Question

Jagger, Inc. production begins in Department A with 1,000 kilograms of material, of which 40% goes to Department B, 50% to Department C, and

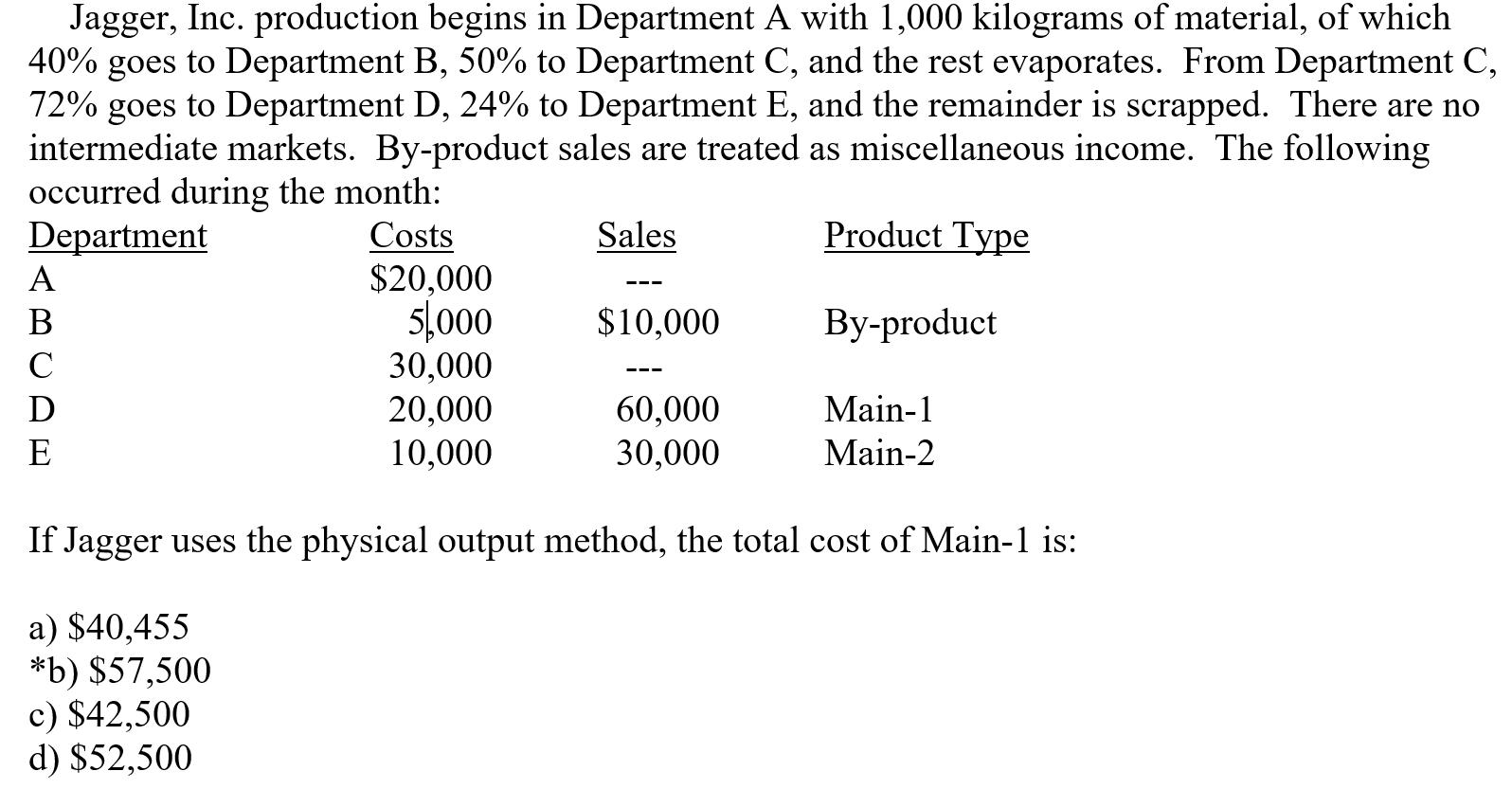

Jagger, Inc. production begins in Department A with 1,000 kilograms of material, of which 40% goes to Department B, 50% to Department C, and the rest evaporates. From Department C, 72% goes to Department D, 24% to Department E, and the remainder is scrapped. There are no intermediate markets. By-product sales are treated as miscellaneous income. The following occurred during the month: Department Costs Sales Product Type $20,000 5000 30,000 20,000 10,000 $10,000 -product Main-1 60,000 30,000 E Main-2 If Jagger uses the physical output method, the total cost of Main-1 is: a) $40,455 *b) $57,500 c) $42,500 d) $52,500

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 57500 Calculated as Total Input in A 1000 kg 50 to Dept C 50 of 10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management

Authors: William J Stevenson

12th edition

2900078024107, 78024102, 978-0078024108

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App