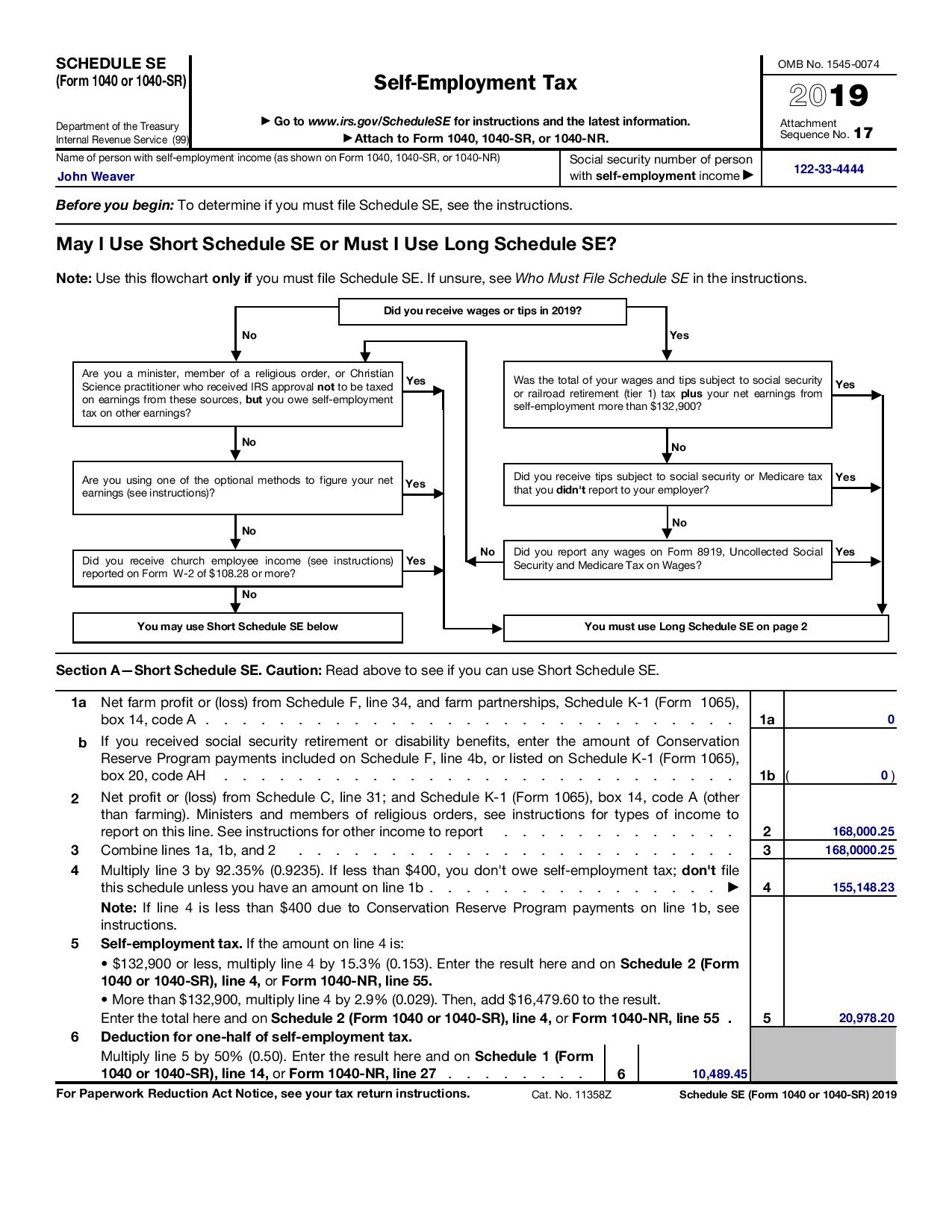

can someone help me properly fill out 1040 form? I was told the information I submitted is incorrect. confirm the annual gross income of the weavers based on info from schedule c and se and the scenario figures. what should my 1040 form look like? where did I go wrong?

g 1 040 Department of the Treasuryilntemal Revenue Service (99) 2 1 9 LE U.S. Individual Income Tax Return OMB No. 1545-0074 IRS Use OnlyDo not write or staple in this space. Filing Status |:| Single Married filing jointly |:| Married filing separately (M FS) Head of household (HOH) Qua ifying widow(er) (QW) grzrhlbznly If you checked the MFS box, enter the name of spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is a child but not your dependent. V Your first name and middle initial Last name Your social security number Jacob Weaver 2 2 2 2 3 3 4 4 If joint return, spouse's first name and middle initial Last name Spouse's social security number Taylor Weaver 5 5 5 6 6 7 7 7 7 Home address (number and street). If you have a PO. box, see instructions. Apt. no. Presidential Election Campaign 1234 happy lane Check here if you, or your spouse if filing jointly, want $3 to go to this fund. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Checking abox below will not change your Happytown MN, 5000 tax or refund. D You |:| spouse Foreign country name Foreign provincejstatycounty Foreign postal code lf more than four dependents, see instructions and ./ here > D Standard Someone can claim: D You as a dependent B Your spouse as a dependent Deduction D Spouse itemizes on a separate return or you were a dualstatus alien Age/Blindness You: I] Were born before January 2, 1955 D Are blind Spouse: D Was born before January 2, 1955 B Is blind Dependents (see instructions): (2) Social secun'ty number (3) Relationship to you (4) ./ if qualifies for (see instructions): (1) First name Last name Child tax credit Credit for other dependents Ashley Weaver 8 8 Bi 9 9 1 2 3 4 daughter [I Patrick Weaver 7 8 9i 5 G 4 3 2 1 son [I John Weaver 1 2 3; 4 5; 6 7 8 9 son D [I 1 Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . . . . . 1 31.000 2a Taxexempt interest . . . . 2a 6.575 b Taxable interest. Attach Sch. B if required 2b Standard 3a Qualified dividends . . . . 3a b Ordinary dividends. Attach Sch. B if required 3b Deduction for 4a IRA distributions . . . . . 4a b Taxable amount . . . . . . 4b ' angle 0' Married c Pensions and annuities . . . 4c d Taxable amount . . . . . . 4d lllng separately, $12200 5a Social security benefits . . . 5a b Taxable amount . . . . . . 5b . Eatgegrgrjifying 6 Capital gain or (loss). Attach Schedule D if required. If not required, check here . . . . . . . P E] 6 $30158\Form 1040 (2019) Page 2 12a Tax (see inst.) Check if any from Form(s): 1 ll 8814 2 [TI 4972 3 H 12a 3.335 b Add Schedule 2, line 3, and line 12a and enter the total . . . _ . . . _ . . . _ . . V 12b 13a Child tax credit or credit for other dependents . . . . . . . . . . 13a 4.000 b Add Schedule 3, line 7, and line 13a and enter the total . . . . . . . . . . . _ _ . > 13b 4.000 14 Subtract line 13b from line 12b. If zero or less, enter 0 . . . . . . . . . . . . . . . 14 15 Other taxes, including self-employment tax, from Schedule 2, line 10 . . . . . . . . . . . . 15 16 Add lines 14 and 15. This is your total tax . . . . . . . . . . . . . . . . . . V 16 17 Federal income tax withheld from Forms W-2 and 1099 . . . . . . . . . . . . . . . 17 2.350 18 Other payments and refundable credits: 0 If you have a qualifying Childr a Earned income credit (EIC) . . . _ . . . . . . . _ . . . 18a attach Sch. EIC. , If you have b Additional child tax credit. Attach Schedule 8812 . . . . . . . . . 18b nontaxable c American opportunity credit from Form 8863, line 8 . . . . . . . . 18c combat pay, see instructions. cl Schedule 3, line 14 . . . . . . . . . . . . . . . . . 18d e Add lines 18a through 18d. These are your total other payments and refundable credits . . . . . V 18c 19 Add lines 17 and 18e. These are your total payments . . . . . . . . . . . . . . . V 19 2.350 Refund 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid . . . . . . 20 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here . . . . . . V I] 21a Direct deplt7 V b Routing number l l l l l l l l l V c Type: E] Checking E] Savings See Instructions. 5 5 I I i i i V d Account number I : g l l l l . l . . . g : l . l ' 22 Amount of line 20 you want applied to your 2020 estimated tax . . . . V 22 Amount 23 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions . . . _ . V 23 YOU owe 24 Estimated tax penalty (see instructions). . . . . . . . . . . V 24 i Third Party Do you want to allow another person (other than your paid preparer) to discuss this return with the RS? See instructions. [:I Yes. Complete below. Designee El No (Other than Designee's Phone Personal identification Paid Preparer) name V no. V number (PIN) V Sign Under penalties of perjury, I declare that l have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an Identity Protection PIN, enter it here Joint return? (see inst.) ml: See instructions. Spouse's signature. If a joint return, both must sign. Date Spouse's occupation If the IRS sent your spouse an Keep a COPY for Identity Protection PIN, enter it here your records. (see inst.) m Phone no. Email address P Id Preparer's name Preparer's signature Date PTIN Check if: Pal :I 3rd Party Designee re arer p Firm's name V I Phone no. I j Self-employed Use Only _ _ Flrm's address V Flrm's EIN V Go to www.irs.gov/Form1040 for insthctions and the latest information. Form 1040 (2019) SCHEDULE C (Form 1040 or 1040-SR) Profit or Loss From Business OMB No. 1545-0074 (Sole Proprietorship) 2019 Department of the Treasury Go to www.irs.gov/ScheduleC for instructions and the latest information. Attachment Internal Revenue Service (99) _ Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) John Weaver 111-22-3333 Principal business or profession, including product or service (see instructions) B Enter code from instructions Contractor 8 1 1 1 9 0 Business name. If no separate business name, leave blank. Employer ID number (EIN) (see instr.) 1 2 3 4 5 6 7 8 9 E Business address (including suite or room no.) City, town or post office, state, and ZIP code Accounting method: (1) Cash (2) Accrual (3) Other (specify) Did you "materially participate" in the operation of this business during 2019? If "No," see instructions for limit on losses Yes No If you started or acquired this business during 2019, check here . OOL Did you make any payments in 2019 that would require you to file Form(s) 1099? (see instructions) . Yes _ No If "Yes," did you or will you file required Forms 1099? Yes No Part | Income Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked . 278,322.25 Returns and allowances 2 0 Subtract line 2 from line 1 278,322.25 Cost of goods sold (from line 42) 0 NODAWN Gross profit. Subtract line 4 from line 3 5 278,322.25 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 0 Gross income. Add lines 5 and 6 . 278,322.25 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising - 8 300 18 Office expense (see instructions) 18 Car and truck expenses (see 19 Pension and profit-sharing plans 19 instructions) . 9 0 Rent or lease (see instructions): 10 Commissions and fees 10 0 a Vehicles, machinery, and equipment 20a 1,768 11 Contract labor (see instructions) b Other business property 20b 12 Depletion 12 0 21 Repairs and maintenance . 21 17,342 13 Depreciation and section 179 22 Supplies (not included in Part III) . 22 expense deduction (not 23 1,412 included in Part III) (see Taxes and licenses . 23 instructions) . 13 0 Travel and meals: 14 Employee benefit programs a Travel . 24a (other than on line 19) . 14 b Deductible meals (see 15 Insurance (other than health) 15 5,500 nstructions) . 24b 0 16 Interest (see instructions) 25 Utilities 25 0 a Mortgage (paid to banks, etc.) 16a 0 26 Wages (less employment credits) . 26 6,300 Other 16b 0 27a Other expenses (from line 48) . 27a 73,750 17 Legal and professional services 17 1,750 b Reserved for future use 27 b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 28 109,122 29 Tentative profit or (loss). Subtract line 28 from line 7 . 29 169,200.25 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: 5.600 and (b) the part of your home used for business 240 Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 1,200 31 Net profit or (loss). Subtract line 30 from line 29. . If a profit, enter on both Schedule 1 (Form 1040 or 1040-SR), line 3 (or Form 1040-NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and 31 168,000.25 trusts, enter on Form 1041, line 3. If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity (see instructions). . If you checked 32a, enter the loss on both Schedule 1 (Form 1040 or 1040-SR), line 3 (or Form 1040-NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 32a All investment is at risk. 31 instructions). Estates and trusts, enter on Form 1041, line 3. 32b Some investment is not at risk. . If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040 or 1040-SR) 2019SGHEDU LE SE OMB No. 1545-00?4 {Form 1010 or 1mm Self-Employment Tax 2 1 9 Department of the Tram > Go to mm.irs.govf5cheotrteSE for instructions and the latest hformation. Attachment 1 7 hten'iel Revenue Smiles (99 >Attacn to Form 1040, 1040-511, or 1040-14 n. Sequence \"0- Name of person with self-employment income (as shown on Form 1040, 1040-SFI, or1040-NFI) Social security number of person John Weaver with self-employment income D 122-3344\" Before you begin: To determine it you must file Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this owchart only it you must file Schedule SE. If unsure, see Who Must Frle Schedule SE in the instructions. Did you receive wages or tips in 2019? No Yes Are you a minister, member of a religious order, or Christian Science practitioner who received lFtS approval not to be taxed Was the totai of your wages and tips subject to social security Yes or railroad retirement {tier 1) tax plus your net earnings from on earnings from these sources. but you owe sell-employment seil-empioyment more than $132,900? tax on other earnings? "D No Are you using one of the optional methods to figure your net Yes Did you receive tips subiect to social security or Medicare tax Yes earnings {see instructions)? that you didn I report to your employer? N No 0 . . _ _ . No Did you report any wages on Form 8919, Uncoilected Sociai Yes D'd you receive church employee Income (see instructions) Security and MedicareTax on Wages? reported on Form W-2 of $108.28 or more? No You may use Short Schedule SE below You must use Long Schedde SE on page 2 Section AShort Schedule SE. Caution: Read above to see if you can use Short Schedule SE. to Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A . b if you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box20,codeAH............................ 2 Net prot or (loss) from Schedule 0, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report Combinelines1a,1b,and2 . . . 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file (a) this schedule unless you have an amount on line 1b . . . . . . . . . . . . . . . . P 155,140.23 Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5 Self-employment tax. if the amount on line 4 is: - $132,900 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 2 (Form 1040 or 1040-83), line 4, or Form 1040-NFI, line 55. 0 More than $132,900, multiply line 4 by 2.9% [0.029). Then, add $16,479.60 to the result. Enter the total here and on Schedule 2 (Form 1040 or 1040-53), line 4, or Form 1040-NR, line 55 . 6 Deduction for one-halt oi self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040 or 1040-SR , line 14, or Form 1040-NFI, line 27 . . . . . _ For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 113532 Schedule SE (Form 1040 or tom-SH) 2019