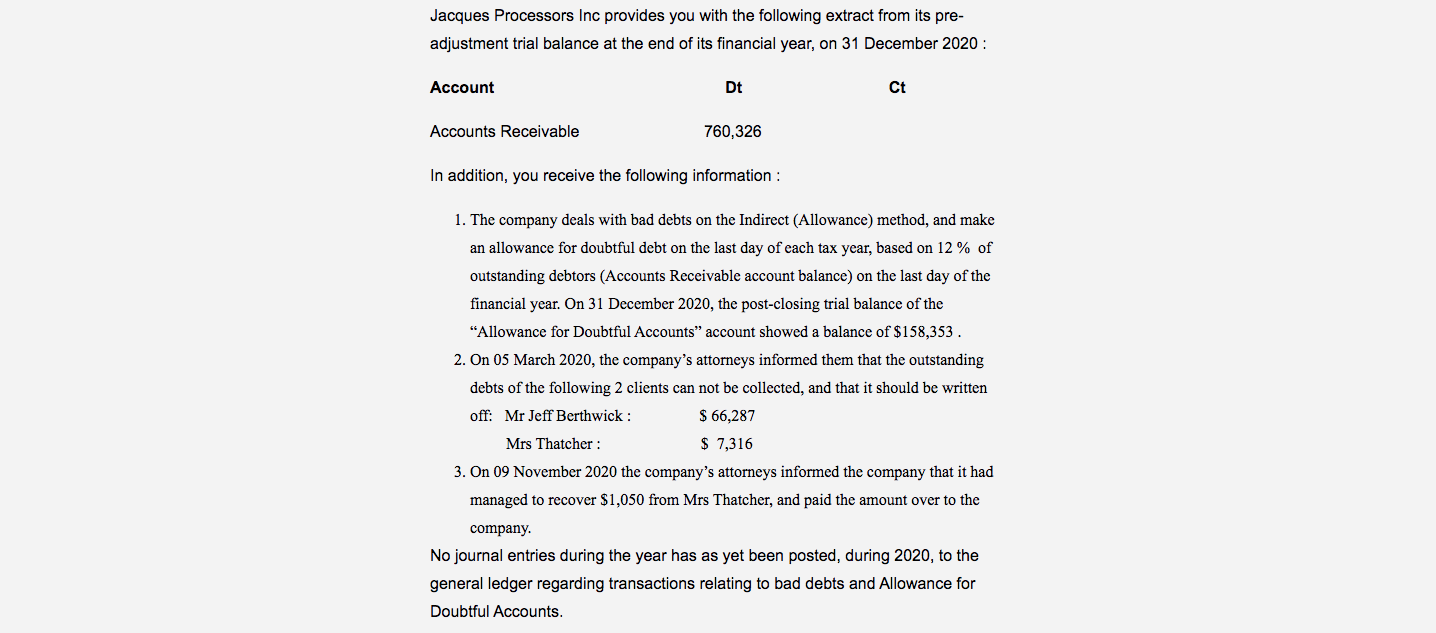

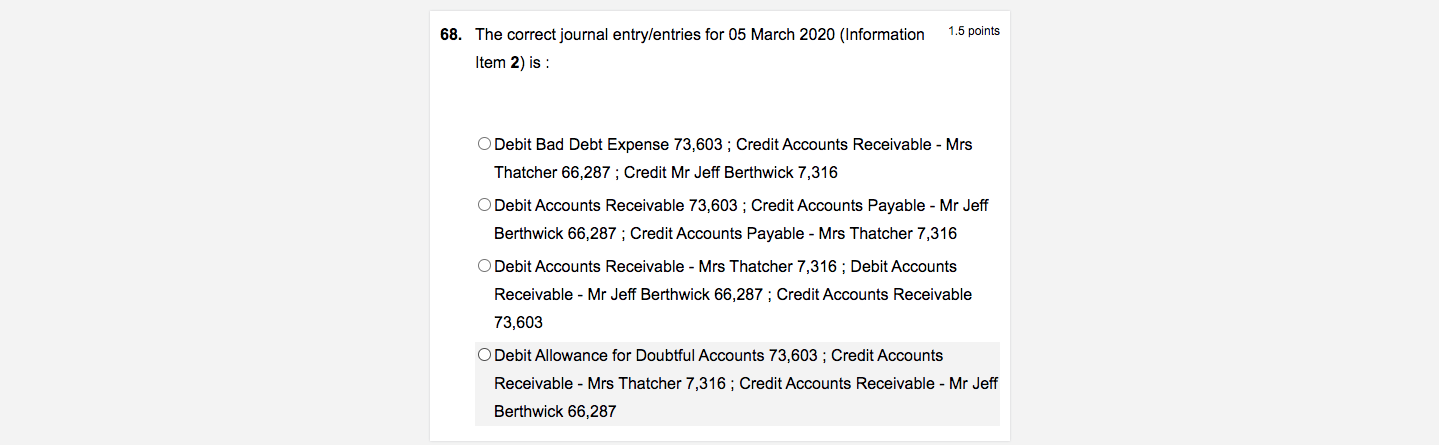

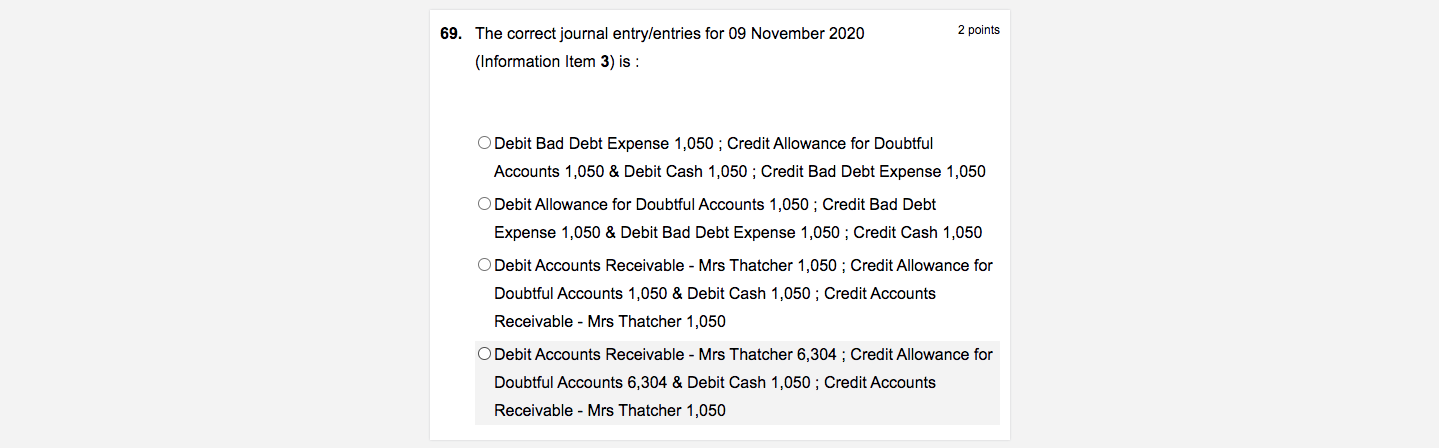

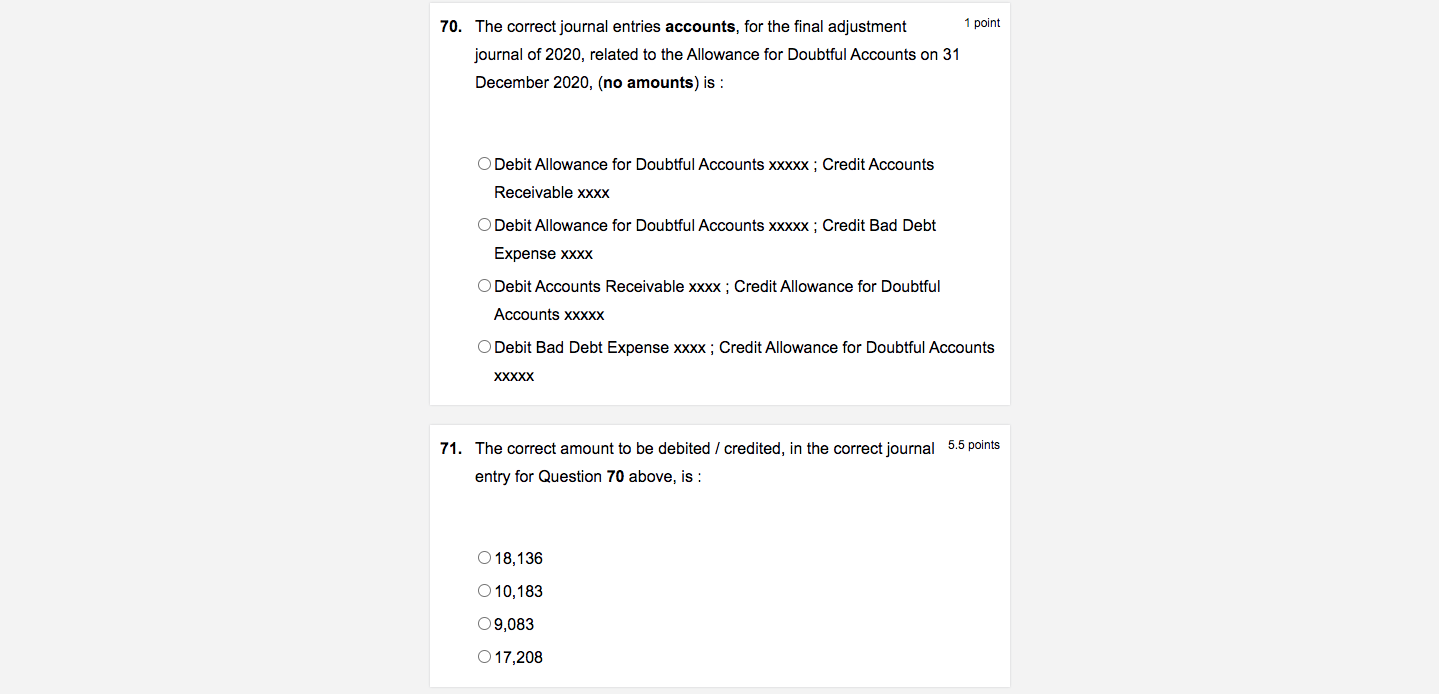

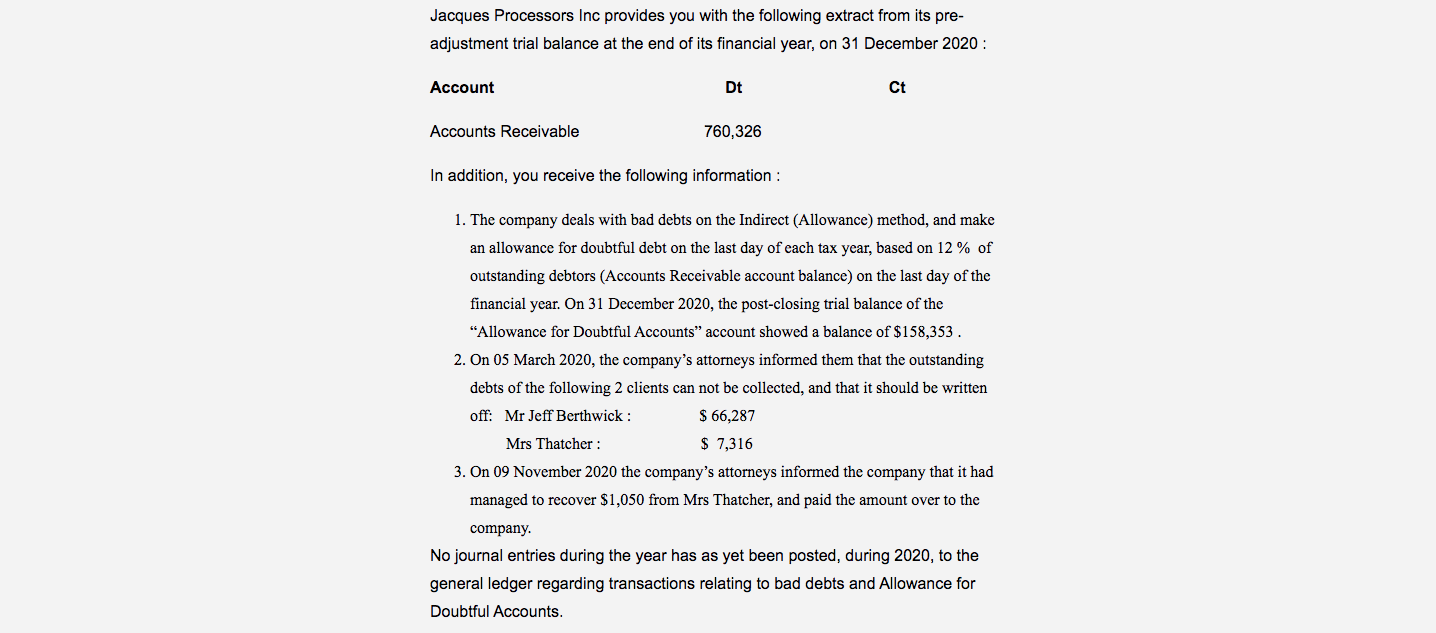

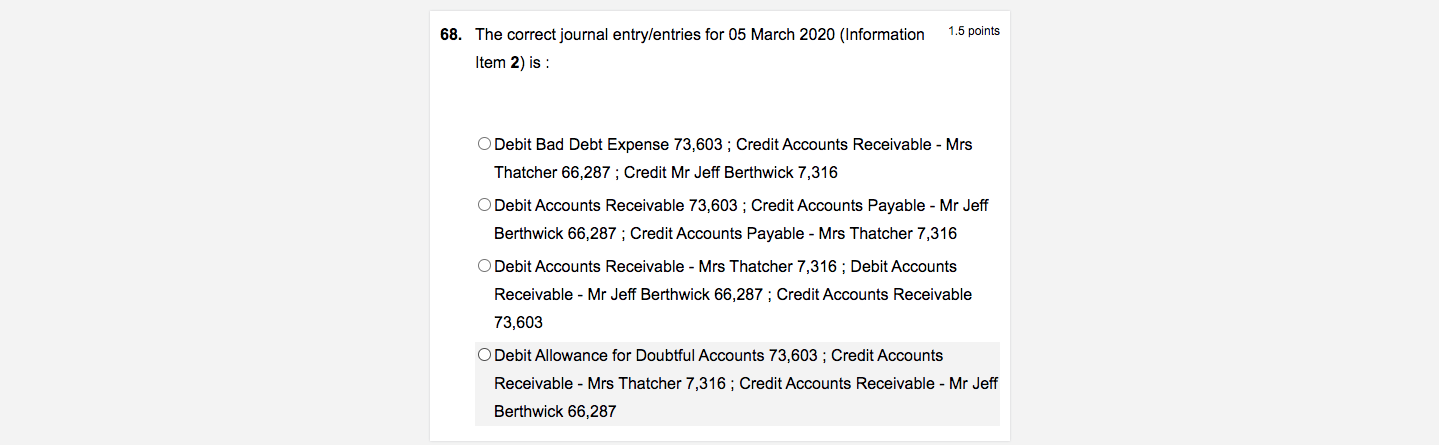

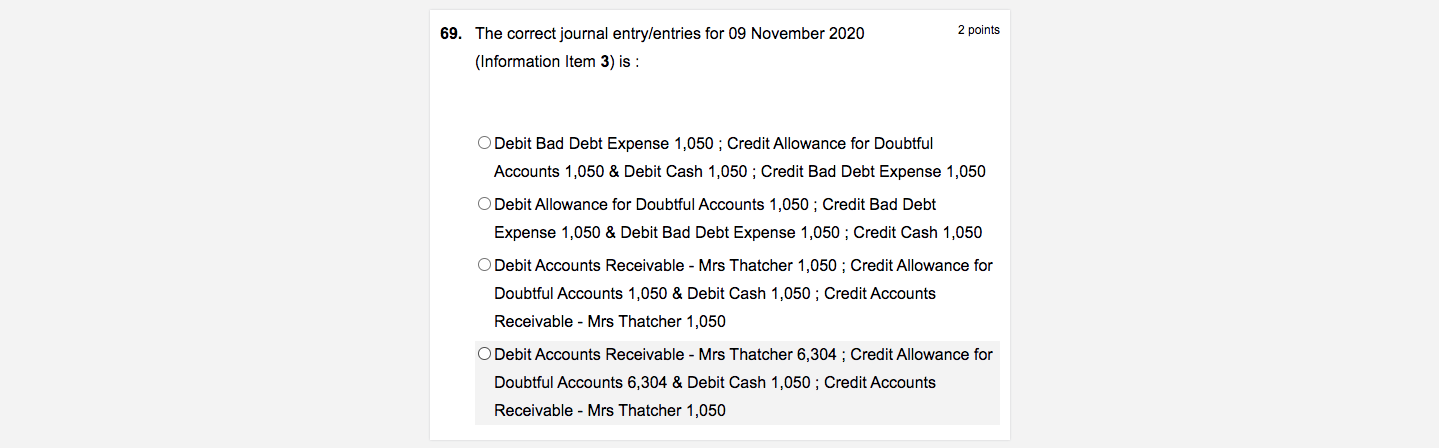

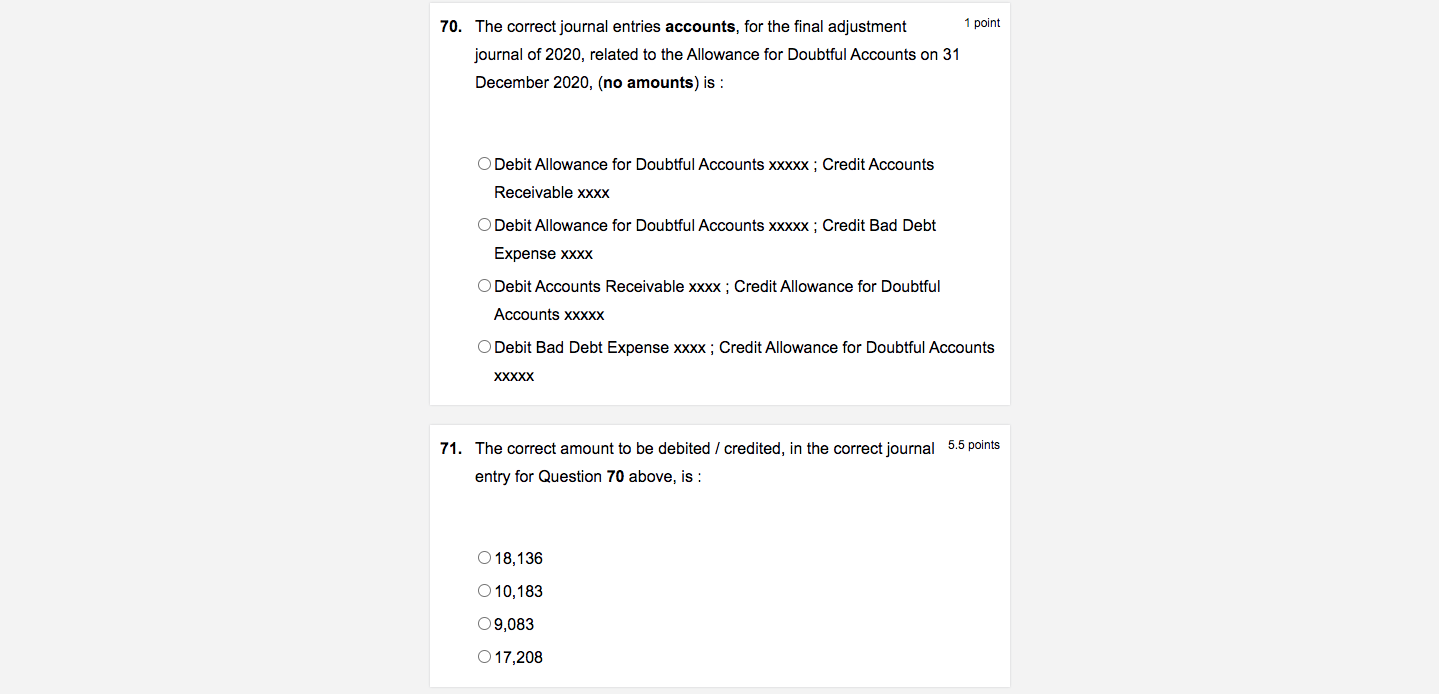

Jacques Processors Inc provides you with the following extract from its pre- adjustment trial balance at the end of its financial year, on 31 December 2020: Account Dt Ct Accounts Receivable 760,326 In addition, you receive the following information : 1. The company deals with bad debts on the Indirect (Allowance) method, and make an allowance for doubtful debt on the last day of each tax year, based on 12% of outstanding debtors (Accounts Receivable account balance) on the last day of the financial year. On 31 December 2020, the post-closing trial balance of the "Allowance for Doubtful Accounts" account showed a balance of $158,353. 2. On 05 March 2020, the company's attorneys informed them that the outstanding debts of the following 2 clients can not be collected, and that it should be written off: Mr Jeff Berthwick : $ 66,287 Mrs Thatcher : $ 7,316 3. On 09 November 2020 the company's attorneys informed the company that it had managed to recover $1,050 from Mrs Thatcher, and paid the amount over to the company. No journal entries during the year has as yet been posted, during 2020, to the general ledger regarding transactions relating to bad debts and Allowance for Doubtful Accounts. 1.5 points 68. The correct journal entry/entries for 05 March 2020 (Information Item 2) is : O Debit Bad Debt Expense 73,603 ; Credit Accounts Receivable - Mrs Thatcher 66,287; Credit Mr Jeff Berthwick 7,316 O Debit Accounts Receivable 73,603 ; Credit Accounts Payable - Mr Jeff Berthwick 66,287 ; Credit Accounts Payable - Mrs Thatcher 7,316 O Debit Accounts Receivable - Mrs Thatcher 7,316 ; Debit Accounts Receivable - Mr Jeff Berthwick 66,287 ; Credit Accounts Receivable 73,603 O Debit Allowance for Doubtful Accounts 73,603 ; Credit Accounts Receivable - Mrs Thatcher 7,316 ; Credit Accounts Receivable - Mr Jeff Berthwick 66,287 2 points 69. The correct journal entry/entries for 09 November 2020 (Information Item 3) is : O Debit Bad Debt Expense 1,050 ; Credit Allowance for Doubtful Accounts 1,050 & Debit Cash 1,050 ; Credit Bad Debt Expense 1,050 O Debit Allowance for Doubtful Accounts 1,050; Credit Bad Debt Expense 1,050 & Debit Bad Debt Expense 1,050 ; Credit Cash 1,050 O Debit Accounts Receivable - Mrs Thatcher 1,050 ; Credit Allowance for Doubtful Accounts 1,050 & Debit Cash 1,050; Credit Accounts Receivable - Mrs Thatcher 1,050 O Debit Accounts Receivable - Mrs Thatcher 6,304 ; Credit Allowance for Doubtful Accounts 6,304 & Debit Cash 1,050; Credit Accounts Receivable - Mrs Thatcher 1,050 1 point 70. The correct journal entries accounts, for the final adjustment journal of 2020, related to the Allowance for Doubtful Accounts on 31 December 2020, (no amounts) is : O Debit Allowance for Doubtful Accounts XXXXX; Credit Accounts Receivable XXXX O Debit Allowance for Doubtful Accounts xxxxx ; Credit Bad Debt Expense xxxx O Debit Accounts Receivable xxxx ; Credit Allowance for Doubtful Accounts XXXXX O Debit Bad Debt Expense xxxx ; Credit Allowance for Doubtful Accounts XXXXX 71. The correct amount to be debited / credited, in the correct journal 5.5 points entry for Question 70 above, is : O 18,136 O 10,183 9,083 O 17,208 Jacques Processors Inc provides you with the following extract from its pre- adjustment trial balance at the end of its financial year, on 31 December 2020: Account Dt Ct Accounts Receivable 760,326 In addition, you receive the following information : 1. The company deals with bad debts on the Indirect (Allowance) method, and make an allowance for doubtful debt on the last day of each tax year, based on 12% of outstanding debtors (Accounts Receivable account balance) on the last day of the financial year. On 31 December 2020, the post-closing trial balance of the "Allowance for Doubtful Accounts" account showed a balance of $158,353. 2. On 05 March 2020, the company's attorneys informed them that the outstanding debts of the following 2 clients can not be collected, and that it should be written off: Mr Jeff Berthwick : $ 66,287 Mrs Thatcher : $ 7,316 3. On 09 November 2020 the company's attorneys informed the company that it had managed to recover $1,050 from Mrs Thatcher, and paid the amount over to the company. No journal entries during the year has as yet been posted, during 2020, to the general ledger regarding transactions relating to bad debts and Allowance for Doubtful Accounts. 1.5 points 68. The correct journal entry/entries for 05 March 2020 (Information Item 2) is : O Debit Bad Debt Expense 73,603 ; Credit Accounts Receivable - Mrs Thatcher 66,287; Credit Mr Jeff Berthwick 7,316 O Debit Accounts Receivable 73,603 ; Credit Accounts Payable - Mr Jeff Berthwick 66,287 ; Credit Accounts Payable - Mrs Thatcher 7,316 O Debit Accounts Receivable - Mrs Thatcher 7,316 ; Debit Accounts Receivable - Mr Jeff Berthwick 66,287 ; Credit Accounts Receivable 73,603 O Debit Allowance for Doubtful Accounts 73,603 ; Credit Accounts Receivable - Mrs Thatcher 7,316 ; Credit Accounts Receivable - Mr Jeff Berthwick 66,287 2 points 69. The correct journal entry/entries for 09 November 2020 (Information Item 3) is : O Debit Bad Debt Expense 1,050 ; Credit Allowance for Doubtful Accounts 1,050 & Debit Cash 1,050 ; Credit Bad Debt Expense 1,050 O Debit Allowance for Doubtful Accounts 1,050; Credit Bad Debt Expense 1,050 & Debit Bad Debt Expense 1,050 ; Credit Cash 1,050 O Debit Accounts Receivable - Mrs Thatcher 1,050 ; Credit Allowance for Doubtful Accounts 1,050 & Debit Cash 1,050; Credit Accounts Receivable - Mrs Thatcher 1,050 O Debit Accounts Receivable - Mrs Thatcher 6,304 ; Credit Allowance for Doubtful Accounts 6,304 & Debit Cash 1,050; Credit Accounts Receivable - Mrs Thatcher 1,050 1 point 70. The correct journal entries accounts, for the final adjustment journal of 2020, related to the Allowance for Doubtful Accounts on 31 December 2020, (no amounts) is : O Debit Allowance for Doubtful Accounts XXXXX; Credit Accounts Receivable XXXX O Debit Allowance for Doubtful Accounts xxxxx ; Credit Bad Debt Expense xxxx O Debit Accounts Receivable xxxx ; Credit Allowance for Doubtful Accounts XXXXX O Debit Bad Debt Expense xxxx ; Credit Allowance for Doubtful Accounts XXXXX 71. The correct amount to be debited / credited, in the correct journal 5.5 points entry for Question 70 above, is : O 18,136 O 10,183 9,083 O 17,208