Question

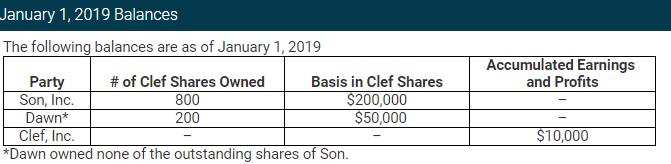

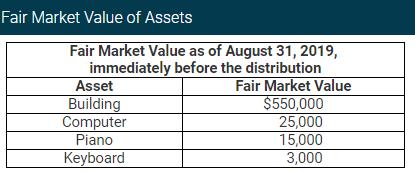

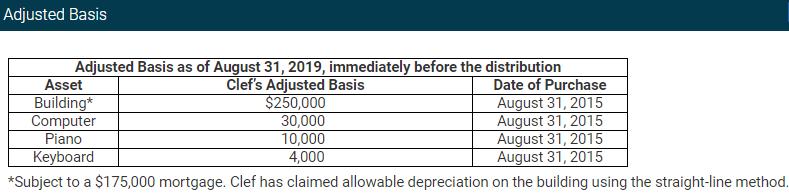

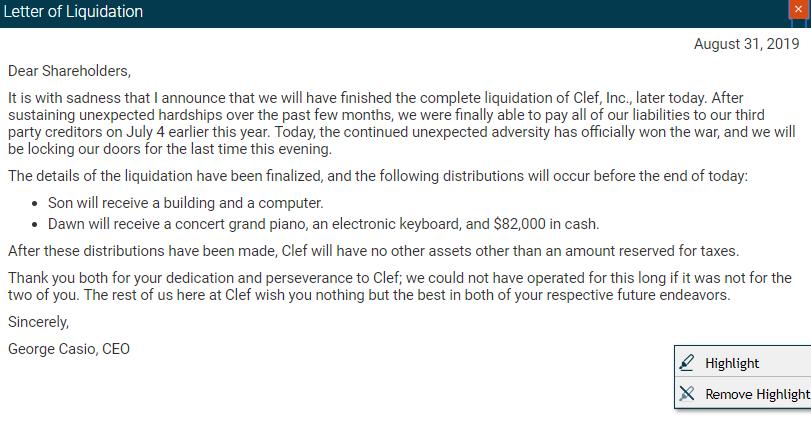

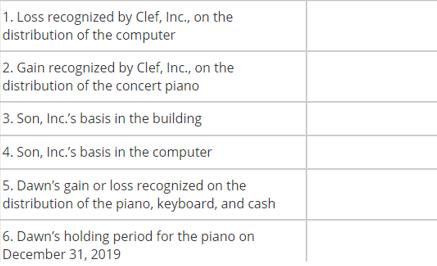

Son, Inc., and Clef, Inc., are both taxable domestic C corporations. Using the information in the exhibits, enter either the correct amount or holding period

Son, Inc., and Clef, Inc., are both taxable domestic C corporations. Using the information in the exhibits, enter either the correct amount or holding period (in a number of months) for each item below. For each item, enter the appropriate amounts in the associated cells. If the amount is zero, enter a zero (0).

January 1, 2019 Balances The following balances are as of January 1, 2019 Accumulated Earnings and Profits # of Clef Shares Owned 800 200 Basis in Clef Shares Party Son, Inc. $200,000 $50,000 Dawn* Clef, Inc. *Dawn owned none of the outstanding shares of Son. $10,000

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: kieso, weygandt and warfield.

14th Edition

9780470587232, 470587288, 470587237, 978-0470587287

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App