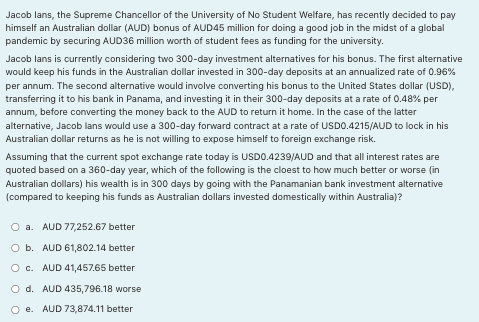

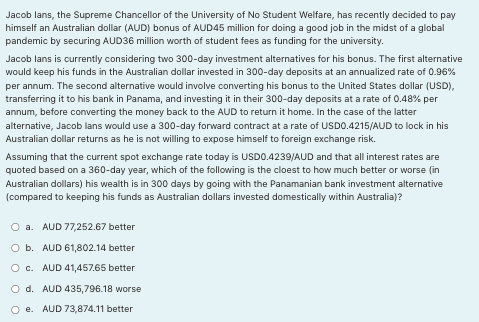

Jacob lans, the Supreme Chancellor of the University of No Student Welfare, has recently decided to pay himself an Australian dollar (AUD) bonus of AUD45 million for doing a good job in the midst of a global pandemic by securing AUD36 million worth of student fees as funding for the university. Jacob lans is currently considering two 300-day investment alternatives for his bonus. The first alternative would keep his funds in the Australian dollar invested in 300-day deposits at an annualized rate of 0.96% per annum. The second alternative would involve converting his bonus to the United States dollar (USD), transferring it to his bank in Panama, and investing it in their 300-day deposits at a rate of 0.48% per annum, before converting the money back to the AUD to return it home. In the case of the latter alternative, Jacob lans would use a 300-day forward contract at a rate of USD0.4215/AUD to lock in his Australian dollar returns as he is not willing to expose himself to foreign exchange risk. Assuming that the current spot exchange rate today is USD0.4239/AUD and that all interest rates are quoted based on a 360-day year, which of the following is the cloest to how much better or worse (in Australian dollars) his wealth is in 300 days by going with the Panamanian bank investment alternative (compared to keeping his funds as Australian dollars invested domestically within Australia)? O a. AUD 77,252.67 better O b. AUD 61,802.14 better O c. AUD 41,457.65 better O d. AUD 435,796.18 worse AUD 73,874.11 better Jacob lans, the Supreme Chancellor of the University of No Student Welfare, has recently decided to pay himself an Australian dollar (AUD) bonus of AUD45 million for doing a good job in the midst of a global pandemic by securing AUD36 million worth of student fees as funding for the university. Jacob lans is currently considering two 300-day investment alternatives for his bonus. The first alternative would keep his funds in the Australian dollar invested in 300-day deposits at an annualized rate of 0.96% per annum. The second alternative would involve converting his bonus to the United States dollar (USD), transferring it to his bank in Panama, and investing it in their 300-day deposits at a rate of 0.48% per annum, before converting the money back to the AUD to return it home. In the case of the latter alternative, Jacob lans would use a 300-day forward contract at a rate of USD0.4215/AUD to lock in his Australian dollar returns as he is not willing to expose himself to foreign exchange risk. Assuming that the current spot exchange rate today is USD0.4239/AUD and that all interest rates are quoted based on a 360-day year, which of the following is the cloest to how much better or worse (in Australian dollars) his wealth is in 300 days by going with the Panamanian bank investment alternative (compared to keeping his funds as Australian dollars invested domestically within Australia)? O a. AUD 77,252.67 better O b. AUD 61,802.14 better O c. AUD 41,457.65 better O d. AUD 435,796.18 worse AUD 73,874.11 better